Global High Barrier Films Market Size, Trends & Growth Opportunity, By Type (PE, PET, PP, PA, Organic Coatings, Inorganic Oxide Coatings, and Others), By End-User (Food & Beverage Packaging, Pharmaceutical Packaging, Agriculture, and Others) and By Region and Forecast till 2027.

Report ID : QR1001418 | Industries : Chemicals & Materials | Published On :January 2022 | Page Count : 236Global High Barrier Films Market

High barrier films play an important role in providing products with the properties they need, as well as extending their shelf life. It also aids in the structure's recycling by ensuring that all layers belong to the same polymer family. Furthermore, high barrier films have a co-extruded, impermeable, and resilient structure. It's solvent-free and doesn't react with pre-packaged foods very often.

The high barrier packaging films help to prevent oxygen, carbon dioxide, and moisture contact while also limiting the effects of mineral oil and UV light. Food qualities such as colour, taste, texture, aroma, and flavour are also held by this powerful barrier made of functional materials.

Drivers: The main drivers of demand for high barrier films are increasing applications of high barrier films in food and beverage product packaging, rising demand for minimally invasive surgeries, growing demand for barrier films in the pharmaceutical and agriculture industries, and rising demand for high barrier films to protect electronic components. The growing dominance of large retail chains in developing and developed national markets is benefiting high-barrier packaging film demand, which is helping to expand the market for packaged food with a focus on cost control and shelf life extension.

Know more about this report: request for sample pages

Restraints: However, during the forecast period, the barrier films market is expected to be hampered by a lack of recycling infrastructure and price fluctuations in raw materials for Hogh barrier films.

Impact of Covid-19

In several countries, the COVID-19 pandemic has been contained, and serious efforts are being made to eradicate the virus globally. With the restoration of the supply chain and logistics, raw materials would be available, restoring the manufacturing industry. Businesses across all industries are likely to increase production capacity in order to flatten the demand curve, which could have a significant impact on the high barrier packaging films market following COVID-19. Furthermore, current demand restraints are most likely to be overcome by rising consumption of food and pharmaceutical packaging products.

Segmentation By Type: The Global High Barrier Films Market is classified on the basis of Type into PE, PET, PP, PA, Organic Coatings, Inorganic Oxide Coatings, and Others.

Segmentation By End-user: The Global High Barrier Films Market is classified on the basis of End-user into Food & Beverage Packaging, Pharmaceutical Packaging, Agriculture, and Others.

Segmentation By Region: The Global High Barrier Films Market is classified on the basis of Region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Competitive Landscape: The key players of Global High Barrier Films Market are Amcor plc (Switzerland), Mondi plc (U.K.), Huhtamaki Group (Finland), Sealed Air Corporation (U.S.), Jindal Poly Films Limited (India), Toppan Printing Co., Ltd. (Japan), Kureha Corporation (Japan), HPM Global, Inc. (South Korea)., Borealis AG (Austria), and Uflex Limited (India).

Industrial Development

- Berry Global Inc. planned to invest USD 30 million in nine of its North American locations in March 2020 for upgrades and new lines to existing assets. The purpose of this investment is to increase the capacity of ultra-high performance stretch films production. This organic growth strategy was implemented to meet the rising demand for stretch films and to strengthen the company's position in the North American market.

- Amcor Plc developed the first recyclable retort flexible packaging in September 2020, reducing the packaging's environmental footprint by 60%. (approximately). High-performance packaging, such as wet pet food, ready-meals, baby foods, and pre-cooked soups, will be recyclable as a result. With this new product development, the company will be able to meet the growing demand for environmentally friendly packaging while also expanding its packaging product portfolio.

- In January 2020, Amcor Plc partnered with Moda Vaccum Packaging System (New Zealand) to offer innovative packaging solutions. By combining Amcor's rollstock film and shrink bag for cheese and meat with Moda's packaging system, producers can achieve total cost savings and operational efficiency.

Market Taxonomy

By Type

- PE

- PET

- PP

- PA

- Organic Coatings

- Inorganic Oxide Coatings

- Others

By End-User

- Food & Beverage Packaging

- Pharmaceutical Packaging

- Agriculture

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key Questions Addressed by the Report

- What are the Key Opportunities in Global High Barrier Films Market?

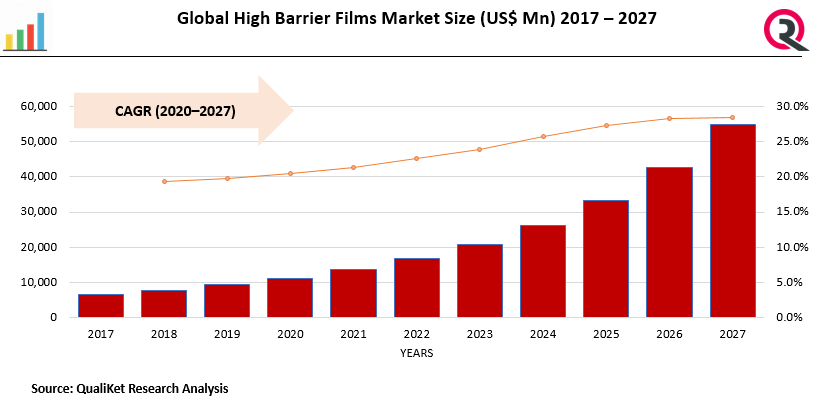

- What will be the growth rate from 2020 to 2027?

- Which segment/region will have highest growth?

- What are the factors that will impact/drive the Market?

- What is the competitive Landscape in the Industry?

- What is the role of key players in the value chain?

Global High Barrier Films Market TOC

Global High Barrier Films Market

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global High Barrier Films Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global High Barrier Films Market, By Product Type

5.1 Y-o-Y Growth Comparison, By Product Type

5.2 Global High Barrier Films Market Share Analysis, By Product Type

5.3 Global High Barrier Films Market Size and Forecast, By Product Type

5.3.1 PE

5.3.2. PET

5.3.3. PP

5.3.4. PA

5.3.5. Organic Coatings

5.3.6. Inorganic Oxide Coatings

5.3.7. Others

6 Global High Barrier Films Market, By End User

6.1 Y-o-Y Growth Comparison, By End User

6.2 Global High Barrier Films Market Share Analysis, By End User

6.3 Global High Barrier Films Market Size and Forecast, By End User

6.3.1 Food & Beverage Packaging

6.3.2. Pharmaceutical Packaging

6.3.3. Agriculture

7 Global High Barrier Films Market, By Region

7.1 Global High Barrier Films Market Share Analysis, By Region

7.2 Global High Barrier Films Market Share Analysis, By Region

7.3 Global High Barrier Films Market Size and Forecast, By Region

8 North America High Barrier Films Market Analysis and Forecast (2021-2027)

8.1 Introduction

8.2 North America High Barrier Films Market Share Analysis, By Product Type

8.3 North America High Barrier Films Market Size and Forecast, By End User

8.5 North America High Barrier Films Market Size and Forecast, By Country

8.5.1 U.S.

8.5.2 Canada

8.5.3 Mexico

9 Europe High Barrier Films Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 Europe High Barrier Films Market Share Analysis, By Product Type

9.3 Europe High Barrier Films Market Size and Forecast, By End User

9.5 Europe High Barrier Films Market Size and Forecast, By Country

9.5.1 Germany

9.5.2 France

9.5.3 UK

9.54. Rest of Europe

10 Asia Pacific High Barrier Films Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Asia Pacific High Barrier Films Market Share Analysis, By Product Type

10.3 Asia Pacific High Barrier Films Market Size and Forecast, By End User

10.5 Asia Pacific High Barrier Films Market Size and Forecast, By Country

10.5.1 China

10.5.2 Japan

10.5.3 India

10.5.4. Rest of Asia Pacific

11 Latin America High Barrier Films Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Latin America High Barrier Films Market Share Analysis, By Product Type

11.3 Latin America High Barrier Films Market Size and Forecast, By End User

11.5 Latin America High Barrier Films Market Size and Forecast, Country

11.5.1. Brazil

11.5.2. Rest of Latin America

12 Middle East High Barrier Films Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Middle East High Barrier Films Market Share Analysis, By Product Type

12.3 Middle East High Barrier Films Market Size and Forecast, By End User

12.5 Middle East High Barrier Films Market Size and Forecast, By Country

12.65.1. Saudi Arabia

12.5.2. UAE

12.5.3. Egypt

15.5.4. Kuwait

12.5.5. South Africa

13 Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14Company Profiles

14.1 Amcor plc (Switzerland)

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2. Mondi plc (U.K.)

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3. Huhtamaki Group (Finland)

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 Sealed Air Corporation (U.S.)

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 Jindal Poly Films Limited (India)

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies

14.6 Toppan Printing Co. Ltd. (Japan)

14.6.1 Overview

14.6.2 Offerings

14.6.3 Key Financials

14.6.4 Business Segment & Geographic Overview

14.6.5 Key Market Developments

14.6.6 Key Strategies

14.7 Kureha Corporation (Japan)

14.7.1 Overview

14.7.2 Offerings

14.7.3 Key Financials

14.7.4 Business Segment & Geographic Overview

14.7.5 Key Market Developments

14.7.6 Key Strategies

14.8 HPM Global, Inc. (South Korea)

14.8.1 Overview

14.8.2 Offerings

14.8.3 Key Financials

14.8.4 Business Segment & Geographic Overview

14.8.5 Key Market Developments

14.8.6 Key Strategies

14.9 Borealis AG (Austria)

14.9.1 Overview

14.9.2 Offerings

14.9.3 Key Financials

14.9.4 Business Segment & Geographic Overview

14.9.5 Key Market Developments

14.9.6 Key Strategies

14.10 Uflex Limited (India)

14.10.1 Overview

14.10.2 Offerings

14.10.3 Key Financials

14.10.4 Business Segment & Geographic Overview

14.10.5 Key Market Developments

14.10.6 Key Strategies