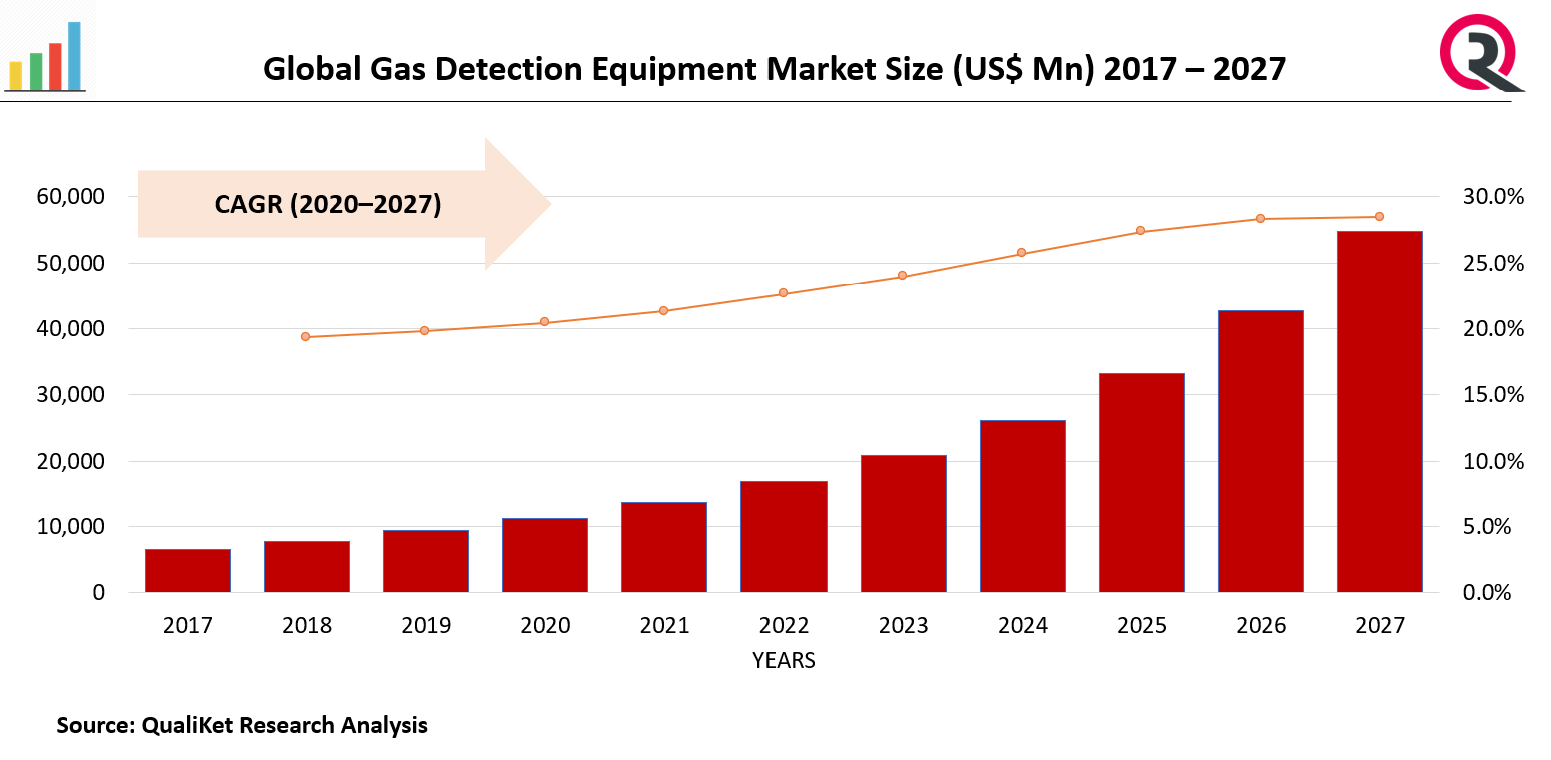

Global Gas Detection Equipment Market Size, Trends & Growth Opportunity, By Type (Wireless or Portable Detection Equipment, Fixed Gas Detection Equipment ), By End User (Automotive, Petrochemical, Industrial, Environmental, Soil Treatment and Others), By Technology (Single Gas Detector, Multi Gas Detector), Region and forecast till 2027.

Report ID : QR1001423 | Industries : Others | Published On :January 2022 | Page Count : 234Gas Detection Equipment Market

Inflammable and poisonous gas leaks are a potential threat to human lives and properties. In industrial operations, it is very important to discover toxic and inflammable gases instantly. Gas detectors are used to measure the concentration of various life-threatening gases in the air and act as an early caution machine to ensure the safety of an area. They can also be linked to a manipulated system to automatically shut down a process at times of gas leak.

Drivers: Increasing Safety Regulations in Industries

The growing issues about employees and plant safety are the key market drivers for the adoption of fuel line detection systems. In addition, protection awareness is on the rise among diverse end users, due to the improved number of fatal accidents and gas explosions, and leakages. Globally, in the last few years, the adoption of fuel line detection device has multiplied throughout, as a result of stringent authorities rules and safety requirements and environmental protection regulations implemented across exclusive applications.

Know more about this report: request for sample pages

Restraints: Technical Issues and Environmental Conditions

The technical troubles relating the new technologies are predicted to restrain the market boom of the gas detection systems.

Impact of COVID-19

The COVID-19 pandemic had a negative impact on the industry since the lockdown was imposed all the world. Closing of factories, No labour decreased standard of living amongst people is being witnessed during the covid era.

Segmentation By Type:

Based on Type, the market is segmented into Wireless or Portable Detector Equipment and Fixed Gas Detector Equipment. The fixed gas detector segment dominates the market share. This is due to their growing use in the food and beverage, and oil and gas sectors. Also, the portable detector segment is expected to grow fast going forward due to its ability to remotely monitor industrial and commercial units.

Segmentation by End Use:

Based on End-use, the market is segmented into Automotive, Petrochemical, Industrial, Environmental and Others. The industrial segment dominates the share of the Gas Detector Equipment Market as gas detectors used for industrial purposes help to ensure safety in the working environments. The petrochemical segment is expected to grow fast due to the growing use of gas detection equipment for detecting harmful gases in oil refineries, pipelines, and processing plants.

Segmentation By Technology:

Based on Technology, the market is segmented into Single Gas Detector and Multi-Gas Detector. A single gas detector measures only one gas at a time using a single sensor. Multi-Gas Detectors are becoming increasingly versatile and affordable. As different environments mostly pose the risk of multiple gas hazards, careful choices have to be made when deciding between single and multi-gas detectors.

Segmentation by Region

By Region the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa. North America holds a significant market share of the global Gas Detector Equipment Market because of the rising implementation of occupational safety regulations. The Asia Pacific region is also expected to grow at a fast pace owing to the rise in investment in petrochemical, power, steel and oil & gas sectors in emerging economies like China and India.

Competitive Landscape:

The key players for the market are Honeywell International, Bacharach Inc., General Electric, Mine Safety Appliances Company & Emerson Electric.

Industrial Development:

NevadaNano announced the release of a new MPS Flammable Gas Sensor, which is the first gas sensor of its type that is able to accurately quantify, detect, and classify a broad array of explosive or flammable gases, using a single calibration.

Drägerwerk AG & Co. KGaA launched a new series of personal single-gas monitors Pac 6000, 6500, 8000 and 8500. The monitors detect not only the standard gases carbon monoxide (CO), hydrogen sulfide (H2S), sulfur dioxide (SO2) and oxygen (O2) (Pac 6000 and 6500), but also special gases such as ozone, phosgene and nitrogen dioxide (Pac 8000 and 8500)..

Market taxonomy

By Type

- Wireless or Portable Detection Equipment

- Fixed Gas Detection Equipment

By End User

- Automotive

- Petrochemical

- Industrial

- Environmental

- Soil Treatment

- Others

By technology

- Single Gas Detector

- Multi Gas Detector

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Gas Detection Equipment Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Gas Detection Equipment Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Gas Detection Equipment Market, By Type

5.1 Y-o-Y Growth Comparison, By Type

5.2 Gas Detection Equipment Market Share Analysis, By Type

5.3 Gas Detection Equipment Market Size and Forecast, By Type

5.3.1 Wireless or Portable Detection Equipment

5.3.2 Fixed Gas Detection Equipment

6 Gas Detection Equipment Market, By End User

6.1 Y-o-Y Growth Comparison, By End User

6.2 Gas Detection Equipment Market Share Analysis, By End User

6.3 Gas Detection Equipment Market Size and Forecast, By End User

6.3.1 Automotive

6.3.2 Petrochemical

6.3.3 Industrial

6.3.4 Environmental

6.3.5 Soil Treatment

6.3.6 Others

7 Gas Detection Equipment Market, By Technology

7.1 Y-o-Y Growth Comparison, By Technology

7.2 Gas Detection Equipment Market Share Analysis, By Technology

7.3 Gas Detection Equipment Market Size and Forecast, By Technology

7.3.1 Single Gas Detector

7.3.2 Multi Gas Detector

8 Gas Detection Equipment Market, By Region

8.1 Gas Detection Equipment Market Share Analysis, By Region

8.2 Gas Detection Equipment Market Size and Forecast, By Region

9 North America Gas Detection Equipment Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 North America Gas Detection Equipment Market Share Analysis, By Type

9.3 North America Gas Detection Equipment Market Size and Forecast, By End User

9.4 North America Gas Detection Equipment Market Size and forecast, By Technology

9.5 North America Gas Detection Equipment Market Size and Forecast, By Country

9.5.1 U.S.

9.5.2 Canada

9.5.3 Mexico

10 Europe Gas Detection Equipment Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Europe Gas Detection Equipment Market Share Analysis, By Type

10.3 Europe Gas Detection Equipment Market Size and Forecast, By End User

10.4 Europe Gas Detection Equipment Market Size and Forecast, By Technology

10.5 Europe Gas Detection Equipment Market Size and Forecast, By Country

10.5.1 Germany

10.5.2 France

10.5.3 UK

10.5.4 Rest of Europe

11 Asia Pacific Gas Detection Equipment Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Asia Pacific Gas Detection Equipment Market Share Analysis, By Type

11.3 Asia Pacific Gas Detection Equipment Market Size and Forecast, By End User

11.4 Asia Pacific Gas Detection Equipment Market Size and Forecast, by Technology

11.5 Asia Pacific Gas Detection Equipment Market Size and Forecast, By Country

11.5.1 China

11.5.2 Japan

11.5.3 India

11.5.4 Rest of Asia Pacific

12 Latin America Gas Detection Equipment Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Latin America Gas Detection Equipment Market Share Analysis, By Type

12.3 Latin America Gas Detection Equipment Market Size and Forecast, By End User

12.4 Latin America Gas Detection Equipment Market Size and Forecast, By Technology

12.5 Latin America Gas Detection Equipment Market Size and Forecast, Country

12.5.1. Brazil

12.5.2. Rest of Latin America

13 Middle East Gas Detection Equipment Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Middle East Gas Detection Equipment Market Share Analysis, By Type

13.3 Middle East Gas Detection Equipment Market size and forecast, By End User

13.4 Middle East Gas Detection Equipment Market Size and forecast, by Technology

13.5 Middle East Gas Detection Equipment Market Size and Forecast, by formulation

13.6 Middle East Gas Detection Equipment Market Size and Forecast, By Country

13.6.1. Saudi Arabia

13.6.2. UAE

13.6.3. Egypt

13.6.4 Kuwait

13.6.5. South Africa

14 Competitive Analysis

14.1 Competition Dashboard

14.2 Market share Analysis of Top Vendors

14.3 Key Development Strategies

15 Company Profiles

15.1 Honeywell International

15.1.1 Overview

15.1.2 Offerings

15.1.3 Key Financials

15.1.4 Business Segment & Geographic Overview

15.1.5 Key Market Developments

15.1.6 Key Strategies

15.2 Bacharach Inc.

15.2.1 Overview

15.2.2 Offerings

15.2.3 Key Financials

15.2.4 Business Segment & Geographic Overview

15.2.5 Key Market Developments

15.2.6 Key Strategies

15.3 General Electric

15.3.1 Overview

15.3.2 Offerings

15.3.3 Key Financials

15.3.4 Business Segment & Geographic Overview

15.3.5 Key Market Developments

15.3.6 Key Strategies

15.4 Mine Safety Appliances Company

15.4.1 Overview

15.4.2 Offerings

15.4.3 Key Financials

15.4.4 Business Segment & Geographic Overview

15.4.5 Key Market Developments

15.4.6 Key Strategies

15.5 Emerson Electric

15.5.1 Overview

15.5.2 Offerings

15.5.3 Key Financials

15.5.4 Business Segment & Geographic Overview

15.5.5 Key Market Developments

15.5.6 Key Strategies