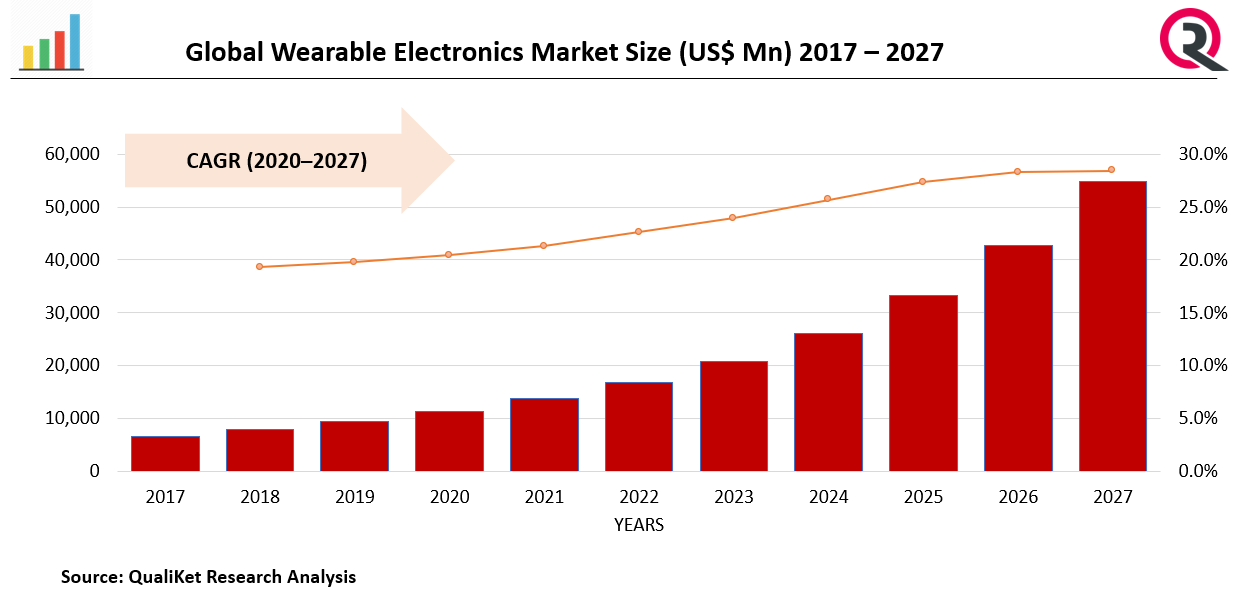

Global Wearable Electronics Market Size, Trends & Growth Opportunity, By Type (Wrist-Wear, Eye-Wear), By Application Type (Consumer Segment, Life-style applications, Sports/fitness application), By Region and Forecast till 2027

Report ID : QR1001292 | Industries : Information and Communication Technology | Published On :December 2021 | Page Count : 246Global Wearable Electronics Market

Wearable electronics refers to an incorporated computing tool or product, which enables the individual or the person carrying it to enhance daily activities. Wearable electronics are electronic gadgets constantly worn by someone as unobstructive as apparel to offer intelligent assistance that augments memory, intellect, creativity, verbal exchange and physical senses. These wearable gadgets are used for monitoring facts on actual time basis. They have movement sensors that take the photo of your day after day interest and sync them with cell gadgets or pc computers.

Drivers: Increasing growth possibilities of next-technology displays in wearable devices.

As end result of more than three decades of R&D, technologists have found out the dream of bringing displays into wearable gadgets such as smart glasses and smartwatches. Recently, it's been feasible to develop flexible and affordable electronic displays; however, the major challenges that corporations face are the excessive requirement of luminance, excessive electricity consumption, and brightness issues. However, recent product launches by numerous industry players suggest upgrades withinside the show generation in wearable gadgets. In February 2019, Nubia Alpha released a one-of-a-type smartwatch that includes an OLED bendy show, a camera, and an eSIM guide at MWC 2019. The Nubia Alpha smartwatch specs encompass a Snapdragon Wear 2100 SoC, 1 GB RAM, and eight GB inner storage. The Nubia Alpha runs on a custom OS and packs a 500-mAh battery. Additionally, improvements in backplane materials are the contemporary trend. Instead of silicon withinside the backplane, engineers use a steel oxide composed of indium, gallium, and zinc in identical parts, giving the cloth its name—IGZO or indium gallium zinc oxide—that is utilized in superior wearable show generation. It is predicted that the enterprise outlook in the direction of integrating the next-technology show generation in wearable gadgets might further enhance the marketability of wearable products.

Know more about this report: request for sample pages

Restraints: Limited Battery Life

The major restricting issue to the growth of the wearable technology market is the absence of a reliable and efficient battery gadget that might be easily worn without compromising at the compactness and simplicity of use of the device. As wearable computing moves in the direction of convergence of all the computing devices into one wearable device, the largest task is to cope with the power requirement and manage power consumption and recharging of batteries. With the growing call for wearable devices, it is not best essential to meet the power efficiency need in a cost-effective manner however also to manage power intake. This issue is anticipated to have an excessive restraining effect on the market.

Impact of COVID-19

COVID-19 is expected to adversely impact the supply chain of the wearable technology market as a few prominent players are based in China, which is the epicentre of the pandemic. Moreover, in light of the current situation, the key wearable technology is presently focusing on maintaining and generating operating revenue, which led to fewer developments within the market in 2020. The impact of COVID-19 is expected to reduce during the forecast period as many scheduled product launches and related developments which were postponed will be realized.

Segmentation by Product type:

Based on product, the market is categorized into neck-wear, foot-wear, wrist-wear, body-wear, eye-wear, and head-wear, and others. The growing adoption of smartwatches and fitness trackers in the healthcare industry is expected to support the segment boom over the forecast period. Smartwatches that are incorporated with disease-precise functions, in particular those that offer cardiovascular indications, have witnessed a huge rise in adoption over the years. For instance, Apple Inc.’s smartwatches, that are geared up with electrical heart sensors to discover unusual heart rhythms, have witnessed an intensive boom in demand over the years.

Segmentation by Component Type

By Component type, it is bifurcated into PCBs, memory, battery, sensor, connectivity, audio, display, camera and others. The growing demand for wrist watches, and other smart devices are likely to boom the sector for battery in the market forecast period.

Segmentation by Application Type

Application segment is divided into consumer, life style, fitness and sports, healthcare, entertainment, commercial, industrial and government. The consumer electronics application section accounted for more than 48.6% of global revenue in 2021. Consumer electronics have several applications, such as health and sports, garments and fashion, multifunction, infotainment and multimedia, and others. Considering the growing demand for wearable consumer electronics from consumers, industry gamers are focused on developing devices that could keep end-customers work hour tracking. Furthermore, growing a machine-to-gadget communication and the rise in linked devices are expected to assist the growth of wearable consumer electronics, thereby supporting the market growth.

Segmentation by Region

By Region the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa. APAC accounted for the largest share in the market in 2026. APAC has the presence of outstanding marketplace gamers. Manufacturers in China and India offer wearable devices at a low price, making them affordable for customers. Many international players get their wearable devices manufactured and assembled by local manufacturers based in the region and then brand their names. The region has many highly populated countries, which account for the high adoption rate of consumer electronics. Wearable device manufacturers are continuously innovating their wearable gadgets to achieve a competitive advantage. Several manufacturers have integrated NFC technology into their wearable devices to enable payment functionalities. Also, increasing per capita income in growing countries in the region as well as improving the standard of living have led to the growing demand for wearable devices. Besides, the wearable technology market in APAC is moderately impacted by the COVID-19 pandemic. The consumer electronics industry in China witnessed a decline in production because of the outbreak of COVID-19. The global prices of consumer electronics witnessed a rise initially owing to the partial clamp down on production centres in China. Also, critical components such as NFC chips and RFID tags which are manufactured in China faced a slowdown in their delivery chain. The pandemic has also positively impacted the market by accelerating the rise of the virtual economy, in particular wearable devices including smartwatches. APAC also includes countries such as China, Japan, Singapore, and Australia, which are proving to be digitally mature markets where demand for consumer electronics has already been at the rise. These factors are fueling the market growth of wearable technology in APAC.

Competitive Landscape:

The wearable technology market is dominated by a few globally established players such as Apple Inc. (US), Fitbit Inc. (US), Google LLC (US), Samsung Electronics Co., Ltd.(South Korea), Garmin Ltd.(Switzerland), LG(South Korea), Huawei (China), Sony Corporation(Japan), Xiaomi Corporation (China), and Microsoft (US).

Industrial Development:

In September 2020, Apple Inc. released Apple Watch Series 6 and Apple Watch SE, iPad fashions, the first fitness experience built for Apple Watch that brings significant developments in health and wellness features to iPhone, iPad, and Apple TV. Apple Watch Series 6 expanded the health capabilities of previous Apple Watch models with a new feature that measures the oxygen saturation of blood for a better understanding of health and well-being. In September 2020, Samsung Electronics Co., Ltd. released the first-ever titanium version of Galaxy Watch3, constructed with premium materials and a beautiful signature rotating bezel. The watch features military-grade sturdiness and water resistance. The watch also features Samsung Pay to enable contactless payments In August 2019, Fitbit Inc. launched Versa 2, a premium, voice-enabled lifestyle smartwatch packed with even extra superior fitness, health, charge capabilities. The watch enables customers to pay via the FitPay software and convenience features powered by 5+ days of battery life.

Market taxonomy

By Product type

- Wrist-Wear

- Eye-Wear

- Foot-Wear

- Neck-Wear

- Body-Wear

- Other-Wear (Finger, Head-Wear)

By Component type

- PCBs

- Memory

- Battery

- Sensor

- Connectivity

- Audio

- Display

- Camera

- Others

By Application Type

- Consumer Segment

- Life-style applications

- Sports/fitness application

- Healthcare applications

- Entertainment applications

- Industrial and Commercial

- Defence

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Global Wearable Electronics Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Wearable Electronic Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Wearable Electronics Market, By Product type

5.1 Y-o-Y Growth Comparison, By Product Type

5.2 Wearable Electronic Market Share Analysis, By Product Type

5.3 Wearable Electronics Market Size and Forecast, By Product Type

5.3.1 Wrist Wear

5.3.2 Eye Wear

5.3.3 Foot Wear

5.3.4 Neck-Wear

5.3.5 Body-Wear

5.3.6 Other Wear (Finger, Head-Wear)

6 Wearable Electronics Market, By Components type

6.1 Y-o-Y Growth Comparison, By Components

6.2 Wearables Electronic Market Share Analysis, By Components

6.3 Wearables Electronic Market Size and Forecast, By Components

6.3.1 PCBs

6.3.2 Memory

6.3.3 Battery

6.3.4 Sensor

6.3.5 Connectivity

6.3.6 Audio

6.3.7 Display

6.3.8 Camera

6.3.9 Others

7 Wearable Electronics Market, By Application type

7.1 Y-o-Y Growth Comparison, By Application

7.2 Wearables Electronic Market Share Analysis, By Application

7.3 Wearables Electronic Market Size and Forecast, By Application

7.4 Consumer Segment

7.5 Life style Applications

7.6 Sports/Fitness Applications

7.7 Healthcare Applications

7.8 Entertainment Applications

7.9 Industrial and Commercial

7.10 Defense

7.11 Others

8 Wearable Electronics Market, By Region

8.1 Wearable Electronics Market Share Analysis, By Region

8.2 Wearable Electronics Market Share Analysis, By Region

8.3 Wearable Electronics Market Size and Forecast, By Region

9 Wearable Electronics Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 North America Wearable Electronics Market Share Analysis, By Product

9.3 North America Wearable Electronics Market Size and Forecast, By Components

9.4 North America Wearable Electronics Market Size and Forecast,By Application

9.5 North America Wearable Electronics Market Size and Forecast, By Country

9.5.1 U.S.

9.5.2 Canada

9.5.3 Mexico

10 Europe Wearable Electronics Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Europe Wearable Electronics Market Share Analysis, By Product

10.3 Europe Wearable Electronics Market Size and Forecast, By component

10.4 Europe Wearable Electronics Market Size and Forecast, By Application

10.5 Europe Wearable Electronics Market Size and Forecast, By Country

10.5.1 Germany

10.5.2 France

10.5.3 UK

10.5.4 Rest of Europe

11 Asia Pacific Wearable Electronics Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Asia Pacific Wearable Electronics Market Share Analysis, By Product

11.3 Asia Pacific Wearable Electronics Market Size and Forecast, By Application

11.4 Asia Pacific Wearable Electronics Market Size and Forecast, By Components

11.5 Asia Pacific Wearable Electronics Market Size and Forecast, By Country

11.5.1 China

11.5.2 Japan

11.5.3 India

11.5.4. Rest of Asia Pacific

12 Latin America Wearable Electronics Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Latin America Wearable Electronic Market Share Analysis, By Product

12.3 Latin America Wearable Electronics Market Size and Forecast, By Application

12.4 Latin America Wearable Electronic Market Size and Forecast, By Components

12.5 Latin America Wearable Electronic Market Size and Forecast, By Country

12.5.1. Brazil

12.5.2. Rest of Latin America

13 Middle East Wearable Electronics Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Middle East Wearable Electronics Market Share Analysis, By Product

13.3 Middle East Wearable Electronics Market Size and Forecast, By Components

13.4 Middle East Wearable Electronics Market Size and Forecast, By applications

13.5 Middle East Wearable Electronics Market Size and Forecast, By Country

13.5.1. Saudi Arabia

13.5.2. UAE

13.5.3. Egypt

13.5.4. Kuwait

13.5.5. South Africa

14 Competitive Analysis

14.1 Competition Dashboard

14.2 Market share Analysis of Top Vendors

14.3 Key Development Strategies

15 Company Profiles

15.1 ADIDAS AG.

15.1.1 Overview

15.1.2 Offerings

15.1.3 Key Financials

15.1.4 Business Segment & Geographic Overview

15.1.5 Key Market Developments

15.1.6 Key Strategies

15.2 APPLE INC.

15.2.1 Overview

15.2.2 Offerings

15.2.3 Key Financials

15.2.4 Business Segment & Geographic Overview

15.2.5 Key Market Developments

15.2.6 Key Strategies

15.3 FITBIT

15.3.1 Overview

15.3.2 Offerings

15.3.3 Key Financials

15.3.4 Business Segment & Geographic Overview

15.3.5 Key Market Developments

15.3.6 Key Strategies

15.4 GOOGLE Inc.

15.4.1 Overview

15.4.2 Offerings

15.4.3 Key Financials

15.4.4 Business Segment & Geographic Overview

15.4.5 Key Market Developments

15.4.6 Key Strategies

15.5 JAWBONE

15.5.1 Overview

15.5.2 Offerings

15.5.3 Key Financials

15.5.4 Business Segment & Geographic Overview

15.5.5 Key Market Developments

15.5.6 Key Strategies

15.6 NIKE, Inc.

15.6.1 Overview

15.6.2 Offerings

15.6.3 Key Financials

15.6.4 Business Segment & Geographic Overview

15.6.5 Key Market Developments

15.6.6 Key Strategies

15.7 SONY CORP.

15.7.1 Overview

15.7.2 Offerings

15.7.3 Key Financials

15.7.4 Business Segment & Geographic Overview

15.7.5 Key Market Developments

15.7.6 Key Strategies

15.8 SAMSUNG ELECTRONICS CO. LTD.

15.8.1 Overview

15.8.2 Offerings

15.8.3 Key Financials

15.8.4 Business Segment & Geographic Overview

15.8.5 Key Market Developments

15.8.6 Key Strategies