Global Smart Building Market with COVID-19 Impact by Component (Solution and Services), Deployment Mode, Organization Size, Vertical (Aerospace and Defense, Healthcare and Life Sciences) Region and forecast till 2027.

Report ID : QR1001468 | Industries : Others | Published On :March 2022 | Page Count : 234Smart Building Market

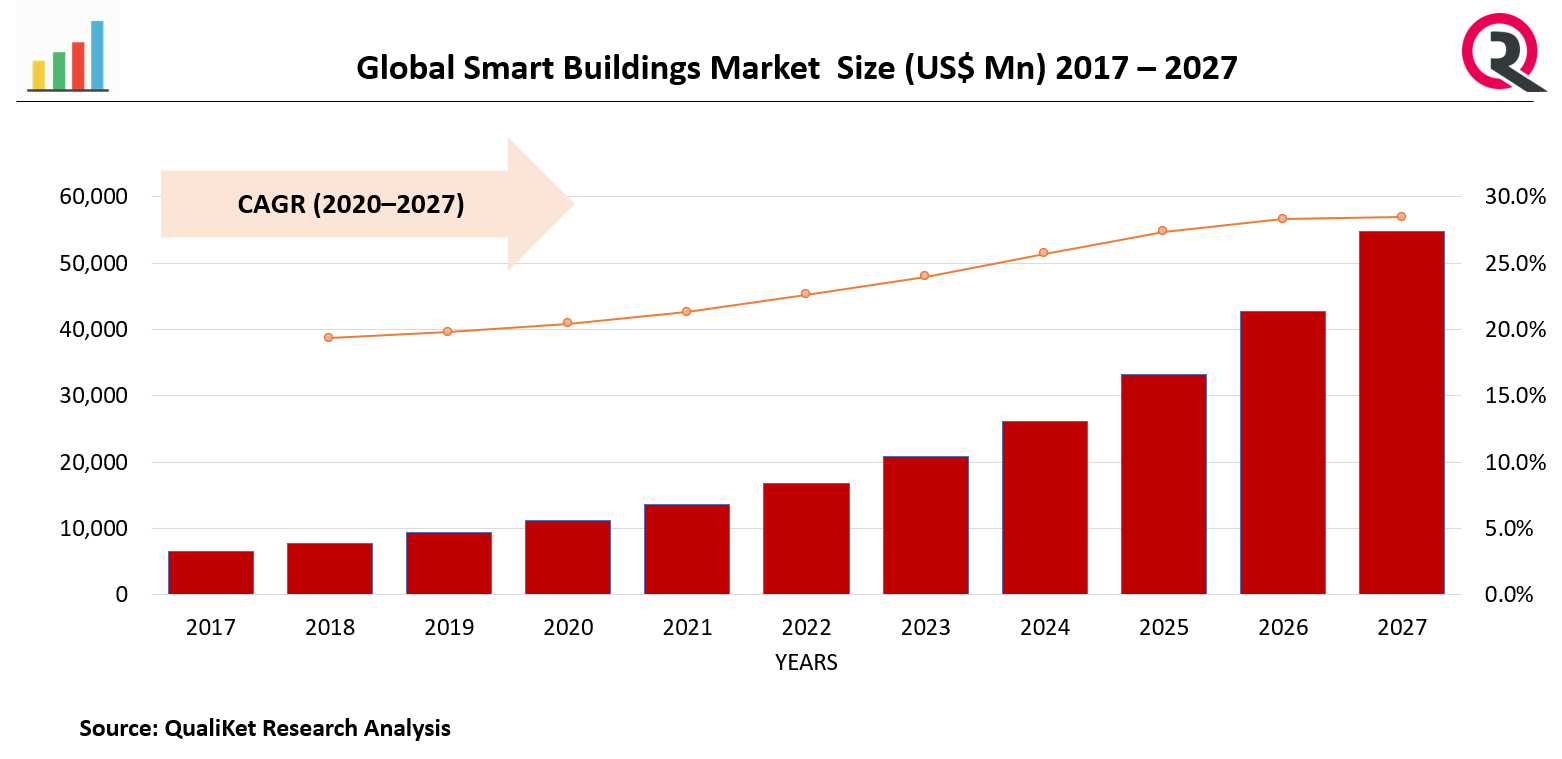

The global Smart Buildings market is expected to grow at a Compound Annual Growth Rate (CAGR) of 10.9 percent from USD 72.6 billion in 2021 to USD 121.6 billion by 2026.

Increased demand for energy-efficient systems, increased adoption of IoT-enabled BMS, and rising industry standards and regulations are expected to drive the adoption of Smart Buildings solutions and services. For smart buildings, solutions such as the Building Energy Management System, Infrastructure Management System, and Intelligent Security System are being used. BEMS are computerised systems that monitor and control energy-related building services plant and equipment such as HVAC systems and lighting, among other things.

Drivers: Adoption of IoT-enabled building management systems is increasing.

The Internet of Things (IoT) has a significant impact on the Commercial Real Estate (CRE) industry due to increased building efficiency, improved tenant relationships, and new revenue generation opportunities. IoT-enabled building management systems are installed and used to improve building performance efficiency and to improve building user experience by utilising sensor-generated data. It can also use a single infrastructure to run all building management solutions, with little to no manual intervention. IoT-enabled building management systems can be used for a variety of purposes, including reducing energy consumption, repairing and maintaining building systems, and lowering administrative costs. Property owners use data collected from various sensors at the building level, such as indoor air quality and space utilisation, to control air conditioning and lighting systems in real time, lowering energy costs and increasing comfort.

Know more about this report: request for sample pages

Restraints: Lack of collaboration among standard-setting bodies

For IoT and existing smart building technologies to work together, there must be extensive collaboration among standard bodies, corporations, city governments, and other stakeholders. This collaboration in the construction of smart cities is critical in realising the full potential of these technologies. Property and tenant management, as well as facility management, each have their own set of requirements and operating systems. Because these systems are not always designed for integration with other systems, obtaining information from building systems can be difficult.

Impact of COVID-19

The COVID-19 outbreak has had a significant impact on economies and societies in a relatively short period of time. Healthcare, telecommunications, media and entertainment, utilities, and government verticals work around the clock to stabilise conditions and provide essential services to everyone. The telecom sector, in particular, is playing a critical role around the world in supporting countries' digital infrastructure in the face of the COVID-19 pandemic.

According to Fujitsu's Global Digital Transformation Survey, offline organisations were more severely harmed, whereas online organisations saw an increase in online demand and revenue. According to 69 percent of business leaders from online organisations, their business revenue will increase in 2020. In contrast, 53 percent of offline organisations reported a decrease in revenue.

Segmentation By Component:

By Component the market is segmented into Solution & Services. The services are likely to show a rapid growth. This Atrributable to the rising implementation of inteligent building services. The demand for professional services such as consultiong services, system intergration, and deployment, support is increasing. Smart Buildings market solution providers provide a wide range of services. Smart Buildings solutions are classified into three categories: consulting, implementation, and support and maintenance. As the smart buildings market evolves and requires proper pre- and post-consulting, deployment, and overall management of solutions, the services segment is expected to have a bright future. Smart building service providers assist in the implementation of intelligent automation and technologies for the efficient operation and maintenance of buildings at a low cost. The advantages of using smart building services include the need for optimal solutions, which result in improved building performance, lower energy consumption, and lower OPEX.

Segmentation By Solution:

Based On the Solution the market is segmented into Building Infrastructure management, and security Management, Energy Management, Network Management, and intergrated work place management system.

Segmentation By Building Type:

Based on the building type the market is segmented into Residential,commercial and industrial. Each and every segment will show a growth in the given forecast period due to increase in population and work buildings.

Segmentation by Region

Based on region, the NGS services market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. In 2021, North America is expected to have the largest market share in the smart building market. North America is expected to account for the lion's share of the global Smart Buildings market. The United States controls a sizable portion of the market in this region. In terms of the use of Smart Buildings-based solutions and services, North America leads the global market. The United States and Canada are major contributors to technology development in this region; for example, US organisations are heavily investing in smart building measures such as building controls and building system integration to leverage energy efficiency and energy storage and deliver smarter, safer, and more sustainable buildings. Simultaneously, the Canadian government is launching initiatives to support the country's commitment to Protecting the environment and its resources by making federal buildings more energy-efficient and lowering greenhouse gas emissions, which is fueling the growth of smart buildings.

Competitive Landscape:

Major players in the market include The major vendors in the global Smart Buildings market include Cisco (US), IBM (US), Honeywell (US), Siemens (Germany), Johnson Controls (Ireland).

Industrial Development:

In January 2022, Johnson Controls completed the acquisition of FogHorn, the leading developer of Edge AI software for industrial and commercial Internet of Things (IoT) solutions. By pervasively integrating Foghorn’s world-class Edge AI throughout Johnson Controls OpenBlue solution portfolio, it accelerated toward its vision of smart, autonomous buildings that continuously learn, adapt and automatically respond to the needs of the environment and people.

In September 2021, Legrand launched Living Now design characterizes extreme purity of design and the precision of its geometries to suit all homes. It can be installed to show its innovative potential with connected smart systems.

In December 2020, Hitachi, Ltd. announced the development of an IoT platform that brings buildings the high added value required for the new normal, including high efficiency of building management and improved comfort for building users.

In June 2020, Siemens signed a new value-added partnership for Siemens building technologies with Comprehensive Energy Services (CES) to provide the Siemens BAS field to the customers of CES. The partnership would enable CES to provide and advanced options related to new construction or existing building control system retrofits.

Market taxonomy

- Solutions

- Safety and security management

- Access control system

- Video surveillance system

- Fire and life safety system

- Energy management

- HVAC control system

- Lighting management system

- Building infrastructure management

- Parking management system

- Smart water management system

- Elevator and escalator management system

- Network management

- Wired technology

- Wireless technology

- IWMS

- Operations and services management

- Real estate management

- Environment and energy management

- Facility management

- Capital project management

- Safety and security management

- Services

- Consulting

- Implementation

- Support and maintenance

- By Building Type:

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Smart Buildings Market Outlook TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Smart Buildings Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5. Smart Buildings Market, By Component

5.1 Y-o-Y Growth Comparison, By Component

5.2 Smart Buildings Market Share Analysis, By Component

5.3 Smart Buildings Market Size and Forecast, By Component

5.3.1 Solutions

5.3.2 Services

6 Smart Buildings Market, By Solutions

6.1 Y-o-Y Growth Comparison, By Solutions

6.2 Smart Buildings Market Share Analysis, By Solutions

6.3 Smart Buildings Market Size and Forecast, By Solutions

6.3.1 Building Infrastructure Management

6.3.1.1 Digital and technological disruptions drive the demand for futuristic building infrastructure

6.3.1.2 Building infrastructure management: Smart buildings market drivers

6.3.1.3 Parking management system

6.3.1.4 Smart water management system

6.3.1.5 Elevators and escalators management system

6.3.2 Safety and Security Management

6.3.2.1 Access control system

6.3.2.2 Video surveillance system

6.3.2.3 Fire and life safety system

6.3.3 Energy Management

6.3.3.1 HVAC Control System

6.3.3.2 Lighting Management System

6.3.4 Network Management

6.3.5 Integrated work Place Management systems

7 Smart Buildings Market, By Building Type

7.1 Y-o-Y Growth Comparison, By Building Type

7.2 Smart Buildings Market Share Analysis, By Building Type

7.3 Smart Buildings Market Size and Forecast, By Building Type

7.3.1 Resedential

7.3.2 Commercial

7.3.3 Industrial

8 Smart Buildings Market, By Region

8.1Smart Buildings Market Share Analysis, By Region

8.2 Smart Buildings Market Size and Forecast, By Region

9 North America Smart Buildings Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 North America Smart Buildings Market Size and forecast, By Component

9.3 North America Smart Buildings Market Size and forecast, By Solutions

9.4 North America Smart Buildings Market size and forecast, By Building Type

9.5 North America Smart Buildings Market Size and Forecast, By Country

9.5.1 U.S.

9.5.2 Canada

9.5.3 Mexico

10 Europe Smart Buildings Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Europe Smart Buildings Market Size and Forecast, By Component

10.3 Europe Smart Buildings Market Size and forecast., By Solutions

10.4 Europe Smart Buildings Market size and forecast, By Building type

10.5 Europe Smart Buildings Market Size and Forecast, By Country

10.5.1 Germany

10.5.2 France

10.5.3 UK

10.5.4 Rest of Europe

11 Asia Pacific Smart Buildings Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.3 Asia Pacific Smart Buildings Market Size and Forecast, by Component

11.4 Asia Pacific Smart Buildings Market size and forecast, By Solutions

11.5 Asia Pacific Smart Buildings Market size and forecast, By Building Type

11.6 Asia Pacific Smart Buildings Market Size and Forecast, By Country

11.6.1 China

11.6.2 Japan

11.6.3 India

11.6.4 Rest of Asia Pacific

12 Latin America Smart Buildings Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Latin America Smart Buildings Market Share Analysis, By Component

12.4 Latin America Smart Buildings Market Size and Forecast, By Solutions

12.5 Latin America Smart Buildings Market size and forecast, By Building Type

12.6 Latin America Smart Buildings Market Size and Forecast, Country

12.6.1. Brazil

12.6.2. Rest of Latin America

13 Middle East Smart Buildings Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Middle East Smart Buildings Market Size and forecast, by Component

13.3 Middle East Smart Buildings Market Size and Forecast, by Solutions

13.4 Middle East Smart Buildings Market size and Forecast, By Building Type

13.5 Middle East Smart Buildings Market Size and Forecast, By Country

13.5.1. Saudi Arabia

13.5.2. UAE

13.5.3. Egypt

13.5.4 Kuwait

13.5.5. South Africa

14 Competitive Analysis

14.1 Competition Dashboard

14.2 Market share Analysis of Top Vendors

14.3 Key Development Strategies

15 Company Profiles

15.1 CISCO

15.1.1 Overview

15.1.2 Product Categorys

15.1.3 Key Financials

15.1.4 Business Segment & Geographic Overview

15.1.5 Key Market Developments

15.1.6 Key Strategies

15.2 IBM

15.2.1 Overview

15.2.2 Product Categorys

15.2.3 Key Financials

15.2.4 Business Segment & Geographic Overview

15.2.5 Key Market Developments

15.2.6 Key Strategies

15.3 HONEYWELL

15.3.1 Overview

15.3.2 Product Categories

15.3.3 Key Financials

15.3.4 Business Segment & Geographic Overview

15.3.5 Key Market Developments

15.3.6 Key Strategies

15.4 SIEMENS

15.4.1 Overview

15.4.2 Product Categorys

15.4.3 Key Financials

15.4.4 Business Segment & Geographic Overview

15.4.5 Key Market Developments

15.4.6 Key Strategies

15.5 JOHNSON CONTROLS

15.5.1 Overview

15.5.2 Product Categorys

15.5.3 Key Financials

15.5.4 Business Segment & Geographic Overview

15.5.5 Key Market Developments

15.5.6 Key Strategie