Global Inspection Management Software Market with COVID-19 Impact by Component (Solution and Services), Deployment Mode, Organization Size, Vertical (Aerospace and Defense, Healthcare and Life Sciences) Region and forecast till 2027.

Report ID : QR1001470 | Industries : Others | Published On :March 2022 | Page Count : 236Inspection Management Software Market

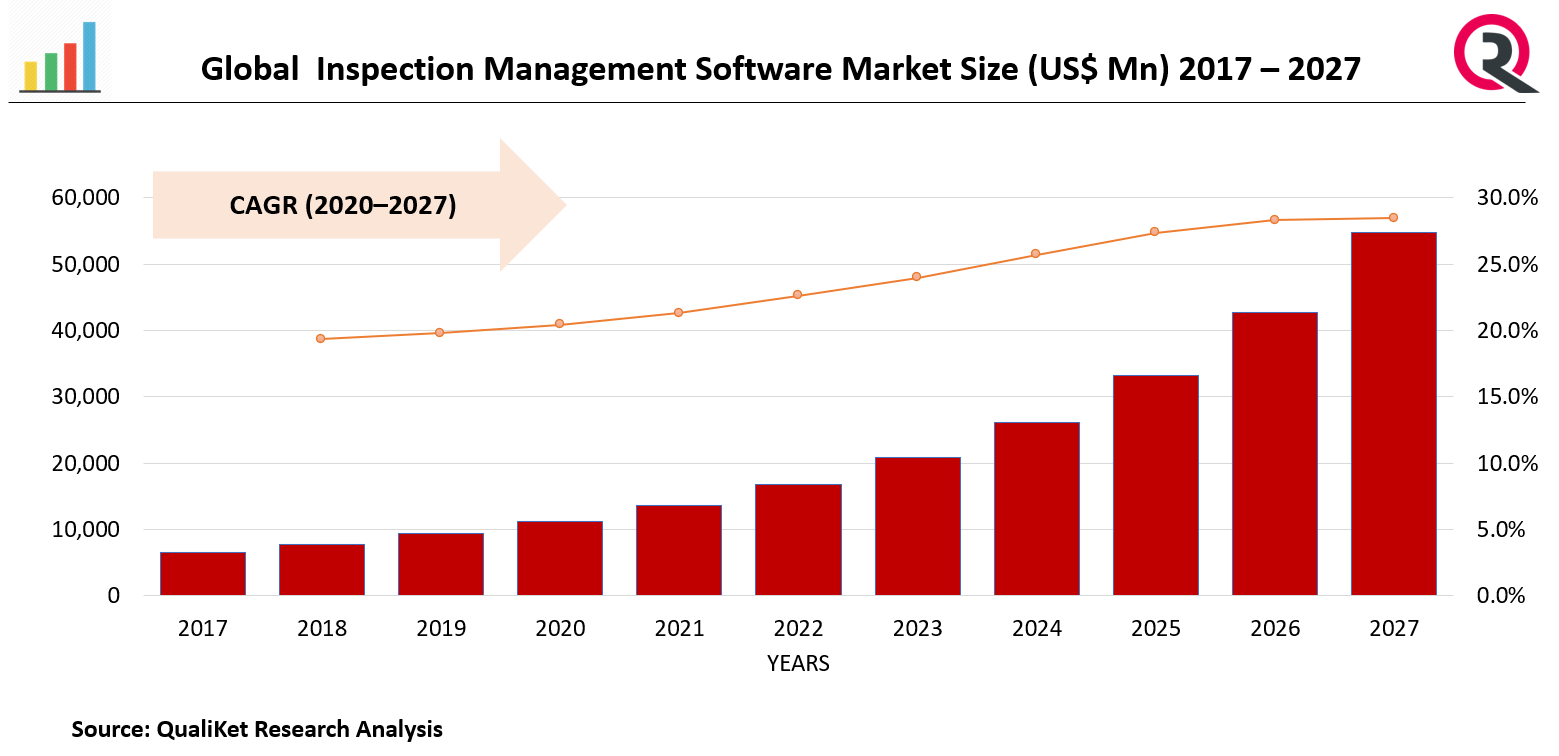

Inspection Management software aids in the simplification of the complex task of managing incoming quality control. Our risk-based workflow automates your incoming inspection process and ensures that you inspect the correct products from the correct suppliers at the correct time. The inspection management software market is expected to grow at a Compound Annual Growth Rate (CAGR) of 11.5 percent during the forecast period, from USD 7.6 billion in 2021 to USD 13.1 billion by 2026. Inspection management software aids in the planning, execution, creation of checklists, storage, and tracking of documents. Audit management, asset management, risk management, third-party inspection, compliance, quality management, and training management are all part of it.

Drivers: A wide range of features are available, including the ability to create forms, checklists, schedule, record, and track a task.

Simple forms and checklists are provided by inspection management software. The inspections monitor actions such as corrective actions and evaluate results using a robust reporting engine. Inspection management software assists in the creation of inspection checklists, the assignment of inspection frequency and responsibility, the tracking of in-progress, missed, and completed inspections, the identification of findings and corrective actions, and the conduct of inspections online or offline via mobile apps. This software helps reduce costs, increase efficiency and productivity, reduce risks, maintain compliances, and standardise reporting by scheduling inspections, recording results, and tracking corrective actions to completion. This encourages companies to use inspection management software, which drives market growth.

Know more about this report: request for sample pages

Restraints: High installation costs and technical issues with inspection management software

The inspection software is installed by a manufacturer, supplier, or mechanical subcontractor. The installer is responsible for adhering to the design documentation, quality assurance, code requirements, and manufacturer's recommendations. This overall installation process is costly, and companies may run into financial difficulties when attempting to install software. The use of proper materials, proper work sequences, specific types of equipment, and periodic inspections, as well as a higher quality of design, increases the cost, but a higher quality of conformity with the design saves the investment.

Impact of COVID-19

COVID-19 has had a variety of effects on the global inspection management software market. Transportation issues arose as a result of the pandemic, affecting the global supply chain industry. In the supply chain, the end user seeks suppliers who will provide high-quality products at reasonable prices and on time. There was widespread lockdown due to COVID-19, and patients were hesitant to visit the clinic. As a result, a number of patients have turned to telemedicine. Lockdowns imposed as a result of the COVID-19 outbreak have brought economies to a halt and are affecting every aspect of the supply chain. As a result, various industries were forced to change their normal manufacturing processes in order to produce essential medical supplies, PPE kits, and so on.

Segmentation By Component:

By Component the market is segmented into Solution & Services. During the forecast period, the solution segment will be the largest contributor to the growth of the inspection management software market. A planned examination or formal evaluation exercise is referred to as an inspection. Inspection in engineering activities entails applying measurements, tests, and gauges to specific characteristics of an object or activity. Inspection is the most common method of achieving standardisation, uniformity, and quality of workmanship. It is a low-cost method of controlling product quality by comparing it to pre-established standards and specifications. It improves quality control, reduces manufacturing costs, eliminates scrap losses, and pinpoints the root causes of defective work. Quality Management Software includes inspection management software (QMS). Audit management, change control, complaint management, document control, and supplier quality management are all features of QMS.

Segmentation By Deployment Mode:

Based On the Deployment mode the market is segmented into On-premises & Cloud. The cloud sector is expected to rule the major part of the market during the given forecast period.

Segmentation By Organization Size:

Based on the Organization Size the market is segmented into large enterprises and small & medium enterprises. During the forecast period, the large enterprise segment will grow at a faster rate. Inspection management software can be used by SMEs because it includes features such as inventory management, production management, accounting management, audit trial, and document management. Change control management, investigation, CAPA, market compliance, audit management, risk management, and training management are all part of a large enterprise's EQMS. This Provide real-time business data, electronic records, and signatures to all stakeholders. Maximum productivity and cost-cutting are critical factors for these businesses, which have limited budgets to keep track of crowdsourced ideas. As a result, these businesses rely on freely available public cloud storage or limited on-premises inspection management software. When compared to large enterprises, SMEs generate less enterprise data which reduces overall costs.

Segmentation By Vertical:

Based on the vertical, the, market is segment into Aerospace & Defense, Automotive, Consumer Goods & Retail, Energy and Utilities, Healthcare and Lifesciences, Manufacturing, Telecom, Transport & Logistics and Other Verticals. During the forecast period, the healthcare and telecom segments are expected to have a greater dominance in the inspection management software market.Certainty Software is a great choice for a variety of audit and inspection tasks in the telecommunications industry. Certainty is an excellent solution for collecting, managing, and reporting audit and inspection results and corrective actions to ensure compliance, reduce risk, and improve performance across the enterprise, from contractor evaluations and energy isolation audits to fall protection and working at height safety inspections. ACTIA has developed a software solution for the end-to-end management of vehicle inspection centres in order to provide global solutions to customers. ACTIA has a number of vehicle inspection management modules, including an appointment module, an inspection module, a supervision module, a check-out module, a lounge module, and a delivery module.

Segmentation by Region

Based on region, the NGS services market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America is the overall leader in the adoption and implementation of inspection management software and services, followed by Europe, which is demonstrating and adopting inspection management software at an unprecedented rate. Lockdowns imposed in response to the COVID-19 outbreak have effectively shut down economies and are affecting every aspect of North America's supply chain. This prompted a number of industries to alter their normal manufacturing processes in order to produce critical medical supplies, PPE kits, and other items. Transportation issues have increased as a result of the pandemic, affecting the global supply chain industry. In the supply chain, the end-user seeks suppliers who will provide high-quality products at reasonable prices and on time. Vehicle sales in the United States have dropped by 47 percent as a result of the pandemic.

Competitive Landscape:

Major players in the market include SAP (Germany), Oracle (US), Siemens (Germany), Dassault Systemes (France), PTC (US)

Industrial Development:

SAP will collaborate with Amazon Business in September 2021 to broaden buyer options. With this collaboration and technological integration, Amazon Business becomes a source of supply for Spot Buy, a feature within SAP Ariba solutions that allows users to buy items from trusted suppliers.

Siemens will launch the 3WA series in September 2020. 3WA circuit breakers are designed to meet the low-voltage power distribution needs of digital environments. They assist with software-based planning and engineering, as well as digital testing and monitoring.

Autodesk acquired Moxion in January 2022. Autodesk's cloud platform for media and entertainment will be expanded upstream, production will be expanded, and new customers will be brought on board to help with better integration across the production chain.

Market taxonomy

Based on the Component:

- Solution

- Services

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on Deployment mode:

- cloud

- on-premise

Based on Vertical:

- Aerospace and Defense

- Manufacturing

- Automotive

- Energy and Utilities

- Transport and Logistics

- Consumer goods and Retail

- Telecom

- Healthcare and Lifesciences

- Others* (hospitality, government, chemical, metal and mining, and construction)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Inspection Management software market Outlook TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Inspection Management software market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5Inspection Management software market, By Solution

5.1 Y-o-Y Growth Comparison, By Solution

5.2Inspection Management software market Share Analysis, By Solution

5.3Inspection Management software market Size and Forecast, By Solution

5.3.1 Access Points

5.3.2 WLAN Controllers

6 Inspection Management software market, By Component

6.1 Y-o-Y Growth Comparison, By Component

6.2Inspection Management software market Share Analysis, By Component

6.3Inspection Management software market Size and Forecast, By Component

6.3.1 Solution

6.3.2 Services

7 Inspection Management software market, By Deployment Mode

7.1 Y-o-Y Growth Comparison, By Deployment Mode

7.2 Inspection Management software market Share Analysis, By Deployment Mode

7.3 Inspection Management software market Size and Forecast, By Deployment Mode

7.3.1 On-Premises

7.3.2 Cloud

8 Inspection Management software market, By Organization Size

8.1 Y-o-Y Growth Comparison, By Organization Size

8.2Inspection Management software market Share Analysis, By Organization Size

8.3Inspection Management software market Size and Forecast, By Organization size

8.3.1 Large Enterprises

8.3.2 Small and medium enterprises

9Inspection Management software market, By Vertical

9.1 Y-o-Y Growth Comparison, By Vertical

9.2Inspection Management software market Share Analysis, By Vertical

9.3Inspection Management software market Size and Forecast, By Vertical

9.3.1 Aerospace & Defense

9.3.2 Automotive

9.3.3 Consumer Goods & Retail

9.3.4 Energy and Utilities

9.3.5 Healthcare and Lifesciences

9.3.6 Manufacturing

9.3.7 Telecom

9.3.8 Transport & Logistics

9.3.9 Other Verticals

10 Inspection Management software market, By Region

10.1Inspection Management software market Share Analysis, By Region

10.2Inspection Management software market Size and Forecast, By Region

11 North America Inspection Management software market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 North America Inspection Management software market Size and forecast, By Component

11.3 North America Inspection Management software market Size and forecast, By Deployment Mode

11.4 North America Inspection Management software market size and forecast, By Organization Size

11.5 North America Inspection Management software market size and forecast, By vertical

11.6 North America Inspection Management software market Size and Forecast, By Country

11.7.1 U.S.

11.7.2 Canada

11.7.3 Mexico

12 Europe Inspection Management software market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Europe Inspection Management software market Size and Forecast, By Component

12.3 Europe Inspection Management software market Size and forecast., By Deployment Mode

12.4 Europe Inspection Management software market size and forecast, By Organization Size

12.5 Europe Inspection Management software market size and forecast, By Vertical

12.6 Europe Inspection Management software market Size and Forecast, By Country

12.6.1 Germany

12.6.2 France

12.7.3 UK

12.7.4 Rest of Europe

13 Asia Pacific Inspection Management software market Analysis and Forecast (2021-2027)

13.1 Introduction

13.3 Asia Pacific Inspection Management software market Size and Forecast, by Component

13.4 Asia Pacific Inspection Management software market size and forecast, By Deployment Mode

13.5 Asia Pacific Inspection Management software market size and forecast, By Organization Size

13.6 Asia Pacific Inspection Management software market size and forecast, By vertical

13.7 Asia Pacific Inspection Management software market Size and Forecast, By Country

13.7.1 China

13.7.2 Japan

13.7.3 India

13.7.4 Rest of Asia Pacific

14 Latin America Inspection Management software market Analysis and Forecast (2021-2027)

14.1 Introduction

14.2 Latin America Inspection Management software market Share Analysis, By Solution

14.3 Latin America Inspection Management software market Size and Forecast, By Component

14.4 Latin America Inspection Management software market Size and Forecast, By Deployment Mode

14.5 Latin America Inspection Management software market size and forecast, By organization size

14.6 Latin America Inspection Management software market size and forecast, by Vertical

14.7 Latin America Inspection Management software market Size and Forecast, Country

14.7.1. Brazil

14.7.2. Rest of Latin America

15 Middle East Inspection Management software market Analysis and Forecast (2021-2027)

15.1 Introduction

15.2 Middle East Inspection Management software market Size and forecast, by Component

15.3 Middle East Inspection Management software market Size and Forecast, by Deployment Mode

15.4 Middle EastInspection Management software market size and Forecast, By Organization Size

15.5 Middle EastInspection Management software market size and forecast, By Vertical

15.6 Middle EastInspection Management software market Size and Forecast, By Country

15.6.1. Saudi Arabia

15.6.2. UAE

15.6.3. Egypt

15.6.4 Kuwait

15.6.5. South Africa

16 Competitive Analysis

16.1 Competition Dashboard

16.2 Market share Analysis of Top Vendors

16.3 Key Development Strategies

17 Company Profiles

17.1 SAP

17.1.1 Overview

17.1.2 Product Categorys

17.1.3 Key Financials

17.1.4 Business Segment & Geographic Overview

17.1.5 Key Market Developments

17.1.6 Key Strategies

17.2 ORACLE

17.2.1 Overview

17.2.2 Product Categorys

17.2.3 Key Financials

17.2.4 Business Segment & Geographic Overview

17.2.5 Key Market Developments

17.2.6 Key Strategies

17.3 SEIMENS

17.3.1 Overview

17.3.2 Product Categories

17.3.3 Key Financials

17.3.4 Business Segment & Geographic Overview

17.3.5 Key Market Developments

17.3.6 Key Strategies

17.4 DASSAULT SYSTEMES

17.4.1 Overview

17.4.2 Product Categorys

17.4.3 Key Financials

17.4.4 Business Segment & Geographic Overview

17.4.5 Key Market Developments

17.4.6 Key Strategies

17.5 PTC

17.5.1 Overview

17.5.2 Product Categorys

17.5.3 Key Financials

17.5.4 Business Segment & Geographic Overview

17.5.5 Key Market Developments

17.5.6 Key Strategie