Global Farm equipment Market Size, Trends & Growth Opportunity, By Drive type (Two-wheel, Four-wheel), By Equipment type (Tractors, Combines, Sprayers, Balers, Others), By Power output (<30 HP, 31–70 HP, 71–130 HP, 131–250 HP, >250 HP), by Propulsion (Battery Electric, Hybrid Electric) By Region and Forecast till 2027.

Report ID : QR1001368 | Industries : Information and Communication Technology | Published On :January 2022 | Page Count : 234Global Farm equipment Market

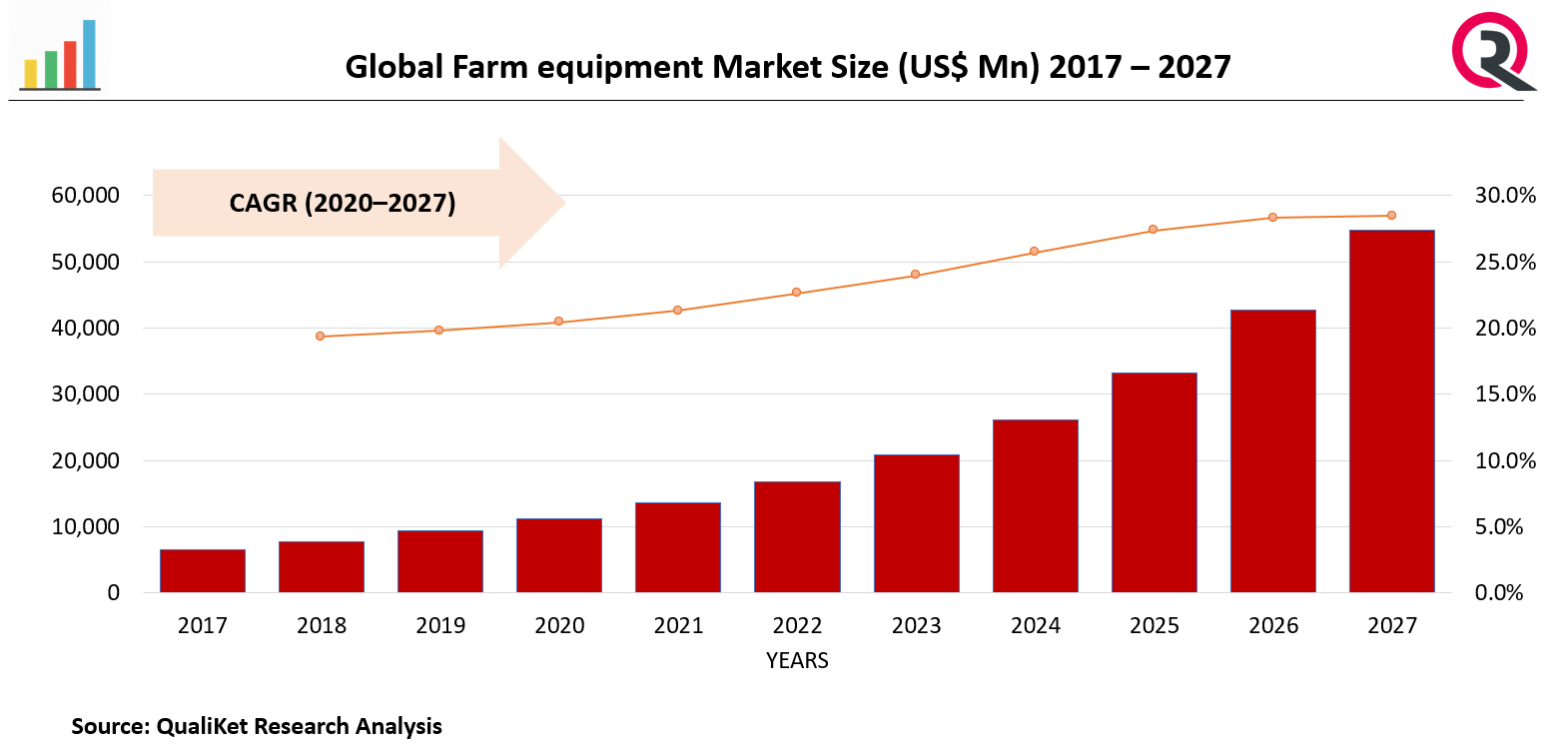

The global Farm equipment market was valued at USD 99.4 Billion in 2020 which expected to reach USD 126.0 Billion by 2027 at a CAGR 4.1% from 2020-2027.

Farm equipment refers to any type of machinery used on a farm to aid in farming. A tractor is the most well-known example. There are numerous other farm implements. The mechanical structures and devices used in farming or other agriculture are referred to as agricultural machinery. There are numerous types of such equipment, ranging from hand tools and power tools to tractors and the numerous farm implements that they tow or operate.

Market Drivers

Government assistance in the form of farm loan waivers/credit financing

Farmers are encouraged to purchase farm equipment as a result of the implementation of farm loan waiver schemes. Governments around the world launched various programmes to help farmers pay off their loans and encourage farm mechanization. According to the Organization for Economic Cooperation and Development's (OECD) Agricultural Policy Monitoring and Evaluation, 2019, farm policies in 53 countries–all OECD, EU countries, and 12 key emerging economies–provided an average of USD 728 billion per year in direct support to farmers from 2018 to 2020.

Know more about this report: request for sample pages

Market Restraints

Growth of rental market

The purchase of farm equipment such as tractors and harvesters is a significant investment in agricultural activities, accounting for the majority of the global rental market. All of the steps involved in designing, manufacturing, and distributing the equipment necessitate large investments, which are reflected in the price of the machinery made available to farmers. Due to small farmers' inability to invest large sums, farm equipment penetration in emerging countries is low.

Impact of COVID-19

Despite the fact that COVID-19 has disrupted the entire supply chain, the agricultural industry appears to have been the least affected of all industries. This was primarily due to the government's decision to classify agricultural activities as essential services. During COVID-19, the agricultural industry faced four major challenges: a limited supply of farm equipment parts, a drop in new tractor sales in the first half, the closure of production facilities, and a decrease in working capital. Regardless of the impact of COVID-19 on the farm equipment market, the market is expected to rebound by the end of 2021.

Market Segmentation

The Global Farm equipment Market is segmented into Drive type, Equipment type, Power output and Propulsion. By Drive type such as Two-wheel, Four-wheel. Further, market is segmented into By Equipment type such as Tractors, Combines, Sprayers, Balers, Others. By Power output such as <30 HP, 31–70 HP, 71–130 HP, 131–250 HP, >250 HP. By Propulsion such as Battery Electric, Hybrid Electric.

Regional Analysis

Global Farm equipment Market is segmented into five regions such as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific has the largest market share and is expected to dominate the market during the forecast period. The Asia Pacific region includes China, India, Japan, South Korea, Australia, and the rest of Asia Oceania.

In addition to high containerized transportation, factors such as rising GDP, infrastructure investments, rising per capita income, a growing inclination toward mechanization, and government initiatives for FDI have created more opportunities for the farming business, driving the farm tractor market in the Asia Oceania region.

Key Players

Various key players are listed in this report such as John Deere, CNH Industrial, CLAAS, and AGCO Corporation, Mahindra and Mahindra, Yanmar

Market Taxonomy

By Drive type

- Two-wheel

- Four-wheel

By Equipment type

- Tractors

- Combines

- Sprayers

- Balers

- Others

By Power output

- <30 HP

- 31–70 HP

- 71–130 HP

- 131–250 HP

- >250 HP

By Propulsion

- Battery Electric

- Hybrid Electric

By Region

- North America

- Latin America

- Europe

- China

- Asia Pacific

- Middle East & Africa

Key Questions Addressed by the Report

- What are the Key Opportunities in Global Farm equipment Market?

- What will be the growth rate from 2020 to 2027?

- Which segment/region will have highest growth?

- What are the factors that will impact/drive the Market?

- What is the competitive Landscape in the Industry?

- What is the role of key players in the value chain?

Global Farm equipment Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global Farm equipment Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global Farm equipment Market, By Drive type

5.1 Y-o-Y Growth Comparison, By Drive type

5.2 Global Farm equipment Market Share Analysis, By Drive type

5.3 Global Farm equipment Market Size and Forecast, By Drive type

5.3.1 Two-wheel

5.3.2Four-wheel

6 Global Farm equipment Market, By Equipment type

6.1 Y-o-Y Growth Comparison, By Equipment type

6.2 Global Farm equipment Market Share Analysis, By Equipment type

6.3 Global Farm equipment Market Size and Forecast, By Equipment type

6.3.1 Tractors

6.3.2 Combines

6.3.3 Sprayers

6.3.4 Balers

6.3.5 Others

7 Global Farm equipment Market, By Power output

7.1 Y-o-Y Growth Comparison, By Power output

7.2 Global Farm equipment Market Share Analysis, By Power output

7.3 Global Farm equipment Market Size and Forecast, By Power output

7.3.1 <30 HP

7.3.2 31–70 HP

7.3.4 71–130 HP

7.4.5 131–250 HP

7.4.6 >250 HP

8 Global Farm equipment Market, By Propulsion

8.1 Y-O-Y Growth Comparison, By Propulsion

8.2 Global Farm equipment Market Share Analysis, By Propulsion

8.3 Global Farm equipment Market Size and Forecast, By Propulsion

8.3.1 Battery Electric

8.3.2Hybrid Electric

9 Global Farm equipment Market, By Region

9.1 Global Farm equipment Market Share Analysis, By Region

9.2 Global Farm equipment Market Share Analysis, By Region

9.3 Global Farm equipment Market Size and Forecast, By Region

10 North America Farm equipment Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 North America Farm equipment Market Share Analysis, By Drive type

10.3 North America Farm equipment Market Size and Forecast, By Equipment type

10.4 North America Farm equipment Market Size and Forecast, By Power output

10.5 North America Farm equipment Market Size and Forecast, By Propulsion

10.6 North America Farm equipment Market Size and Forecast, By Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

11 Europe Farm equipment Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Europe Farm equipment Market Share Analysis, By Drive type

11.3 Europe Farm equipment Market Size and Forecast, By Equipment type

11.4 Europe Farm equipment Market Size and Forecast, By Power output

11.5 Europe Farm equipment Market Size and Forecast, By Propulsion

11.6 Europe Farm equipment Market Size and Forecast, By Country

11.6.1 Germany

11.6.2 France

11.6.3 UK

11.6.4. Rest of Europe

12 Asia Pacific Farm equipment Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Asia Pacific Farm equipment Market Share Analysis, By Drive type

12.3 Asia Pacific Farm equipment Market Size and Forecast, By Equipment type

12.4 Asia Pacific Farm equipment Market Size and Forecast, By Power output

12.5 Asia Pacific Farm equipment Market Size and Forecast, By Propulsion

12.6 Asia Pacific Farm equipment Market Size and Forecast, By Country

12.6.1 China

12.7.2 Japan

12.8.3 India

12.9.4. Rest of Asia Pacific

13 Latin America Farm equipment Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Latin America Farm equipment Market Share Analysis, By Drive type

13.3 Latin America Farm equipment Market Size and Forecast, By Equipment type

13.4 Latin America Farm equipment Market Size and Forecast, By Power output

13.5 Latin America Farm equipment Market Size and Forecast, By Propulsion

13.6 Latin America Farm equipment Market Size and Forecast, Country

13.7.1. Brazil

13.8.2. Rest of Latin America

14 Middle East Farm equipment Market Analysis and Forecast (2021-2027)

14.1 Introduction

14.2 Middle East Farm equipment Market Share Analysis, By Drive type

14.3 Middle East Farm equipment Market Size and Forecast, By Equipment type

14.4 Middle East Farm equipment Market Size and Forecast, By Power output

14.5 Middle East Farm equipment Market Size and Forecast, By Propulsion

14.6 Middle East Farm equipment Market Size and Forecast, By Country

14.7.1. Saudi Arabia

14.8.2. UAE

14.9.3. Egypt

14.10.4. Kuwait

14.11.5. South Africa

15Competitive Analysis

15.1 Competition Dashboard

15.2 Market share Analysis of Top Vendors

15.3 Key Development Strategies

16 Company Profiles

16.1 John Deere

16.1.1 Overview

16.1.2 Offerings

16.1.3 Key Financials

16.1.4 Business Segment & Geographic Overview

16.1.5 Key Market Developments

16.1.6 Key Strategies

17.2. CNH Industrial

17.2.1 Overview

17.2.2 Offerings

17.2.3 Key Financials

17.2.4 Business Segment & Geographic Overview

17.2.5 Key Market Developments

17.2.6 Key Strategies

17.3 CLAAS

17.3.1 Overview

17.3.2 Offerings

17.3.3 Key Financials

17.3.4 Business Segment & Geographic Overview

17.3.5 Key Market Developments

17.3.6 Key Strategies

17.4 AGCO Corporation

17.4.1 Overview

17.4.2 Offerings

17.4.3 Key Financials

17.4.4 Business Segment & Geographic Overview

17.4.5 Key Market Developments

17.4.6 Key Strategies

17.5 Mahindra and Mahindra

17.5.1 Overview

17.5.2 Offerings

17.5.3 Key Financials

17.5.4 Business Segment & Geographic Overview

17.5.5 Key Market Developments

17.5.6 Key Strategies

17.6 Yanmar

17.6.1 Overview

17.6.2 Offerings

17.6.3 Key Financials

17.6.4 Business Segment & Geographic Overview

17.6.5 Key Market Developments

17.6.6 Key Strategies