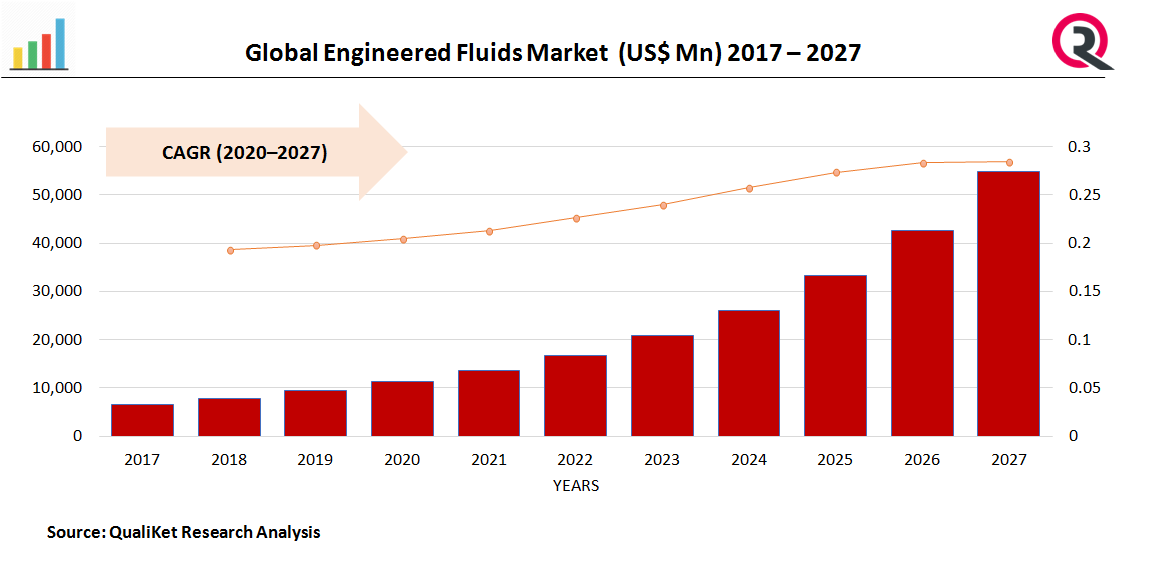

Global Engineered Fluids Market (Fluorinated fluids) Market by Type (Lubricants, Solvents, Heat Transfer Fluids), End-Use Industry (Electronics & Semiconductor, Automotive, Chemical Processing, Oil & Gas, Power Generation, Aerospace), Region - Global Forecast to 2023

Report ID : QR1001406 | Industries : Others | Published On :January 2022 | Page Count : 243Global Engineered Fluids Market

The market for engineered fluids (fluorinated fluids) is expected to grow at an 8.8 percent CAGR from USD 854 million in 2018 to USD 1,304 million by 2023. Engineered fluids (fluorinated fluids) are versatile materials used in thermal management.

Drivers: Global Engineered Fluids Market

The Driving Factors of Global Engineered Fluids Market are such as amplified thermal management issues in the electronics and semiconductors, automotive, and aerospace industries Fluorinated materials have these properties, which allow them to perform under extreme conditions such as high pressure, oxidation-prone environments, and high temperature operating conditions.

Know more about this report: request for sample pages

Restraints: Global Engineered Fluids Market

The Global Engineered Fluids Market is impacted by high cost of technology development and manufacturing of engineered fluids, on the other hand, is a market restraint.

Impact of COVID-19

Almost every industry in the world has suffered a setback in the last 18 months. This can be attributed to severe disruptions in their respective manufacturing and supply-chain operations as a result of various precautionary lockdowns and other restrictions imposed by governments worldwide. The global market for Engineered Fluids (Fluorinated Fluids) is comparable.

Segmentation by Type:

By Type, the global Engineered Fluids Market is segmented into Lubricants, Solvents, Heat Transfer Fluids. Among product type categories, the lubricants segment had the highest revenue share. Fluorinated lubricants offer long-term performance with little oxidation, degradation, or evaporation. These are fire-resistant and can be used in a wide range of temperatures. Lubricants can also be used to lubricate plastic and rubber in areas where chemicals or solvents are spilled.

Segmentation by End use

By form, the global submarine cable system market is split into End-User such as Electronics and Semiconductors, Automotive, Oil and Gas, Aerospace, and Others. Among industry vertical categories, the oil and gas segment had the highest revenue share. These fluids make high-performance clothing resistant to water and oil, as well as staining and abrasion. High-performance outerwear and gear make it easier to clean spills in inclement weather, extending the life of the apparatus. Surfactants are used in adhesives, sealants, and caulks to strengthen the bond between surfaces. It aids in the reduction of infrastructure failures caused by corrosion and weather, lowering maintenance costs and increasing occupant safety.

Segmentation by Region

North America, Europe, Asia Pacific, and the Rest of the World are the regions that make up the Global Engineered Fluids Market. The Engineered Fluids Market in APAC is expected to be the largest in the world. The region has emerged as the largest consumer of engineered fluids due to increased demand in nations such as China, Japan, India, South Korea, and Indonesia (fluorinated fluids). The rapid industrialization of these countries, combined with low manufacturing costs, has enticed multinational corporations to establish themselves in APAC.

Competitive Landscape:

Daikin Industries, Solvay SA, The Chemours Company, 3M, Asahi Glass Company, Halocarbon Products Corporation, Halopolymer, F2 Chemicals, IKV Tribology, Lubrilog Lubrication Engineering.

Industrial Development:

Chemours opened a new production facility at its Christi plant in Ingleside, Texas, in February 2017. (US). This will triple the company's capacity for HFO-1234yf-based products and position it as a global leader in low-GWP products.

Solvay acquired Energain Technology from DuPont in February 2017, expanding its product portfolio to serve the battery manufacturing industry. This acquisition strengthens Solvay's technological roadmap in the battery manufacturing industry.

Market taxonomy

By Type

- Lubricants

- Solvents

- Heat Transfer Fluids

By End use

- Aerospace

- Automotive

- Electronics & Semiconductor

- Oil & Gas

- Power Generation

- Chemical Processing

By region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Global Engineered Fluids Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global Engineered Fluids Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global Engineered Fluids Market, By Type

5.1 Y-o-Y Growth Comparison, By Type

5.2 Global Engineered Fluids Market Share Analysis, By Type

5.3 Global Engineered Fluids Market Size and Forecast, By Type

5.3.1 Lubricants

5.3.2 Solvents

5.3.3 Heat Transfer Fluids

6 Global Engineered Fluids Market, By End Use

6.1 Y-o-Y Growth Comparison, By application

6.2 Global Engineered Fluids Market Share Analysis, By application

6.3 Global Engineered Fluids Market Size and Forecast, By application

6.3.1 Aerospace

6.3.2 Automotive

6.3.3 Electronics & Semiconductor

6.3.4 Oil & Gas

6.3.5 Power Generation

6.3.6 Chemical Processing

7 Global Engineered Fluids Market, By Region

7.1 Global Engineered Fluids Market Share Analysis, By Region

7.2 Global Engineered Fluids Market Share Analysis, By Region

7.3 Global Engineered Fluids Market Size and Forecast, By Region

8 North America Global Engineered Fluids Market Analysis and Forecast (2021-2027)

8.1 Introduction

8.2 North America Global Engineered Fluids Market Share Analysis, By Type

8.3 North America Global Engineered Fluids Market Size and Forecast, By application

8.4 North America Global Engineered Fluids Market Size and Forecast, By End User

8.5 North America Global Engineered Fluids Market Size and Forecast, By Country

8.5.1 U.S.

8.5.2 Canada

8.5.3 Mexico

9 Europe Global Engineered Fluids Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 Europe Global Engineered Fluids Market Share Analysis, By Type

9.3 Europe Global Engineered Fluids Market Size and Forecast, By application

9.4 Europe Global Engineered Fluids Market Size and Forecast, By End User

9.5 Europe Global Engineered Fluids Market Size and Forecast, By Country

9.5.1 Germany

9.5.2 France

9.5.3 UK

9.5.4. Rest of Europe

10 Asia Pacific Global Engineered Fluids Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Asia Pacific Global Engineered Fluids Market Share Analysis, By Type

10.3 Asia Pacific Global Engineered Fluids Market Size and Forecast, By application

10.4 Asia Pacific Global Engineered Fluids Market Size and Forecast, By End User

10.5 Asia Pacific Global Engineered Fluids Market Size and Forecast, By Country

10.5.1 China

10.5.2 Japan

10.5.3 India

10.5.4. Rest of Asia Pacific

11 Latin America Global Engineered Fluids Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Latin America Global Engineered Fluids Market Share Analysis, By Type

11.3 Latin America Global Engineered Fluids Market Size and Forecast, By application

11.4 Latin America Global Engineered Fluids Market Size and Forecast, By End User

11.5 Latin America Global Engineered Fluids Market Size and Forecast, Country

11.5.1. Brazil

11.5.2. Rest of Latin America

12 Middle East Global Engineered Fluids Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Middle East Global Engineered Fluids Market Share Analysis, By Type

12.3 Middle East Global Engineered Fluids Market Size and Forecast, By application

12.4 Middle East Global Engineered Fluids Market Size and Forecast, By End User

12.5 Middle East Global Engineered Fluids Market Size and Forecast, By Country

12.5.1. Saudi Arabia

12.5.2. UAE

12.5.3. Egypt

12.5.4. Kuwait

12.5.5. South Africa

13 Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14 Company Profiles

14.1 Daikin Industries

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2. Solvay SA

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3. The Chemours Company

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 3M

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 Asahi Glass Company

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies

14.6 Halocarbon Products Corporation

14.6.1 Overview

14.6.2 Offerings

14.6.3 Key Financials

14.6.4 Business Segment & Geographic Overview

14.6.5 Key Market Developments

14.6.6 Key Strategies

14.7 Halopolymer

14.7.1 Overview

14.7.2 Offerings

14.7.3 Key Financials

14.7.4 Business Segment & Geographic Overview

14.7.5 Key Market Developments

14.7.6 Key Strategies

14.8 F2 Chemicals

14.8.1 Overview

14.8.2 Offerings

14.8.3 Key Financials

14.8.4 Business Segment & Geographic Overview

14.8.5 Key Market Developments

14.8.6 Key Strategies

14.9 IKV Tribology

14.9.1 Overview

14.9.2 Offerings

14.9.3 Key Financials

14.9.4 Business Segment & Geographic Overview

14.9.5 Key Market Developments

14.9.6 Key Strategies

14.10 Lubrilog Lubrication Engineering

14.10.1 Overview

14.10.2 Offerings

14.10.3 Key Financials

14.10.4 Business Segment & Geographic Overview

14.10.5 Key Market Developments

14.10.6 Key Strategies