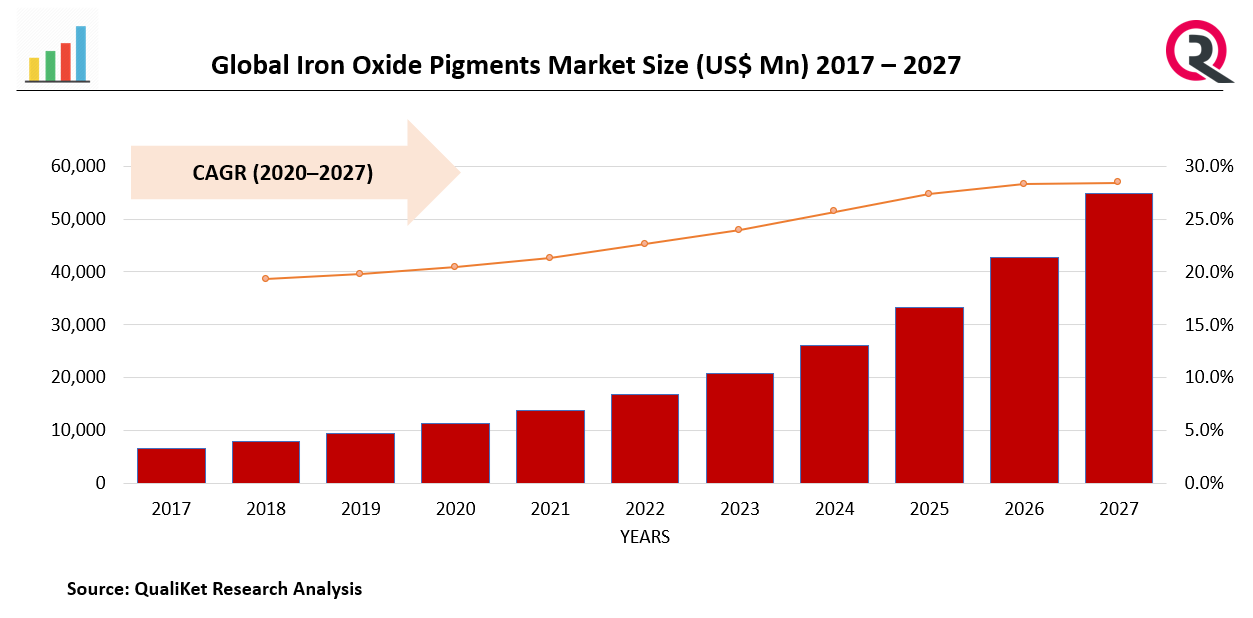

Global Iron Oxide Pigments Market Size, Trends & Growth Opportunity, By Color (Red, Yellow, Black, Others), By Type (Synthetic, Natural), By End User Industry (Construction, Coatings, Plastics, Paint, Others), By Region and Forecast till 2027

Report ID : QR1001290 | Industries : Chemicals & Materials | Published On :December 2021 | Page Count : 249Iron Oxide Pigments Market

Paints, varnishes, roofing tiles, mortar, and other concrete products typically contain iron oxide pigments. Natural pigments are utilized in primers and undercoats where colour consistency isn't as important, but synthetic pigments are used in topcoats where it is.

Drivers: Iron Oxide Pigments Market

The Driving factors of iron oxide pigments include Black, Red, yellow, other blended colours. These pigments are frequently utilised for a variety of applications because of their exceptional tinting strength, purity, and colour consistency. Paints, gold polish, mosaic tiles, plastics, floorings, and papers are all made with red iron oxide pigments. The global consumption of red iron oxide pigments is predicted to be driven by the wide availability of these pigments, as well as increased demand for these pigments from diverse end users.

Know more about this report: request for sample pages

Restraints: Iron Oxide Pigments Market

The market is impacted During the forecast period, raw material price volatility and exchange rate changes are projected to have an impact on the worldwide iron oxide pigments market's growth. The global iron oxide pigments market is further restrained by strict environmental rules governing the manufacture of synthetic iron oxide pigments.

Segmentation by Colour

The market is organised into four categories based on colour: red, yellow, black, and others. The sector of red iron oxide pigment had the largest market share. Its clean hue, constant qualities, and tinting strength have all contributed to its growth. Yellow iron oxide pigment, on the other hand, is predicted to increase at the fastest rate with the highest CAGR throughout the projection period.

Segmentation by end use industry

Based on End-User, the market is divided into Paints, Construction, Paints and Coatings, Plastics and Others. The construction industry has the major market portion. This is due to its widespread use as a colourant in the construction and building sector. Paints & Coatings, on the other hand, are predicted to expand at the fastest rate (CAGR) during the projection period.

Segmentation by Type

Based on Type, the market is classified into Synthetic and Natural. Synthetic had the most market share and is expected to continue to do so during the projection period. The development is mostly due to the increased usage of synthetic iron oxide pigments in electrical and electronic components, paints and coatings, medical and industrial equipment.

Segmentation by Region

By Region the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa. In the Global Iron Oxide Pigments Market, Asia Pacific held the largest market share. This is owing to the high demand for iron oxide pigments in the region's primary end-use industries, as well as the region's rapid industrial development.

Competitive Landscape:

TATA Pigments, Lanxess AG, Heubach GmbH, BASF SE, Huntsman Corporation, E.I. du Pont de Nemours and Company, Kronos Worldwide, Inc., CATHAY INDUSTRIES, Hunan Three-ring Pigments Co., Ltd., Tronox Ltd., Tronox Ltd.

Industrial Development:

TATA PIGMENTS created synthetic red iron oxide pigments using the direct Red Precipitation-cum-Hydrolysis technique and improved seed-making technology for yellow iron oxide pigments, resulting in a pollution-free environment.

Mr. Terence Yu, CEO of Cathay Industries Group, said, "Following a thorough planning and restructuring process, we have successfully launched a controlled process improvement programme, increasing output capacity on high quality spray-dried granule pigment product range by 100% plus effective March 2021."

Market taxonomy

By Colour

- Red

- Yellow

- Black

- Others

By Type

- Synthetic

- Natural

By end-use industry

- Construction

- Coatings

- Plastics

- Paint

- Others

By region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Global Iron Oxide Pigments Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Iron Oxide Pigments Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Iron Oxide Pigments Market, By Color

5.1 Y-o-Y Growth Comparison, By Color

5.2 Iron Oxide Pigments Market Share Analysis, By Color

5.3 Iron Oxide Pigments Market Size and Forecast, By Color

5.3.1 Red

5.3.2 Yellow

5.3.3 Black

5.3.4 Others

6 Iron Oxide Pigments Market, By End user

6.1 Y-o-Y Growth Comparison, By End user

6.2 Iron Oxide Pigments Market Share Analysis, By End user

6.3 Iron Oxide Pigments Market Size and Forecast, By End user

6.3.1 Construction

6.3.2 Coatings

6.3.3 Plastics

6.3.4 Paints

6.3.5 Others

7 Iron Oxide Pigments Market, By Type

7.1 Y-o-Y Growth Comparison, By Type

7.2 Iron Oxide Pigments Market Share Analysis, By Type

7.3 Iron Oxide Pigments Market Size and Forecast, By Type

7.3.1 Synthetic

7.3.2 Natural

8 Iron Oxide Pigments Market, By Region

8.1 Iron Oxide Pigments Market Share Analysis, By Region

8.2 Iron Oxide Pigments Market Share Analysis, By Region

8.3 Iron Oxide Pigments Market Size and Forecast, By Region

9 North America Iron Oxide Pigments Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 North America Iron Oxide Pigments Market Share Analysis, By Product

9.3 North America Iron Oxide Pigments Market Size and Forecast, By Application

9.5 North America Iron Oxide Pigments Market Size and Forecast, By Country

9.5.1 U.S.

9.5.2 Canada

9.5.3 Mexico

10 Europe Iron Oxide Pigments Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Europe Iron Oxide Pigments Market Share Analysis, By Product

10.3 Europe Iron Oxide Pigments Market Size and Forecast, By Application

10.5 Europe Iron Oxide Pigments Market Size and Forecast, By Country

10.5.1 Germany

10.5.2 France

10.5.3 UK

10.54. Rest of Europe

11 Asia Pacific Iron Oxide Pigments Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Asia Pacific Iron Oxide Pigments Market Share Analysis, By Product

11.3 Asia Pacific Iron Oxide Pigments Market Size and Forecast, By Application

11.5 Asia Pacific Iron Oxide Pigments Market Size and Forecast, By Country

11.5.1 China

11.5.2 Japan

11.5.3 India

11.5.4. Rest of Asia Pacific

12 Latin America Iron Oxide Pigments Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Latin America Iron Oxide Pigments Market Share Analysis, By Product

12.3 Latin America Iron Oxide Pigments Market Size and Forecast, By Application

12.5 Latin America Iron Oxide Pigments Market Size and Forecast, Country

12.5.1. Brazil

12.5.2. Rest of Latin America

13 Middle East Iron Oxide Pigments Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Middle East Iron Oxide Pigments Market Share Analysis, By Product

13.3 Middle East Iron Oxide Pigments Market Size and Forecast, By Application

13.5 Middle East Iron Oxide Pigments Market Size and Forecast, By Country

13.65.1. Saudi Arabia

13.5.2. UAE

13.5.3. Egypt

13.5.4. Kuwait

13.5.5. South Africa

14 Competitive Analysis

14.1 Competition Dashboard

14.2 Market share Analysis of Top Vendors

14.3 Key Development Strategies

15Company Profiles

15.1 Lanxess AG

15.1.1 Overview

15.1.2 Offerings

15.1.3 Key Financials

15.1.4 Business Segment & Geographic Overview

15.1.5 Key Market Developments

15.1.6 Key Strategies

15.2. BASF SE

15.2.1 Overview

15.2.2 Offerings

15.2.3 Key Financials

15.2.4 Business Segment & Geographic Overview

15.2.5 Key Market Developments

15.2.6 Key Strategies

15.3. Huntsman Corporation

15.3.1 Overview

15.3.2 Offerings

15.3.3 Key Financials

15.3.4 Business Segment & Geographic Overview

15.3.5 Key Market Developments

15.3.6 Key Strategies

15.4 E.I. du Pont de Nemours and Company

15.4.1 Overview

15.4.2 Offerings

15.4.3 Key Financials

15.4.4 Business Segment & Geographic Overview

15.4.5 Key Market Developments

15.4.6 Key Strategies

15.5 Kronos Worldwide, Inc.

15.5.1 Overview

15.5.2 Offerings

15.5.3 Key Financials

15.5.4 Business Segment & Geographic Overview

15.5.5 Key Market Developments

15.5.6 Key Strategies

15.6 Heubach GmbH

15.6.1 Overview

15.6.2 Offerings

15.6.3 Key Financials

15.6.4 Business Segment & Geographic Overview

15.6.5 Key Market Developments

15.6.6 Key Strategies

15.7 CATHAY INDUSTRIES

15.7.1 Overview

15.7.2 Offerings

15.7.3 Key Financials

15.7.4 Business Segment & Geographic Overview

15.7.5 Key Market Developments

15.7.6 Key Strategies

15.8 Hunan Three-ring Pigments Co., Ltd.

15.8.1 Overview

15.8.2 Offerings

15.8.3 Key Financials

15.8.4 Business Segment & Geographic Overview

15.8.5 Key Market Developments

15.8.6 Key Strategies

15.9 Tronox Ltd.

15.9.1 Overview

15.9.2 Offerings

15.9.3 Key Financials

15.9.4 Business Segment & Geographic Overview

15.9.5 Key Market Developments

15.9.6 Key Strategies

15.10 Applied Minerals Inc.

15.10.1 Overview

15.10.2 Offerings

15.10.3 Key Financials

15.10.4 Business Segment & Geographic Overview

15.10.5 Key Market Developments

15.10.6 Key Strategies