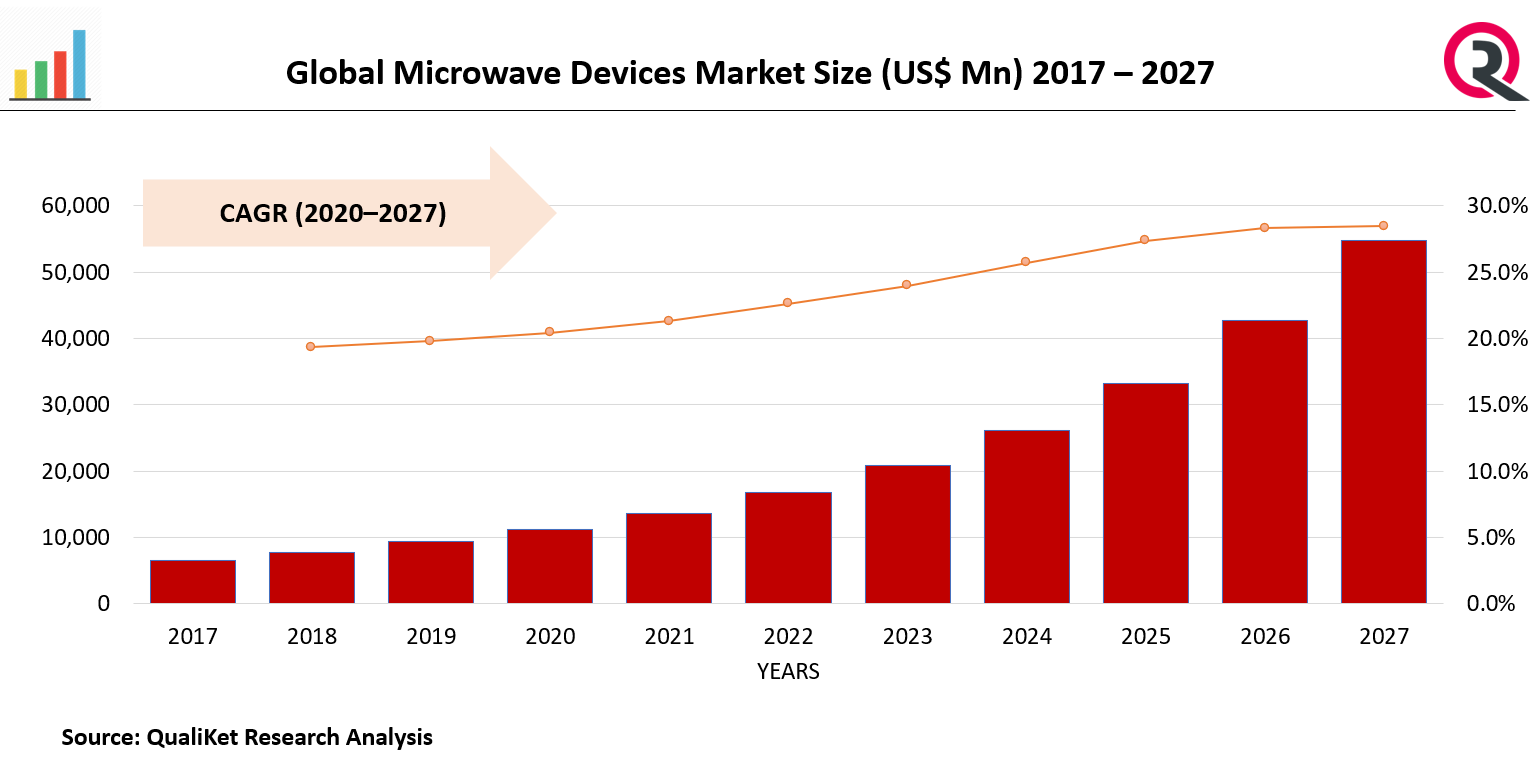

Microwave Devices Market Size, Trends & Growth Opportunity, Product (Active Devices, Passive Devices), Frequency (Ku-band, C-band, Ka-band, L-band, X-band, S-band), End User (Space & Communication, Military & Defense, Healthcare), Region and forecast till 2027.

Report ID : QR1001415 | Industries : Others | Published On :January 2022 | Page Count : 238Microwave Devices Market

Because of the significant advances in microwave transistor technologies, microwave device modeling—particularly nonlinear active device modeling—has been an insatiable field of research. Some of the technologies that have had a significant impact on circuit design are the gallium arsenide (GaAs) metal-semiconductor field-effect transistor (MESFET), the GaAs and indium phosphide (InP) high electron-mobility transistor (HEMT), the GaAs and silicon germanium (SiGe) heterojunction bipolar transistor (HBT), the silicon light-diffusion metal-oxide (LDMOS) field- In fact, physics-based models (directly derived from device geometry and semiconductor physics) and equivalent-circuit models are both driven by transistor technology and must therefore keep up with any changes in technology.

Drivers: Rising military & defense expenditure

The global political situation is likely to remain uncertain for a long time as a result of growing disagreements between two or more nations, such as the oil price war between Saudi Arabia and Russia and the withdrawal of US military forces from Afghanistan, among other things. To address this situation, regulatory bodies in various countries are requesting increased budgets from their respective governments. Although defence budgets around the world fell during the COVID-19 pandemic as governments focused on containing the virus and providing emergency relief, they may see a significant increase after 2021. As the global military sector focuses on developing cutting-edge warfare infrastructure for defence purposes in the face of current political uncertainty, as the popularity of microwave devices is skyrocketing.

Know more about this report: request for sample pages

Restraints: Device complexity

In electronic circuitry, the microwave device is a combination of active components such as transistors and tubes and passive components such as isolators, resistors, and filters. As a result of the design complexity, it is difficult to understand how microwave products work, resulting in inefficient end results. Furthermore, bulky electronic circuits require a lot of energy to work efficiently and are slow. With the rapid evolution of smartphone designs, cellular network requirements, and the increasing deployment of modern warfare infrastructure, device complexity is expected to be a major impediment to the adoption of microwave devices.

Impact of COVID-19

Because of the varied frequency availability, the microwave devices market has experienced unprecedented growth since its inception, with a broadening of application areas by different end users. The COVID-19 disaster disrupted the market's supply chain, resulting in decreased demand for these devices across multiple domains. However, the onset of COVID-19 during the first and second waves worldwide did not cause significant disruptions in the micorwave devices market because end users continued to rely on cutting-edge solutions to meet the massive demand for higher bandwidths as the global population works remotely.Rising military and defence spending, a growing need for secure and fast communications, and rising demand for microwave devices in patient monitoring are driving the growth of the microwave devices market.

Segmentation By Products:

On the basis of Products, the market is segmented into Active Devices and Passive Devices. The active microwave devices segment held a dominant share of the market and is expected to expand at a significant rate during the forecast period due to its widespread use in various defence and space electronics.

Segmentation By Frequency:

By Frequency, the market is segmented into KU-Band, C Band, KA-Band,L Band, X Band, S Band, Other Bands. During the forecast period, the Ku-band segment is expected to account for the largest share of the microwave devices market. The Ku-band (Ku stands for Kurz unter) represents the 12 GHz to 18 GHz mid-frequency range. It is used in satellite communication, specifically direct transmission for television, space shuttle, maritime, and industrial control systems. Because it has a lower throughput and is less susceptible to attenuation, Ku-band has been a pioneer in implementing high-speed communication channels. It also has shorter wavelengths, better spot beam coverage, and requires less investment. In recent years, these characteristics have paved the way for Ku-band compatible microwave devices, and this trend is expected to continue during the forecast period.

Segmentation By End User:

By End User the market is segmented into Space & communication, Military & Defense, Healthcare and others. Due to the widespread use of the devices in various space vehicles and satellites, the space & communication segment accounted for a sizable share of the market. The commercial segment accounted for a sizable share of the market and is expected to expand at a steady rate during the forecast period due to the increasing adoption of treatment instruments integrated with these devices.

Segmentation by Region

Based on region, the NGS services market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. During the forecast period, the North American region is expected to hold the largest share of the microwave devices market. Because of the rapid deployment of microwave devices in their warfare equipment, the market for microwave devices in the United States and North America is expected to see enormous growth during the forecast period. Furthermore, rising investments in 5G infrastructure are expected to drive microwave device market growth in 2020.

Competitive Landscape:

The microwave devices market players have implemented various types of organic as well as inorganic growth strategies, such as new product launches, and acquisitions to strengthen their offerings in the market. The major players in market are Thales Group (France), L3 Harris Technologies, Inc. (US), Teledyne Technologies Incorporated (US), CPI International Inc. (US), Qorvo, Inc. (US),

Industrial Development:

Qorvo, Inc. will release two Bulk Acoustic Wave (BAW) filters in September 2021. The pin-compatible QPQ3500 and QPQ3501 filters provide reduced insertion loss and improved out-of-band rejection to OEMs offering 5G base stations.

Thales Group will launch a product line of L-band satellite solutions in June 2021. This series is designed for increased mobility while still providing the benefits of Iridium. It includes a built-in 802.11b/g Wi-Fi access point with multiple user capabilities.

Teledyne Technologies RESON SeaBat T51-R Multibeam Echosounder that offers full swath coverage shallow water operations at 800 kHz without better efficiency will be released in June 2021.

Market taxonomy

By Product:

- Active Microwave Devices

- Solid-State Microwave Devices, By Type

- Solid-State Power Amplifier

- Other Solid-State Microwave Devices

- Solid-State Microwave Devices, By Material

- Gallium Arsenide (GAAS)

- Silicon

- Gallium Nitride (GAN)

- Silicon Carbide (SIC)

- Other Materials

- Vacuum Electron Microwave Devices, By Type

- Travelling Wave Tube Amplifier (TWTA)

- Klystron

- Magnetron

- Crossed-Field Amplifier

- Other Vacuum Electron Microwave Devices

- Solid-State Microwave Devices, By Type

- Passive Microwave Devices

By Frequency:

- Ku-Band

- C-Band

- Ka-Band

- L-Band

- X-Band

- S-Band

- Other Bands

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Microwave devices market Outlook TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Microwave devices market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Microwave devices market, By Products

5.1 Y-o-Y Growth Comparison, By Products

5.2Microwave devices market Share Analysis, By Products

5.3 Microwave devices market Size and Forecast, By Products

5.3.1 Active Devices

5.3.1.1 Solid State Microwave Devices

5.3.1.1.1 Solid-state power amplifier

5.3.1.1.2 Other solid-state microwave devices

5.3.1.2 Solid state microwave devices, by material

5.3.1.2.1 Gallium arsenide (GaAs)

5.3.1.2.2 Silicon

5.3.1.2.3 Gallium nitride (GaN)

5.3.1.2.4 Silicon carbide (SiC)

5.3.1.2.5 Other materials

5.3.1.3 Vaccum Electron Microwave Devices

5.3.1.3.1 Traveling-wave tube amplifier (TWTA)

5.3.1.3.2 Klystron

5.3.1.3.3 Magnetron

5.3.1.3.4 Crossed-field amplifier

5.3.1.3.5 Other vacuum electron microwave devices

5.3.2 Passive Devices

5.3.2.1 Waveguide

5.3.2.2 Couplers

5.3.2.3 Attenuattors

5.3.2.4 Isolators

5.3.2.5 Circulators

5.3.2.6 Others

6 Microwave devices market, By Frequency

6.1 Y-o-Y Growth Comparison, By Frequency

6.2 Microwave devices market Share Analysis, By Frequency

6.3 Microwave devices market Size and Forecast, By Frequency

6.3.1 KU-Band

6.3.2 C-Band

6.3.3 KA-Band

6.3.4 L-Band

6.3.5 X-Band

6.3.6 S-Band

6.3.7 Other Bands

7 Microwave devices market, By End User

7.1 Y-o-Y Growth Comparison, By End User

7.2Microwave devices market Share Analysis, By End User

7.3Microwave devices market Size and Forecast, By End User

7.3.1 Space and Communication

7.3.2 Military & Defense

7.3.3 Healthcare

7.3.4 Others

8 Microwave devices market, By Region

8.1 Microwave devices market Share Analysis, By Region

8.2 Microwave devices market Size and Forecast, By Region

9 North America Microwave devices market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 North America Microwave devices market Share Analysis, By Products

9.3 North America Microwave devices market Size and forecast, By Frequency

9.4 North America Microwave devices market Size and forecast, By End User

9.5 North America Microwave devices market Size and Forecast, By Country

9.5.1 U.S.

9.5.2 Canada

9.5.3 Mexico

10 Europe Microwave devices market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Europe Microwave devices market Share Analysis, By Products

10.3 Europe Microwave devices market Size and Forecast, By Frequency

10.4 Europe Microwave devices market Size and forecast., By End User

10.5 Europe Microwave devices market Size and Forecast, By Country

10.5.1 Germany

10.5.2 France

10.5.3 UK

10.5.4 Rest of Europe

11 Asia Pacific Microwave devices market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Asia Pacific Microwave devices market Share Analysis, By Products

11.3 Asia Pacific Microwave devices market Size and Forecast, by Frequency

11.4 Asia Pacific Microwave devices market size and forecast, By End User

11.5 Asia Pacific Microwave devices market Size and Forecast, By Country

11.5.1 China

11.5.2 Japan

11.5.3 India

11.5.4 Rest of Asia Pacific

12 Latin America Microwave devices market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Latin America Microwave devices market Share Analysis, By Products

12.3 Latin America Microwave devices market Size and Forecast, By Frequency

12.4 Latin America Microwave devices market size and forecast, By application

12.5 Latin America Microwave devices market Size and Forecast, Country

12.5.1. Brazil

12.5.2. Rest of Latin America

13 Middle East Microwave devices market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Middle East Microwave devices market Share Analysis, By Products

13.3 Middle East Microwave devices market Size and forecast, by Frequency

13.4 Middle East Microwave devices market Size and Forecast, by End User

13.5 Middle East Microwave devices market Size and Forecast, By Country

13.5.1. Saudi Arabia

13.5.2. UAE

13.5.3. Egypt

13.5.4 Kuwait

13.5.5. South Africa

14 Competitive Analysis

14.1 Competition Dashboard

14.2 Market share Analysis of Top Vendors

14.3 Key Development Strategies

15 Company Profiles

15.1 THALES GROUP

15.1.1 Overview

15.1.2 Productss

15.1.3 Key Financials

15.1.4 Business Segment & Geographic Overview

15.1.5 Key Market Developments

15.1.6 Key Strategies

15.2 L3 HARRIS TECHNOLOGIES, INC.

15.2.1 Overview

15.2.2 Productss

15.2.3 Key Financials

15.2.4 Business Segment & Geographic Overview

15.2.5 Key Market Developments

15.2.6 Key Strategies

15.3 TELEDYNE TECHNOLOGIES INCORPORATED

15.3.1 Overview

15.3.2 Productss

15.3.3 Key Financials

15.3.4 Business Segment & Geographic Overview

15.3.5 Key Market Developments

15.3.6 Key Strategies

15.4 CPI INTERNATIONAL INC.

15.4.1 Overview

15.4.2 Productss

15.4.3 Key Financials

15.4.4 Business Segment & Geographic Overview

15.4.5 Key Market Developments

15.4.6 Key Strategies

15.5 QORVO, INC

15.5.1 Overview

15.5.2 Productss

15.5.3 Key Financials

15.5.4 Business Segment & Geographic Overview

15.5.5 Key Market Developments

15.5.6 Key Strategies