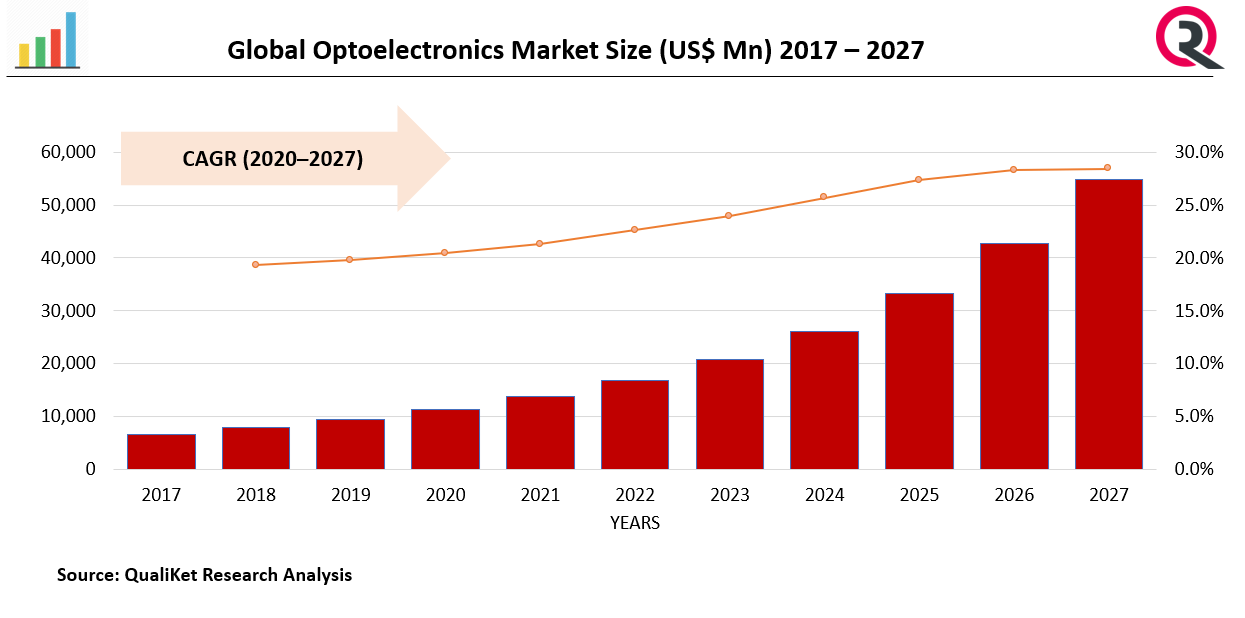

Global Optoelectronics Market Size, Trends & Growth Opportunity, By component Type (LED, Laser Diode, Image Sensors, Optocouplers, Photovoltaic cells, Others), By End User Type (Healthcare, Information & Technology, Automotive, Residential and Commerce, Industries and Others), By Region and Forecast till 2027

Report ID : QR1001303 | Industries : Semiconductors and Electronics | Published On :January 2022 | Page Count : 253Optoelectronics Market

Optoelectronics is based on the quantum mechanical effects of light on electronic materials, especially semiconductors. Optoelectronics concerns the study and application of electronic devices that source, detect and control light. Optoelectronic devices consist of different semiconductor alloys lying on substrates. During the growth of the multi-quantum well of a laser active region, different layers of semiconductors are sequentially deposited onto the substrate, alternating between well and barrier regions.

Drivers: Growing demand for Smart Consumer Electronics and Next Generation Technologies

Growing consumption of advanced manufacturing and fabricating technologies is further driving the consumption of optoelectronic components in the industrial sector, with the use of Laser and Machine vision systems. The increasing demand in the automotive industry specifically with the increase in the adoption of electric vehicles, self-driven trucks, and autonomous vehicles is expected to boost the usage of optoelectronic devices which would further drive the market.

Restraints: High Manufacturing and Fabricating Costs

The cost of Optoelectronics based products are higher compares to conventional products this is one of the factors which limits the growth of the market. Customer may choose alternative technology instead of optoelectronics-based products such as LCD display instead of LED display, as LCD is an economical solution. The cost involved in replacement of spare parts is higher in compared to conventional products. Therefore, cost acts as a restraining factor in the growth of optoelectronics market. As LCD displays play a major part in the optoelectronic market, the decreased sales will influence the market largely.

Know more about this report: request for sample pages

Impact of COVID-19

The market witnessed a sudden dip due to the lockdown imposed, leading to disruptions in supply chains and trade restrictions. Moreover, as the market slowly and steadily opened up with relaxations in the lockdown, a demand-supply gap was witnessed due to the shutting down of production facilities and halted manufacturing operations. However, the market is expected to gain traction by 2021, with manufacturing facilities gradually resuming operations at full capacity to cater to the growing demand across several industry verticals.

Segmentation by Component type:

Based on Component, the market is segmented into (Photo Voltaic (PV) Cells, Optocouplers, Image sensors, Light Emitting Diodes (LED), Laser Diode (LD), Infra-Red Components (IR)). Laser diodes are the most widely used optoelectronic components deployed in laser generation across various applications including fibre optic communications, DVD/Blu-ray players, Bar Code readers, Printing and Communication technologies. While growing demand for Lasers in the industrial sector has also been identified to boost the market growth. With Increasing investments in LiDAR and additive manufacturing technologies, the optoelectronics market is expected to grow significantly.

Segmentation by End Use Type:

Based on End-User, the market is segmented into Healthcare, Information & Technology, Automotive, Aerospace & Defense, Consumer Electronics, Residential and Commerce, Industries and Others. The largest market share of the consumer electronics segment is attributed to the growing adoption of optoelectronic components in the manufacture of consumer electronics and advancements in electronic devices such as smartphones, high-end cameras, smart television displays, LED projectors, organic LEDs, and flexible 3-D displays.

Segmentation by Region

By Region the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa. North America is expected to witness a hold highest share in the market. Increasing investments in the development of smart infrastructure and focus in automation technologies will be key in the growth of the market in this region while growing investments in infrastructure development are likely to further support the market. U.S. Department of Agriculture’s National Institute of Food and Agriculture (NIFA) has sanctioned a grant funding to the Purdue-led team of academic and industry scientists from Wisconsin, Michigan, and New Jersey to investigate the use of light emitting diodes in order to provide a perfect light spectrum which is most efficient for photosynthesis in plants. Initiatives like these are supposed to boost the optoelectronics market.

Competitive Landscape:

The major players in the market are General Electric Company, Panasonc Corporation, Samsung Electronics, OmniVision Technologies Inc, and Sony Corporation.

Industrial Development:

U.S. Department of Agriculture’s National Institute of Food and Agriculture (NIFA) has sanctioned a grant funding to the Purdue-led team of academic and industry scientists from Wisconsin, Michigan, and New Jersey to investigate the use of light emitting diodes in order to provide a perfect light spectrum which is most efficient for photosynthesis in plants. Initiatives like these are supposed to boost the optoelectronics market.With optoelectronics finding its applications in the indicators and headlights of the vehicles, the US in the year imported USD 178.5 billion worth of cars originating from a total of 68 countries or territories. This number is expected to grow over the forecasted period which would boost the optoelectronics market.

In December 2019, Mitsubishi Electric Corporation launched the ML562G86 pulse laser diode (LD) for projectors, featuring a vibrant 638-nanometer (nm) red light, the output power of 3.0W under pulse operation and mean time to failure1 (MTTF) of over 20,000 hours.

Market taxonomy

By Component type

- LED

- Laser Diode

- Image Sensors

- Optocouplers

- Photovoltaic Cells

- Others

By End use type

- Healthcare

- Information & Technology

- Automotive,

- Aerospace & Defense,

- Consumer Electronics

- Residential and Commerce

- Industries

- Other

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Global Optoelectronics Market

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Optoelectronics Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Optoelectronics Market, By Component type

5.1 Y-o-Y Growth Comparison, By Component Type

5.2 Optoelectronics Market Share Analysis, By Component Type

5.3 Optoelectronics Market Size and Forecast, By Component Type

5.3.1 LED

5.3.2 Laser Diode

5.3.3 Image Sensors

5.3.4 OptoCouplers

5.3.5 Photovoltaic Cells

5.3.6 Others

6 Optoelectronics Market, By End Use

6.1 Y-o-Y Growth Comparison, By End Use

6.2 Optoelectronics Market Share Analysis, By End Use

6.3 Optoelectronics Market Size and Forecast, By End Use

6.3.1 Healthcare

6.3.2 Information Technology

6.3.3 Automotive

6.3.4 Aerospace & Defense

6.3.5 Conumer Electronics

6.3.6 Residential and Commerce

6.3.7 Industrial

6.3.8 Others

7 Optoelectronics Market, By Region

7.1 Optoelectronics Market Share Analysis, By Region

7.2 Optoelectronics Market Share Analysis, By Region

7.3 Optoelectronics Market Size and Forecast, By Region

8 North America Optoelectronics Market Analysis and Forecast (2021-2027)

8.1 Introduction

8.2 North America Optoelectronics Market Share Analysis, By component Type

8.3 North America Optoelectronics Market Size and Forecast, By End-Use.

8.5 North America Optoelectronics Market Size and Forecast, By Country

8.5.1 U.S.

8.5.2 Canada

8.5.3 Mexico

9 Europe Optoelectronics Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 Europe Optoelectronics Market Share Analysis, By component Type

9.3 Europe optoelectronics Market Size and Forecast, By End-Use

9.5 Europe optoelectronics Market Size and Forecast, By Country

9.5.1 Germany

9.5.2 France

9.5.3 UK

9.54. Rest of Europe

10 Asia Pacific Optoelectronics Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Asia Pacific optoelectronics Market Share Analysis, By component Type

10.3 Asia Pacific optoelectronics Market Size and Forecast, By End-Use

10.5 Asia Pacific optoelectronics Market Size and Forecast, By Country

10.5.1 China

10.5.2 Japan

10.5.3 India

10.5.4. Rest of Asia Pacific

11 Latin America Optoelectronics Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Latin America Optoelectronics Market Share Analysis, By component Type

11.3 Latin America Optoelectronics Market Size and Forecast, By End-Use.

11.5 Latin America Optoelectronics Market Size and Forecast, Country

11.5.1. Brazil

11.5.2. Rest of Latin America

12 Middle East Optoelectronics Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Middle East Optoelectronics Market Share Analysis, By Component Type

12.3 Middle East Optoelectronics Market Size and Forecast, By End Use

12.5 Middle East Optoelectronics Market Size and Forecast, By Country

12.65.1. Saudi Arabia

12.5.2. UAE

12.5.3. Egypt

15.5.4. Kuwait

12.5.5. South Africa

13 Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14Company Profiles

14.1 General Electric Company

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2. Panasonic Corporation

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3. Samsung Electronics

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 Omnivision Technologies Inc.

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 Sony Corporation

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies