Global Polyvinyl Butyral (PVB) Market Size, Trends & Growth Opportunity, By Type (Adhesives, Paints & Coatings, Films & Sheets and Others), By End Use Type (Construction, Automotive, Power Generation and Others), By Region and Forecast till 2027

Report ID : QR1001150 | Industries : Chemicals & Materials | Published On :May 2021 | Page Count : 253Polyvinyl Butyral (PVB) Market

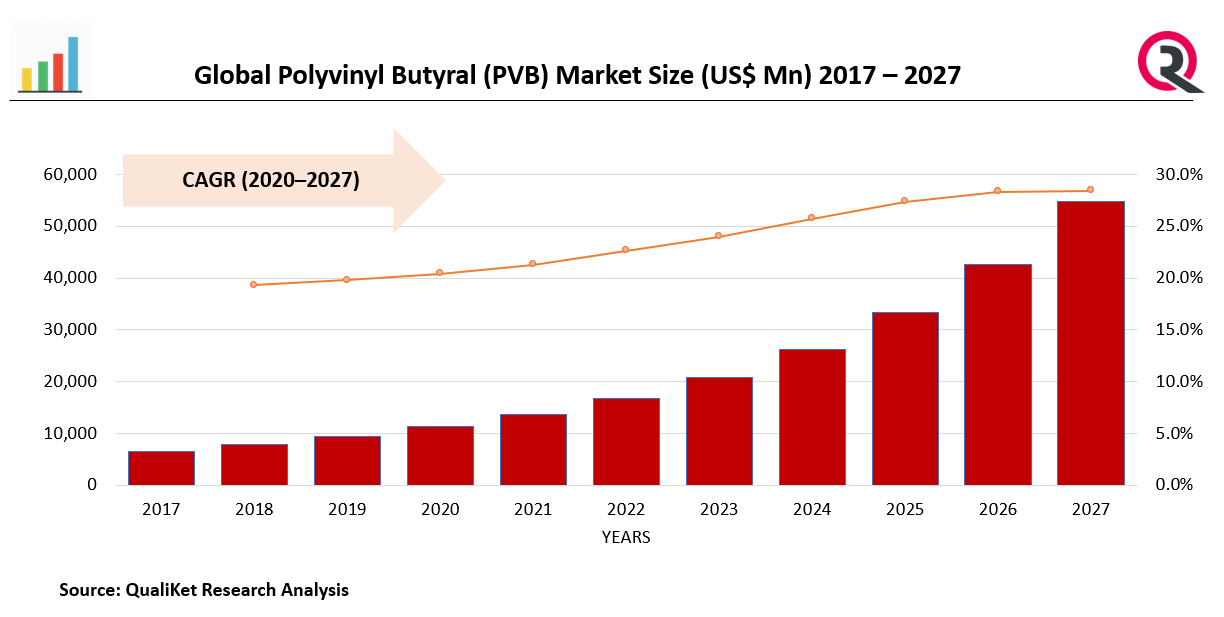

Global polyvinyl butyral (PVB) Market was valued at US$ 2.81 Bn in 2020, estimated to reach US$ 4.50 Bn in 2027 with a CAGR of 6.06% from 2021-2027.

Polyvinyl butyral (PVB) is defined as a glass interlayer utilized in various end-use industries owing to its different chemical properties. These films and sheets offer special characteristics including impact resistance, transparency, elasticity, and high tensile strength. These properties make the sheets & films suitable for producing safety glass.

Market Drivers: Rising application of PVB in the laminated glass market will boost the market growth

PVB has found its application for its short-term growth in the laminated glass market. PVB is used in a form of resin for applications that require binding, optical clarity, adhesion to glass surfaces, toughness and flexibility. The major application of Polyvinyl butyral is as the interlayer in laminated safety glass for architectural purposes & automotive windscreens. PVB laminated glass is manufactured by combining two or more annealed or heat-treated glass sheets bonded with one or more of PVB interlayers and subjected to heat and pressure, in order to ensure perfect adhesion between the constituent elements.

Know more about this report: request for sample pages

Recently, the demand for usage of PVB as an interlayer in the sandwich laminated glass has been significantly growing, owing to its usage for safety and security purposes in automobile windshields. PVB avoids the shattering of glass, during an accident, thus preventing personal injury by sharp glass fragments. PVB laminated glass also offers good impact resistance, acoustic insulation, and UV resistance. Furthermore, the UV protection feature of PVB laminated glass prevents interiors from fading up.

Market Challenges: High production cost might limit the growth of the market

PVB when compared to its substitute products such as Ethylene Vinyl Acetate (EVA), has high manufacturing and processing costs. The PVB material inception is been for many years the reference material for laminating glass in the building and transport industries but EVA has been gaining ground in recent years due to its properties which in some cases are better than PVB. Processing for PVB film requires a special temperature-controlled chamber and the glass must then be processed in an autoclave, which in turn requires an expensive and large machine suitable for companies with large volumes. On the other hand, EVA laminated glass can be produced in convection or infrared lamination furnaces, these furnaces are small and accessible to small and medium-sized enterprises. Also, the current COVID-19 pandemic has been proving a hindrance to the growth of the market owing to the major application areas of PVB such as construction and automotive industries are at halt.

Market Opportunities: Growing demand in photovoltaic industry will act as a growth prospect for the market

PVB is gaining momentum in the manufacturing of thin film solar PV modules. The PV circuit is formed on a glass sheet using thin film deposition and patterning techniques. Two layers, which are a PVB layer and a second layer of glass (called back glass) are then placed directly on the circuit. This lamination encapsulates the circuit and protects it from the environmental conditions. PVB back sheet provides a range of properties as it has good impact properties and is considered a cheaper alternative to tedlar based back sheets. Moreover, the optical properties of PVB are better than that of EVA, also the adhesion of PVB to photovoltaic cell is better than EVA. Photovoltaic industry is attracting market investment in order to cater to the increasing demand of clean and sustainable energy, the rise in the market of photovoltaic industry is anticipated to be a promising growth prospect for PVB market during the analysis period.

PVB Market, By Type

Based on type the market is divided into adhesives, paints & coatings, films & sheets and others. Films & sheets market is expected to lead the type segment owing to its application in the laminated glass market which are predominantly used in construction industry.

PVB Market, By End User Type

Based on end user the market is bifurcated into construction, automotive, power generation and others. Construction and automotive segment are expected to dominate the market globally, owing to the rising construction activities in the developing and developed economies and growth in the production of electrical automotive vehicles.

PVB Market, By Region

The geographic segments in this report include North America, Europe, Asia Pacific, Middle East & Africa and Latin America. Asia-Pacific region is expected to account for the largest share of the market in 2020. Asia-Pacific is expected to dominate the global market owing to the increasing construction activities in China, and Japan combined with the continuous investments done in the region to advance solar energy production activities.

Competitive Landscape:

- The global Polyvinyl Butyral (PVB) market is consolidated due to the presence of large number of international players across the globe. Due to the partial consolidated nature of the market, the competition among the global players is high.

- Market players are embracing various strategies, including product development, strategic collaborations, and mergers and acquisitions among others. The figure Competition Landscape Analysis shows competition scenario in the market.

- The global Polyvinyl Butyral (PVB) market is analyzed based on parameters such as: Mergers and Acquisition, New Product Launch, Collaboration, Product Approval, New Facility Development, Project Completion, Research & Development.

Key players:

Some key operating players are discussed in this report such as DuPont, Chang Chun Group, DuLite PVB FILM, Eastman Chemical Company, EVERLAM NV, Genau Manufacturing Company LLP (GMC LLP), Huakai Plastic (Chongqing) Co., Ltd., KB PVB, KURARAY CO., LTD., SEKISUI CHEMICAL CO., LTD, etc.

Recent Developments:

In March 2021: Eastman Chemical Company announced that it is making an investment to upgrade and expand its extrusion capabilities for production of interlayer’s product lines at its Springfield, Massachusetts, manufacturing facility. The investment will strengthen Eastman’s supply capability to respond to regional and global demand for Saflex® polyvinyl butyral (PVB) products in the automotive and architectural markets and enhance facility capabilities to enable production of specialty architecture and automotive PVB products, including thicker gauges and advanced tri-layers formulations such as Saflex® acoustic interlayer products. The project is expected to be complete in the fourth quarter of 2021.

In August 2020: DuPont announced the launch of its new product for reduced Global Warming Potential (GWP) solution for Styrofoam™ Brand XPS Boardstock in order to fully comply with the Canadian Environmental Protection Act as new federal and provincial regulations come into effect on January 1, 2021. Beginning in the 4th quarter of 2020, with a complete Canadian conversion ready by January 1, 2021, DuPont will transition its heritage Blue Styrofoam™ Brand XPS Boardstock family of products to a new Grey, reduced GWP product line.

Market Taxonomy

By Type

- Adhesives

- Paints & Coatings

- Films & Shits

- Others

By End Use Type

- Construction

- Automotive

- Power Generation

- Others

By Region

- North America

- Latin America

- Europe

- Asia Pacific

- Middle East & Africa

Key Questions Addressed by the Report

- What are the Key Opportunities in Global Polyvinyl Butyral (PVB) Market?

- What will be the growth rate from 2019 to 2027?

- Which segment/region will have highest growth?

- What are the factors that will impact/drive the Market?

- What is the competitive Landscape in the Industry?

- What is the role of key players in the value chain?

- What are the strategies adopted by key players?

Global Polyvinyl Butyral (PVB) Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global Polyvinyl Butyral (PVB) Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global Polyvinyl Butyral (PVB) Market, By Type

5.1 Y-o-Y Growth Comparison, By Type

5.2 Global Polyvinyl Butyral (PVB) Market Share Analysis, By Type

5.3 Global Polyvinyl Butyral (PVB) Market Size and Forecast, By Type

5.3.1 Adhesives

5.3.2 Paints & Coatings

5.3.3. Films & Shits

5.3.4. Others

6 Global Polyvinyl Butyral (PVB) Market, By End User Type

6.1 Y-o-Y Growth Comparison, By End User Type

6.2 Global Polyvinyl Butyral (PVB) Market Share Analysis, By End User Type

6.3 Global Polyvinyl Butyral (PVB) Market Size and Forecast, By End User Type

6.3.1 Construction

6.3.2 Automotive

6.3.3 Power Generation

6.3.4 Others

7Global Polyvinyl Butyral (PVB) Market, By Region

7.1 Global Polyvinyl Butyral (PVB) Market Share Analysis, By Region

7.2 Global Polyvinyl Butyral (PVB) Market Share Analysis, By Region

7.3 Global Polyvinyl Butyral (PVB) Market Size and Forecast, By Region

8North America Polyvinyl Butyral (PVB) Market Analysis and Forecast (2020 – 2027)

8.1 Introduction

8.2 North America Polyvinyl Butyral (PVB) Market Share Analysis, By Type

8.3 North America Polyvinyl Butyral (PVB) Market Size and Forecast, By End User Type

8.4 North America Polyvinyl Butyral (PVB) Market Size and Forecast, By Country

8.4.1 U.S

8.4.2 Canada

8.4.3 Mexico

9Europe Polyvinyl Butyral (PVB) Market Analysis and Forecast (2020 – 2027)

9.1 Introduction

9.2 Europe Polyvinyl Butyral (PVB) Market Share Analysis, By Type

9.3 Europe Polyvinyl Butyral (PVB) Market Size and Forecast, By End User Type

9.4 Europe Polyvinyl Butyral (PVB) Market Size and Forecast, By Country

9.4.1 Germany

9.4.2 France

9.4.3 UK

9.4.4. Rest of Europe

10Asia Pacific Polyvinyl Butyral (PVB) Market Analysis and Forecast (2020 – 2027)

10.1 Introduction

10.2 Asia Pacific Polyvinyl Butyral (PVB) Market Share Analysis, By Type

10.3 Asia Pacific Polyvinyl Butyral (PVB) Market Size and Forecast, By End User Type

10.4 Asia Pacific Polyvinyl Butyral (PVB) Market Size and Forecast, By Country

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4. Rest of Asia Pacific

11Latin America Polyvinyl Butyral (PVB) Market Analysis and Forecast (2020 – 2027)

11.1 Introduction

11.2 Latin America Polyvinyl Butyral (PVB) Market Share Analysis, By Type

11.3 Latin America Polyvinyl Butyral (PVB) Market Size and Forecast, By End User Type

11.4 Latin America Polyvinyl Butyral (PVB) Market Size and Forecast, By Country

12Middle East Polyvinyl Butyral (PVB) Market Analysis and Forecast (2020 – 2027)

12.1 Introduction

12.2 Middle East Polyvinyl Butyral (PVB) Market Share Analysis, By Type

12.3 Middle East Polyvinyl Butyral (PVB) Market Size and Forecast, By End User Type

12.4 Middle East Polyvinyl Butyral (PVB) Market Size and Forecast, By Country

13Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14Company Profiles

14.1 DuPont

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2 Chang Chun Group

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3 DuLite PVB FILM

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 Eastman Chemical Company

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 EVERLAM NV

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies

14.6 Genau Manufacturing Company LLP (GMC LLP)

14.6.1 Overview

14.6.2 Offerings

14.6.3 Key Financials

14.6.4 Business Segment & Geographic Overview

14.6.5 Key Market Developments

14.6.6 Key Strategies

14.7 Huakai Plastic (Chongqing) Co., Ltd

14.7.1 Overview

14.7.2 Offerings

14.7.3 Key Financials

14.7.4 Business Segment & Geographic Overview

14.7.5 Key Market Developments

14.7.6 Key Strategies

14.8 KB PVB

14.8.1 Overview

14.8.2 Offerings

14.8.3 Key Financials

14.8.4 Business Segment & Geographic Overview

14.8.5 Key Market Developments

14.8.6 Key Strategies

14.9 KURARAY CO., LTD.

14.9.1 Overview

14.9.2 Offerings

14.9.3 Key Financials

14.9.4 Business Segment & Geographic Overview

14.9.5 Key Market Developments

14.9.6 Key Strategies

14.10 SEKISUI CHEMICAL CO., LTD

14.10.1 Overview

14.10.2 Offerings

14.10.3 Key Financials

14.10.4 Business Segment & Geographic Overview

14.10.5 Key Market Developments

14.10.6 Key Strategies