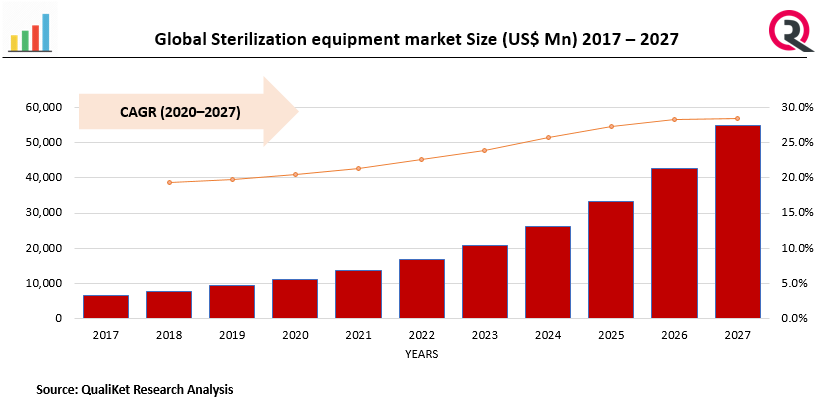

Global Sterilization Equipment Market by Product and; Services {Equipment [Heat, Low-temperature (Ozone, Formaldehyde), Filtration), Consumables (Sterilization Indicators, Sterilants), Services (Gamma, Steam)], End User (Hospitals, Pharma)} - Global Forecast to 2027and Regions (Asia Pacific, Europe, North America, Middle East & Africa, and Latin America) – Global Industry Analysis, Growth, Share,

Report ID : QR1001380 | Industries : Healthcare | Published On :January 2022 | Page Count : 236Sterilization equipment market

Sterilization is a critical process in a variety of industries, including healthcare. This process is critical in the healthcare sector for eliminating, destroying, or killing biological entities in order to maintain a hygienic or sterile environment. This method is commonly used in hospitals to prevent hospital-acquired infections.

Drivers: Sterilization equipment market

The Driving Factors of Sterilization equipment market are Hospital-acquired infections (HAIs) are a leading cause of morbidity and mortality around the world. Central line-associated bloodstream infections, catheter-associated urinary tract infections, and ventilator-associated pneumonia are examples of these. C. difficile, methicillin-resistant Staphylococcus aureus (MRSA), Klebsiella, E. coli, Enterococcus, and Pseudomonas species are the most common bacteria associated with HAIs. The increasing global prevalence of HAIs is the primary growth driver for the sterilisation equipment market.

Know more about this report: request for sample pages

Restraints: Sterilization equipment market

Advanced medical device cleaning, disinfection, and sterilisation Inadequate sterilisation of these devices may put patients at risk of contracting HAIs. Furthermore, with the introduction of technologically advanced instruments on the market, such as endoscopes and analyzers, there is a growing demand for advanced sterilisers that are compatible with the automated endoscope reprocessors (AER) used for cleaning and disinfecting flexible endoscopes after each procedure.

Impact of COVID-19

The COVID-19 pandemic is having a negative impact on several industries by halting production and disrupting supply chains. Currently, healthcare facilities such as clinics and hospitals are closing their wound care departments in order to prevent the spread of coronavirus infection. Virtual consultation services are now being offered by healthcare professionals and clinicians. Such factors are expected to reduce wound care device sales in 2020.

Segmentation by Product:

Based on product, the equipment segment is expected to command the largest share of the sterilization equipment market in 2020. Their effectiveness in sterilising reusable medical instruments, surgical instruments, and other materials required for various microbial-safe environments accounted for the majority of their market share. Furthermore, the rising number of HAIs, pharma and biotech companies' increased focus on developing vaccines to combat the recent outbreak of COVID-19, and the growing need for food safety drive the growth of this market.

Segmentation by End use

By End users, the hospitals & clinics segment dominated the market due to the growing incidence of hospital-acquired infections (HAIs), and the rising number of surgical procedures. Aside from these factors, rising chronic diseases associated with an ageing population, increased public awareness of the importance of quality care, an increase in hospitalizations due to the sudden outbreak of COVID-19, and a reduction in the healthcare burden caused by HAIs all aided market growth for this end-user segment.

Segmentation by Region

At the regional level, North America is expected to dominate the sterilisation equipment market in 2020, while Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. Accelerated economic growth, increased government focus on the healthcare sector, rising prevalence of chronic diseases, the outbreak of COVID-19, government investment to expand healthcare facilities, and favourable regulatory reforms are driving the growth of the Asia-Pacific market.

Competitive Landscape:

STERIS plc., Cantel Medical Corp., Getinge AB, 3M Company, Advanced Sterilization Products, MMM Group, MATACHANA group, Cardinal Health, Inc., Sotera Health, and Belimed.

Industrial Development:

To diversify its vast portfolio of sterilisation instruments and services, STERIS acquired Cantel, a global provider of infection prevention products and services, through a US subsidiary in June 2021.

Getinge will launch the Getinge Solsus 66 steam steriliser for hospitals and surgical instruments in October 2020, with increased capacity and operational reliability compared to other sterilisers.

Market taxonomy

By Product –

Sterilization Instruments

- Heat Sterilization Instruments

- Moist Heat Sterilizers

- Dry Heat Sterilizers

- Low-temperature Sterilization Instruments

- Hydrogen Peroxide Sterilizers

- Ethylene Oxide Sterilizers

- Ozone-based Sterilizers

- Formaldehyde Sterilizers

- Other Low-temperature Sterilization Instruments

- Filtration Sterilization Instruments

- Ionizing Radiation Sterilization Instruments

- E-beam Radiation Sterilization Instruments

- Gamma Radiation Sterilization Instruments

- Sterilization Consumables & Accessories

- Sterilization Indicators

- Chemical Indicators

- Biological Indicators

- Sterilization Pouches

- Sterilization Lubricants

- Sterilization Accessories

- Sterilization Indicators

- Sterilization Services

- Ethylene Oxide Sterilization Services

- Gamma Sterilization Services

- E-beam Sterilization Services

- Steam Sterilization Services

- Other Sterilization Services

By End use

- Hospitals & Clinics

- Medical Device Companies

- Pharmaceutical Companies

- Food & Beverage Industry

- Other End Users

By region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Global Sterilization equipment market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global Sterilization equipment market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global Sterilization equipment market, By Product

5.1 Y-o-Y Growth Comparison, By Product

5.2 Global Sterilization equipment market Share Analysis, By Product

5.3 Global Sterilization equipment market Size and Forecast, By Product

5.3.1 Sterilization Instruments

- Heat Sterilization Instruments

- Moist Heat Sterilizers

- Dry Heat Sterilizers

- Low-temperature Sterilization Instruments

- Hydrogen Peroxide Sterilizers

- Ethylene Oxide Sterilizers

- Ozone-based Sterilizers

- Formaldehyde Sterilizers

- Other Low-temperature Sterilization Instruments

- Filtration Sterilization Instruments

- Ionizing Radiation Sterilization Instruments

- E-beam Radiation Sterilization Instruments

- Gamma Radiation Sterilization Instruments

- Sterilization Consumables & Accessories

- Sterilization Indicators

- Chemical Indicators

- Biological Indicators

- Sterilization Pouches

- Sterilization Lubricants

- Sterilization Accessories

- Sterilization Indicators

- Sterilization Services

- Ethylene Oxide Sterilization Services

- Gamma Sterilization Services

- E-beam Sterilization Services

- Steam Sterilization Services

- Other Sterilization Services

6 Global Sterilization equipment market, By End use

6.1 Y-o-Y Growth Comparison, By End use

6.2 Global Sterilization equipment market Share Analysis, By End use

6.3 Global Sterilization equipment market Size and Forecast, By End use

6.3.1 Hospitals & Clinics

6.3.2 Medical Device Companies

6.3.3 Pharmaceutical Companies

6.3.4 Food & Beverage Industry

6.3.5 Other End Users

7 Global Sterilization equipment market, By Region

7.1 Global Sterilization equipment market Share Analysis, By Region

7.2 Global Sterilization equipment market Share Analysis, By Region

7.3 Global Sterilization equipment market Size and Forecast, By Region

8 North America Global Sterilization equipment market Analysis and Forecast (2021-2027)

8.1 Introduction

8.2 North America Global Sterilization equipment market Share Analysis, By Product

8.3 North America Global Sterilization equipment market Size and Forecast, By End use

8.5 North America Global Sterilization equipment market Size and Forecast, By Country

8.5.1 U.S.

8.5.2 Canada

8.5.3 Mexico

9 Europe Global Sterilization equipment market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 Europe Global Sterilization equipment market Share Analysis, By Product

9.3 Europe Global Sterilization equipment market Size and Forecast, By End use

9.5 Europe Global Sterilization equipment market Size and Forecast, By Country

9.5.1 Germany

9.5.2 France

9.5.3 UK

9.54. Rest of Europe

10 Asia Pacific Global Sterilization equipment market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Asia Pacific Global Sterilization equipment market Share Analysis, By Product

10.3 Asia Pacific Global Sterilization equipment market Size and Forecast, By End use

10.5 Asia Pacific Global Sterilization equipment market Size and Forecast, By Country

10.5.1 China

10.5.2 Japan

10.5.3 India

10.5.4. Rest of Asia Pacific

11 Latin America Global Sterilization equipment market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Latin America Global Sterilization equipment market Share Analysis, By Product

11.3 Latin America Global Sterilization equipment market Size and Forecast, By End use

11.5 Latin America Global Sterilization equipment market Size and Forecast, Country

11.5.1. Brazil

11.5.2. Rest of Latin America

12 Middle East Global Sterilization equipment market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Middle East Global Sterilization equipment market Share Analysis, By Product

12.3 Middle East Global Sterilization equipment market Size and Forecast, By End use

12.5 Middle East Global Sterilization equipment market Size and Forecast, By Country

12.65.1. Saudi Arabia

12.5.2. UAE

12.5.3. Egypt

15.5.4. Kuwait

12.5.5. South Africa

13 Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14Company Profiles

14.1 STERIS plc.

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2. Cantel Medical Corp.

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3. Getinge AB

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 3M Company

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 Advanced Sterilization Products

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies

14.6 MMM Group

14.6.1 Overview

14.6.2 Offerings

14.6.3 Key Financials

14.6.4 Business Segment & Geographic Overview

14.6.5 Key Market Developments

14.6.6 Key Strategies

14.7 MATACHANA group

14.7.1 Overview

14.7.2 Offerings

14.7.3 Key Financials

14.7.4 Business Segment & Geographic Overview

14.7.5 Key Market Developments

14.7.6 Key Strategies

14.8 Cardinal Health, Inc.

14.8.1 Overview

14.8.2 Offerings

14.8.3 Key Financials

14.8.4 Business Segment & Geographic Overview

14.8.5 Key Market Developments

14.8.6 Key Strategies

14.9 Sotera Health

14.9.1 Overview

14.9.2 Offerings

14.9.3 Key Financials

14.9.4 Business Segment & Geographic Overview

14.9.5 Key Market Developments

14.9.6 Key Strategies

14.10 Belimed.

14.10.1 Overview

14.10.2 Offerings

14.10.3 Key Financials

14.10.4 Business Segment & Geographic Overview

14.10.5 Key Market Developments

14.10.6 Key Strategies