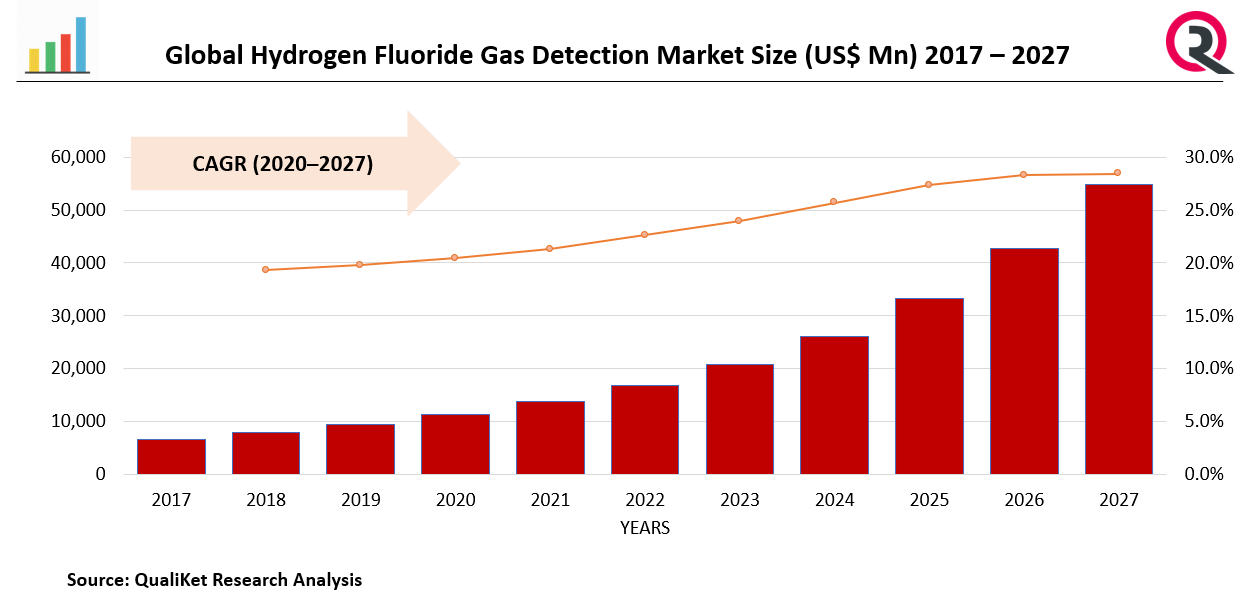

Global Hydrogen Fluoride Gas Detection Market Size, Trends & Growth Opportunity, By Type (Fixed Devices, Portable Devices) By End use (Introduction, Chemical, Mining and Metallurgical, Pharmaceutical, Glass Etching, Others) By Region and Forecast till 2027

Report ID : QR1001324 | Industries : Semiconductors and Electronics | Published On :January 2022 | Page Count : 253Global Hydrogen Fluoride Gas Detection Market

Hydrogen fluoride detectors allow for precise measurement of this gas's concentrations in the atmosphere. Fixed or portable HF gas detectors provide numerous options for adapting to various applications that require monitoring of this gas. Discover our entire inventory of hydrogen fluoride monitoring equipment on this page.

Drivers: Hydrogen Fluoride Gas Detection Market

The Driving Factors of Hydrogen Fluoride Gas Detection Market are water retention structures, repair operations, protective coatings, and other applications (free formed structures and new constructions). Increased urbanisation, rapid economic development, and subsurface transportation are all driving growth in underground building.

Know more about this report: request for sample pages

Restraints: Hydrogen Fluoride Gas Detection Market

However, the market is impacted because High price of hydrogen fluoride gas detection devices. Because hydrogen fluoride gas is extremely hazardous to human health and the environment, it must be constantly monitored. However, when compared to other gas detection devices, hydrogen fluoride gas detection devices are extremely expensive.

Impact of COVID-19

The COVID-19 pandemic outbreak and spread had a negative impact on the hydrogen fluoride gas detection market in 2020, resulting in lower shipments of hydrogen fluoride gas detection devices. As a result, revenues fell, resulting in a market with low growth in the first half of 2020. This pattern persisted until the first quarter of 2021.

Segmentation by Type:

By application, Hydrogen Fluoride Gas Detection Market is further classified into Fixed Devices, Portable Devices. Portable devices, such as detectors and handheld gas monitors, are less expensive to end users than fixed monitors and make it easier to locate hydrogen fluoride gas. Wireless gas detectors, for example, can be used in large manufacturing plants to detect exact locations or exact points of hydrogen fluoride gas leaks.

Segmentation by End use

By end use market is segmented by Various end-user industries, including chemicals, pharmaceuticals, semiconductors, mining and metallurgical, automotive, consumer electronics, and oil and gas, have begun to implement Industry 4.0 concepts in their manufacturing processes to capitalise on benefits such as increased productivity, flexibility, and safety, better quality, reduced need for consumables, and lower production costs.

Segmentation by Region

By Region the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa. The increased demand for underground Construction is predicted to be driven by the region's growing population and expanding disposable income. From 2016 to 2021, South America is expected to be the second-fastest-growing market. This expansion can be ascribed to the region's Tarmac Building Products Limited industry.

Competitive Landscape:

Honeywell International Inc., Teledyne Technologies Incorporated, Drägerwerk AG & Co. KGaA, MSA Safety Incorporated, GfG Instrumentation, Inc., Sensidyne, LP, Crowcon Detection Instruments Ltd., Analytical Technology, Inc., RKI Instruments, Inc., and R.C. Systems, Inc.

Industrial Development:

MSA Safety Incorporated will open a new 20,000 square-foot manufacturing facility in Cranberry Township, Pennsylvania, in September 2021, to establish a global centre of excellence for gas detection technology. The new facility will primarily be used for assembly work associated with the recent relocation of multiple fixed gas and flame detection (FGFD) product lines from Lake Forest, California.

MSA Safety Incorporated will purchase Bacharach, Inc., a leader in gas detection technologies used in the heating, ventilation, air conditioning, and refrigeration (HVAC-R) markets, in July 2021. Bacharach, Inc. generates approximately USD 70 million in revenue per year. MSA's access to attractive end markets around the world was accelerated as a result of the acquisition.

Market taxonomy

By Type –

- Fixed Devices

- Portable Devices

By End use

- Introduction

- Chemical

- Mining and Metallurgical

- Pharmaceutical

- Glass Etching

- Others (pulp & paper, wastewater treatment, and semiconductor)

By region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Hydrogen Fluoride Gas Detection Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Hydrogen Fluoride Gas Detection Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Hydrogen Fluoride Gas Detection Market, By Type

5.1 Y-o-Y Growth Comparison, By Type

5.2 Hydrogen Fluoride Gas Detection Market Share Analysis, By Type

5.3 Hydrogen Fluoride Gas Detection Market Size and Forecast, By Type

5.3.1 Fixed Devices

5.3.2 Portable Devices

6 Hydrogen Fluoride Gas Detection Market, By End use

6.1 Y-o-Y Growth Comparison, By End use

6.2 Hydrogen Fluoride Gas Detection Market Share Analysis, By End use

6.3 Hydrogen Fluoride Gas Detection Market Size and Forecast, By End use

6.3.1 chemicals

6.3.2 pharmaceuticals

6.3.3 semiconductors

6.3.4 mining and metallurgical

6.3.5 automotive

7 Hydrogen Fluoride Gas Detection Market, By Region

7.1 Hydrogen Fluoride Gas Detection Market Share Analysis, By Region

7.2 Hydrogen Fluoride Gas Detection Market Share Analysis, By Region

7.3 Hydrogen Fluoride Gas Detection Market Size and Forecast, By Region

8 North America Hydrogen Fluoride Gas Detection Market Analysis and Forecast (2021-2027)

8.1 Introduction

8.2 North America Hydrogen Fluoride Gas Detection Market Share Analysis, By Type

8.3 North America Hydrogen Fluoride Gas Detection Market Size and Forecast, By End use

8.4 North America Hydrogen Fluoride Gas Detection Market Size and Forecast, By End User

8.5 North America Hydrogen Fluoride Gas Detection Market Size and Forecast, By Country

8.5.1 U.S.

8.5.2 Canada

8.5.3 Mexico

9 Europe Hydrogen Fluoride Gas Detection Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 Europe Hydrogen Fluoride Gas Detection Market Share Analysis, By Type

9.3 Europe Hydrogen Fluoride Gas Detection Market Size and Forecast, By End use

9.4 Europe Hydrogen Fluoride Gas Detection Market Size and Forecast, By End User

9.5 Europe Hydrogen Fluoride Gas Detection Market Size and Forecast, By Country

9.5.1 Germany

9.5.2 France

9.5.3 UK

9.5.4. Rest of Europe

10 Asia Pacific Hydrogen Fluoride Gas Detection Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Asia Pacific Hydrogen Fluoride Gas Detection Market Share Analysis, By Type

10.3 Asia Pacific Hydrogen Fluoride Gas Detection Market Size and Forecast, By End use

10.4 Asia Pacific Hydrogen Fluoride Gas Detection Market Size and Forecast, By End User

10.5 Asia Pacific Hydrogen Fluoride Gas Detection Market Size and Forecast, By Country

10.5.1 China

10.5.2 Japan

10.5.3 India

10.5.4. Rest of Asia Pacific

11 Latin America Hydrogen Fluoride Gas Detection Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Latin America Hydrogen Fluoride Gas Detection Market Share Analysis, By Type

11.3 Latin America Hydrogen Fluoride Gas Detection Market Size and Forecast, By End use

11.4 Latin America Hydrogen Fluoride Gas Detection Market Size and Forecast, By End User

11.5 Latin America Hydrogen Fluoride Gas Detection Market Size and Forecast, Country

11.5.1. Brazil

11.5.2. Rest of Latin America

12 Middle East Hydrogen Fluoride Gas Detection Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Middle East Hydrogen Fluoride Gas Detection Market Share Analysis, By Type

12.3 Middle East Hydrogen Fluoride Gas Detection Market Size and Forecast, By End use

12.4 Middle East Hydrogen Fluoride Gas Detection Market Size and Forecast, By End User

12.5 Middle East Hydrogen Fluoride Gas Detection Market Size and Forecast, By Country

12.5.1. Saudi Arabia

12.5.2. UAE

12.5.3. Egypt

12.5.4. Kuwait

12.5.5. South Africa

13 Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14 Company Profiles

14.1 Honeywell International Inc.

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2. Teledyne Technologies Incorporated

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3. Drägerwerk AG & Co. KGaA

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 MSA Safety Incorporated

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 GfG Instrumentation, Inc.

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies

14.6 Sensidyne

14.6.1 Overview

14.6.2 Offerings

14.6.3 Key Financials

14.6.4 Business Segment & Geographic Overview

14.6.5 Key Market Developments

14.6.6 Key Strategies

14.7 Crowcon Detection Instruments Ltd.

14.7.1 Overview

14.7.2 Offerings

14.7.3 Key Financials

14.7.4 Business Segment & Geographic Overview

14.7.5 Key Market Developments

14.7.6 Key Strategies

14.8 Analytical Technology, Inc.

14.8.1 Overview

14.8.2 Offerings

14.8.3 Key Financials

14.8.4 Business Segment & Geographic Overview

14.8.5 Key Market Developments

14.8.6 Key Strategies

14.9 RKI Instruments, Inc.

14.9.1 Overview

14.9.2 Offerings

14.9.3 Key Financials

14.9.4 Business Segment & Geographic Overview

14.9.5 Key Market Developments

14.9.6 Key Strategies

14.10 R.C. Systems, Inc.

14.10.1 Overview

14.10.2 Offerings

14.10.3 Key Financials

14.10.4 Business Segment & Geographic Overview

14.10.5 Key Market Developments

14.10.6 Key Strategies