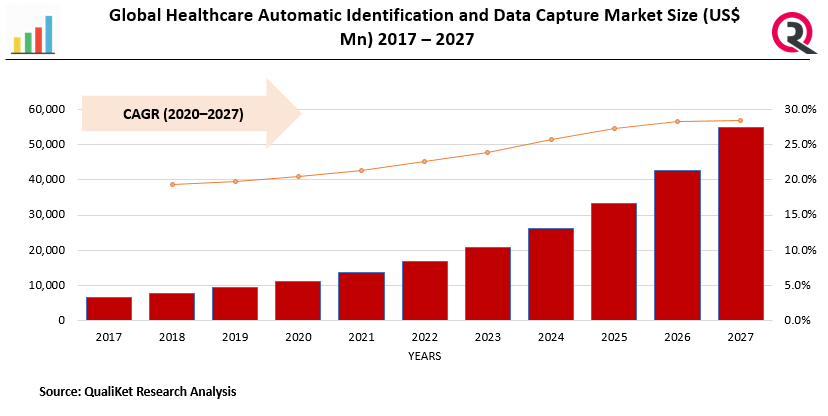

Global Healthcare Automatic Identification and Data Capture Market Size, Trends & Growth Opportunity, Product (Scanner, Biometric, Printer), Technology (RFID, Barcode, Biometrics, Smart Cards, OCR), Application (Patient, Asset, Inventory, Facility, Medication, Specimen Management), Region and forecast till 2027.

Report ID : QR1001420 | Industries : Healthcare | Published On :January 2022 | Page Count : 238Healthcare Automatic Identification and Data Capture Market

AIDC, which is commonly abbreviated as Automatic Identification and Data Collection, can enter a computer without human intervention and is a method that helps in the identification and collection of data. There are several technologies that are part of AIDC, including magnetic stripes, barcodes, QR codes, biometrics, radio frequency identification, optical character recognition, smart cards, and voice recognition. Using Healthcare's Automatic Identification and Data Collection (AIDC), it enables users to have error-free data collection with better patient care by reducing the risk of medication errors.

Drivers: Managing the healthcare workforce

Managing the healthcare workforce as well as scheduling patient workflow efficiently leads to the growth of the market.

Know more about this report: request for sample pages

Restraints: High installation cost of AIDC solutions

The high cost of installation is one of the main factors hindering the adoption of automatic identification and data collection products by small and medium-sized businesses. When automatic identification and data collection products such as smart cards are installed, one or two contactless products need to be installed. Point-of-sale terminals, which is very expensive for small and medium-sized businesses with limited investment capital. Similarly, many small retailers still rely more on cash transactions than credit or debit cards for payments.

Impact of COVID-19

The COVID19 pandemic has impacted AIDC sales worldwide. However, it has created opportunities and challenges for the actors present in the ecosystem. With healthcare still active around the world, AIDC will be in demand. Face and fingerprint recognition to access any system's database. If the person does not meet any of the identification criteria, access to the database will be denied. These additional security features offered by biometrics present an opportunity for the growth of the automatic identification and data collection market. A rising number of patients and deaths from COVID19 will force all countries to increase their healthcare spending, which is expected to have a positive impact. on the growth of the AIDC product market.

Segmentation By Product:

Based on Product, the Healthcare AIDC market is broadly segmented into Biometric Scanners, Printers & Recorders, Scanners & Readers, Mobile Computing, Consumables, and Software. In 2021, the scanners and readers segment is expected to account for the largest share of the global healthcare AIDC market due to increased demand for AIDC systems to reduce custom data entry errors, patient tracking, more efficient supply chain and inventory management, and asset management. Furthermore, this segment is expected to grow at the fastest growth rate during the forecast period owing to the increasing demand for safe specimen management during the COVID19 pandemic. In terms of volume, the consumables segment is expected to account for the largest share in 2021. The segment is also expected to grow at the highest growth rate during the forecast period.

Segmentation By Technology:

Based on technology, the healthcare AIDC market is broadly categorized into RFID, barcodes, biometrics, smart cards, magnetic stripes, and OCR. In 2021, the RFID segment is estimated to have the largest share of the global AIDC market in 2021 owing to the increasing demand for AIDC systems to reduce user-defined data entry errors, the steady increase in identity fraud, the growing importance of access control and the increasing demand for AIDC systems Healthcare account for the growing demand for contactless data access post COVID19. However, due to the increasing demand for biometric devices in the industry, the biometric segment is expected to register the fastest CAGR during the forecast period.

Segmentation By Application:

Based on Application, the Healthcare AIDC market is broadly categorized into Asset Management, Inventory Management, Patient & Prescription Management, Facility Management, Medication Management, Sample Management. In 2020, the Prescribing and Patient Management segment is expected to account for the majority of the global healthcare AIDC market due to the increasing adoption of AIDC technologies for patient safety during COVID19 and advancements in AIDC technologies. Additionally, the drug delivery segment is expected to register the fastest CAGR during the forecast period as AIDC claims increase for the initial assessment of patient need for psychiatric drugs.

Segmentation by Region

Based on region, the NGS services market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America is expected to control the largest share of the global healthcare AIDC market. The North American region is one of the most advanced regions in terms of technology adoption and development. North America's large share is primarily attributed to the presence of leading AIDC solution providers and their growing focus on developing advanced AIDC technology for healthcare and increasing government funding for new advances. Also, the Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The economic growth of the region, increasing per capita income, increasing per capita consumption with a large population base, high economic growth rate and increased government investment to improve healthcare safety in the region are driving the growth of the market in APAC region.

Competitive Landscape:

The key players for the market are Zebra Technologies Corporation (U.S.), Honeywell International Inc. (U.S.), Avery Dennison Corporation (U.S.), Newland EMEA (Netherlands), NEC Corporation (Japan).

Industrial Development:

In January 2019, Zebra Technologies (US) delivered its WT6000 wearable computer and RS4000 ring scanner to Mobis Parts Australia (MPAU), an Australian wholesale distributor of motor vehicle supplies, accessories, tools, and equipment. With Zebra’s offerings, MPAU aims to streamline its warehouse operations with a reduction in errors when compared to voice-only solutions.

Market taxonomy

By Product

- Biometric Scanners

- Printers & recorders

- Scanners & Readers

- Mobile computers barcodes

- Software

By Technology

- RFID

- Barcodes

- Biometrics

- Smart Cards

- Magnetic Strips

By Application

- Asset management

- Inventory management

- Patient & prescription management

- Facility management

- Medication Management

- Specimen Management

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Healthcare Automatic Identification and Data Capture Market Outlook TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Healthcare Automatic Identification and Data Capture Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Healthcare Automatic Identification and Data Capture Market, By Product

5.1 Y-o-Y Growth Comparison, By Product

5.2 Healthcare Automatic Identification and Data Capture Market Share Analysis, By Product

5.3 Healthcare Automatic Identification and Data Capture Market Size and Forecast, By Product

5.3.1 Biometric Scanners

5.3.2 Printers & recorders

5.3.3 Scanners & Readers

5.3.4 Mobile computers barcodes

5.3.6 Software

6 Healthcare Automatic Identification and Data Capture Market, By Technology

6.1 Y-o-Y Growth Comparison, By Technology

6.2 Healthcare Automatic Identification and Data Capture Market Share Analysis, By Technology

6.3 Healthcare Automatic Identification and Data Capture (AIDC) Market Size and Forecast, By Technology

6.3.1 RFID

6.3.2 Barcodes

6.3.3 Biometrics

6.3.4 Smart Cards

6.3.5 Magnetic Strips

6.3.6 OCR

7 Healthcare Automatic Identification and Data Capture Market, By Application

7.1 Y-o-Y Growth Comparison, By Application

7.2 Healthcare Automatic Identification and Data Capture Market Share Analysis, By Application

7.3 Healthcare Automatic Identification and Data Capture Market Size and Forecast, By Application

7.3.1 Asset management

7.3.2 Inventory management

7.3.3 Patient & prescription management

7.3.4 Facility management

7.3.5 Medication Management

7.3.6 Specimen Management

8 Healthcare Automatic Identification and Data Capture Market, By Region

8.1 Healthcare Automatic Identification and Data Capture Market Share Analysis, By Region

8.2 Healthcare Automatic Identification and Data Capture Market Size and Forecast, By Region

9 North America Healthcare Automatic Identification and Data Capture Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 North America Healthcare Automatic Identification and Data Capture (AIDC) Market Share Analysis, By Product

9.3 North America Healthcare Automatic Identification and Data Capture (AIDC) Market Size and forecast, By Technology

9.4 North America Healthcare Automatic Identification and Data Capture (AIDC) Market Size and forecast, By application

9.5 North America Healthcare Automatic Identification and Data Capture (AIDC) Market Size and Forecast, By Country

9.5.1 U.S.

9.5.2 Canada

9.5.3 Mexico

10 Europe Healthcare Automatic Identification and Data Capture Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Europe Healthcare Automatic Identification and Data Capture Market Share Analysis, By Product

10.3 Europe Healthcare Automatic Identification and Data Capture (AIDC) Market Size and Forecast, By Technology

10.4 Europe Healthcare Automatic Identification and Data Capture (AIDC) Market Size and forecast., By Application

10.5 Europe Healthcare Automatic Identification and Data Capture (AIDC) Market Size and Forecast, By Country

10.5.1 Germany

10.5.2 France

10.5.3 UK

10.5.4 Rest of Europe

11 Asia Pacific Healthcare Automatic Identification and Data Capture Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Asia Pacific Healthcare Automatic Identification and Data Capture Market Share Analysis, By Product

11.3 Asia Pacific Healthcare Automatic Identification and Data Capture Market Size and Forecast, by Technology

11.4 Asia Pacific Healthcare Automatic Identification and Data Capture Market size and forecast, By Application

11.5 Asia Pacific Healthcare Automatic Identification and Data Capture Market Size and Forecast, By Country

11.5.1 China

11.5.2 Japan

11.5.3 India

11.5.4 Rest of Asia Pacific

12 Latin America Healthcare Automatic Identification and Data Capture Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Latin America Healthcare Automatic Identification and Data Capture MarketShare Analysis, By Product

12.3 Latin America Healthcare Automatic Identification and Data Capture (AIDC) Market Size and Forecast, By Technology

12.4 Latin America Healthcare Automatic Identification and Data Capture (AIDC) Market Size and Forecast, By application

12.5 Latin America Healthcare Automatic Identification and Data Capture (AIDC) Market Size and Forecast, Country

12.5.1. Brazil

12.5.2. Rest of Latin America

13 Middle East Healthcare Automatic Identification and Data Capture (AIDC) Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Middle East Healthcare Automatic Identification and Data Capture Market Share Analysis, By Product

13.3 Middle East Healthcare Automatic Identification and Data Capture Market Size and forecast, by Technology

13.4 Middle East Healthcare Automatic Identification and Data Capture Market Size and Forecast, by Application

13.5 Middle East Healthcare Automatic Identification and Data Capture Market Size and Forecast, By Country

13.5.1. Saudi Arabia

13.5.2. UAE

13.5.3. Egypt

13.5.4 Kuwait

13.5.5. South Africa

14 Competitive Analysis

14.1 Competition Dashboard

14.2 Market share Analysis of Top Vendors

14.3 Key Development Strategies

15 Company Profiles

15.1 Zebra Technologies Corporation (U.S.)

15.1.1 Overview

15.1.2 Offerings

15.1.3 Key Financials

15.1.4 Business Segment & Geographic Overview

15.1.5 Key Market Developments

15.1.6 Key Strategies

15.2 Honeywell International Inc. (U.S.)

15.2.1 Overview

15.2.2 Offerings

15.2.3 Key Financials

15.2.4 Business Segment & Geographic Overview

15.2.5 Key Market Developments

15.2.6 Key Strategies

15.3 Avery Dennison Corporation (U.S.)

15.3.1 Overview

15.3.2 Offerings

15.3.3 Key Financials

15.3.4 Business Segment & Geographic Overview

15.3.5 Key Market Developments

15.3.6 Key Strategies

15.4 Newland EMEA (Netherlands)

15.4.1 Overview

15.4.2 Offerings

15.4.3 Key Financials

15.4.4 Business Segment & Geographic Overview

15.4.5 Key Market Developments

15.4.6 Key Strategies

15.5 NEC Corporation (Japan)

15.5.1 Overview

15.5.2 Offerings

15.5.3 Key Financials

15.5.4 Business Segment & Geographic Overview

15.5.5 Key Market Developments

15.5.6 Key Strategies