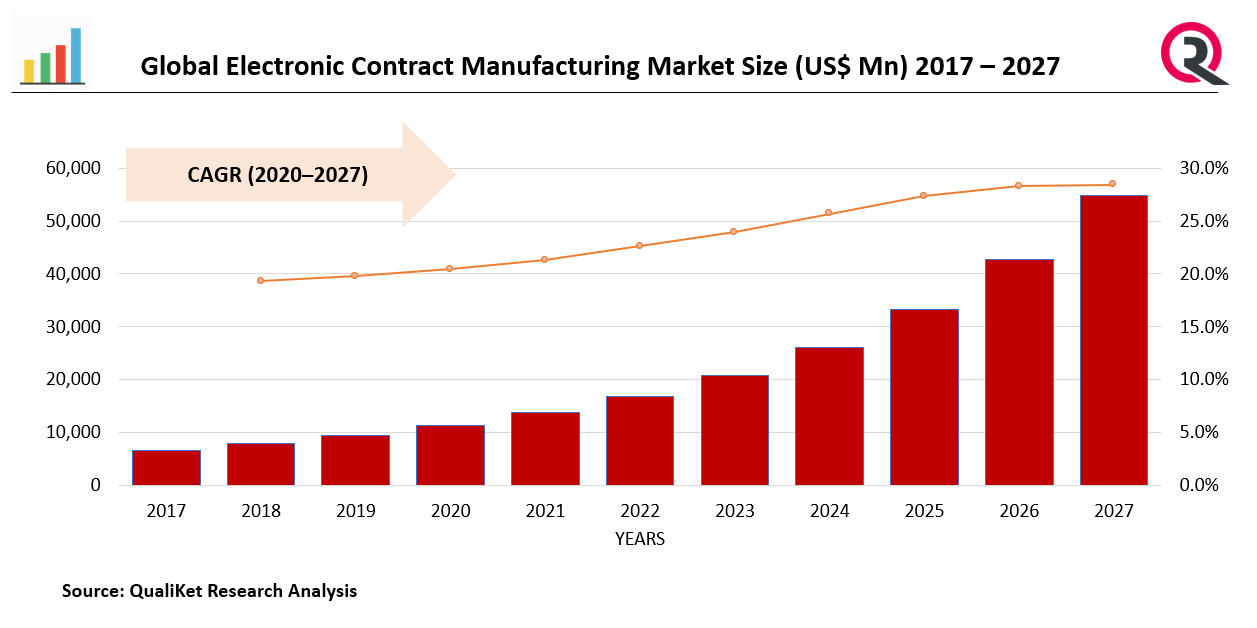

Global Electronic Contract Manufacturing Market Size, Trends & Growth Opportunity, By Service Type (Electronic Design & Engineering and Others), By End User Type (Healthcare, IT & Telecom, Automotive, Aerospace & Defense, and Others), By Region and Forecast till 2027

Report ID : QR1001304 | Industries : Semiconductors and Electronics | Published On :December 2022 | Page Count : 253Global Electronic Contract Manufacturing Market

Electronic Contract Manufacturing (ECM) refers to a variety of services that may include engineering design, PCB fabrication, subassembly manufacturing, turnkey or box builds, functional testing, distribution and order fulfilment on behalf of OEMs (Original Electronic Manufacturers). Electronic contract manufacturing may be utilized as either a supplement to or as a replacement of company-owned manufacturing operations.

Drivers: Growing need for resource optimization and the increasing proliferation of mobile devices.

The demand for the electronic contract manufacturing is expected to grow at a massive scale in the upcoming period mainly backed by shorter lifecycle of the electronic products. Changing demand cycle of the electronic products and constant pressure on the electronic product manufacturer to improve the quality of the products to stay updated is further in-favour the outsourcing manufacturing services.

Know more about this report: request for sample pages

Restraints: Increasing labour costs raise end-product prices

More expensive labour and engineers will have implications not only for the tablet keyboard industry but also for the entire electronics industry. Increasing labour costs raise end-product prices, and affect the sales revenues and profits of the corporations. Consumer prices grow in the same direction as labour costs, but the size of the growth is much lower. Moreover, increasing labour and engineers ‘cost is a leading reason that has triggered the prices of keyboard, thus hampering the growth of the global electronic contract manufacturing & design services market.

Impact of COVID-19

Many workers in these factories originate from regions far away, and returning to them is a problem for many workers because of the quarantines and restrictions in place due to the outbreak. All the factories were shut down. The outbreak threatens to make the situation worse since all the processes are delayed and manufacturing is paused.

Segmentation by Service type:

Based on Service, the market is segmented into Electronic Design & Engineering, Electronics Assembly, Electronic Manufacturing, and Others. By service, the electronic manufacturing segment dominates the market share. The electronic design and engineering segment are expected to witness a significant growth going forward owing to the inclination of unique system producers towards outsourcing their designing requirements. There is an upsurge in call for electronic circuit boards due to their growing presence in various electronic devices, such as mobile phones and tablets.

Segmentation by End Use Type:

Based on End-User, the market is segmented into Healthcare, IT & Telecom, Automotive, Aerospace & Defense, Consumer Electronics, and Others. By End-Use, the IT & Telecom accounted for the largest market proportion of 41.38% in 2021, and is projected to develop at a long term CAGR of 9.98% during the forecast period. However, there may be low penetration of electronic contract manufacturing and design services in segments that include healthcare, automotive, aerospace, and defense. Thus, there is scope for further boom possibilities in these sectors going forward.

Segmentation by Region

By Region the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and Africa. Asia Pacific accounted for the largest market share of 40.38% in 2020, with a market value of USD 285 Billion and is projected to grow at a long term CAGR of 8.89% during the forecast period. Rapid growth in the electronics sector in emerging economies such as India and China boosting the growth of the electronic contract manufacturing and design services market in the Asia Pacific region.

Competitive Landscape:

The major players in the market are Benchmark Electronics Inc., Celestica Inc., Compal Electronics Inc., Creating Technologies LP, Flextronics International Ltd., Hon Hai Precision Industry Co. Ltd., Jabil Circuit Inc., Plexus Corporation, Fabrinet, and Venture Corporation Limited.

Industrial Development:

Communications and computer products are expected to be the leading segments driving the most significant growth in the electronics industry. Outsourcing processes has become a critical element in keeping the electronics industry expanding and handling costs to the margin each year, a leading factor in stimulating consumer demand. The leading OEMs, such as Apple, also employ electronic contract manufacturing from Foxconn, which employs approximately 350,000 people and produces about half of the world's iPhones. Before the fall release of a new iPhone in the busy summer months, the factory produces around 500,000 phones a day.

Advanced Circuits inaugurated its newest facility at Chandler. The company has invested USD 7 million in this new 50,000-square-foot location, which opened in September 2019. This State-of-the-art facility is a welcome addition to the company's manufacturing facilities in Aurora, Colorado, and Maple Grove, Minnesota. It is twice the size of the old facility in Tempe, Arizona.

Market taxonomy

By Service type

- Electronic Design & Engineering

- Electronics Assembly

- Electronic Manufacturing

- Others

By End use type

- Healthcare

- IT & Telecom

- Automotive

- Aerospace & Defense

- Consumer Electronics

- Others

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Global Electronic Contract Manufacturing Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Electronic Contract Manufacturing Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Electronic Contract Manufacturing Market, By Service type

5.1 Y-o-Y Growth Comparison, By Service Type

5.2 Electronic Contract Manufacturing Market Share Analysis, By service Type

5.3 Electronic contract Manufacturing Market Size and Forecast, By Service Type

5.3.1 Electronic Design and Engineering

5.3.2 Electronics assembly

5.3.3 Electronic Manufacturing

5.3.4 Others

6 Electronic Contract Manufacturing Market, By End Use

6.1 Y-o-Y Growth Comparison, By End Use

6.2 Electronic Contract Manufacturing Market Share Analysis, By End Use

6.3 Electronic Contract Manufacturing Market Size and Forecast, By End Use

6.3.1 Healthcare

6.3.2 IT & Telecom

6.3.3 Automotive

6.3.4 Aerospace & Defense

7 Electronic Contract Manufacturing Market, By Region

7.1 Electronic Contract Manufacturing Market Share Analysis, By Region

7.2 Electronic Contract Manufacturing Market Share Analysis, By Region

7.3 Electronic Contract Manufacturing Market Size and Forecast, By Region

8 North America Electronic Contract Manufacturing Market Analysis and Forecast (2021-2027)

8.1 Introduction

8.2 North America Electronic Contract Manufacturing Market Share Analysis, By Service Type

8.3 North America Electronic Contract Manufacturing Market Size and Forecast, End-Use.

8.5 North America Electronic Contract Manufacturing Market Size and Forecast, By Country

8.5.1 U.S.

8.5.2 Canada

8.5.3 Mexico

9 Europe Electronic Contract Manufacturing Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 Europe Electronic Contract Manufacturing Market Share Analysis, By service Type

9.3 Europe Electronic Contract Manufacturing Market Size and Forecast, By End-Use

9.5 Europe Electronic Contract Manufacturing Market Size and Forecast, By Country

9.5.1 Germany

9.5.2 France

9.5.3 UK

9.54. Rest of Europe

10 Asia Pacific Electronic Contract Manufacturing Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Asia Pacific Electronic Contract Manufacturing Market Share Analysis, By Service Type

10.3 Asia Pacific Electronic Contract Manufacturing Market Size and Forecast, By End-Use

10.5 Asia Pacific Electronic Contract Manufacturing Market Size and Forecast, By Country

10.5.1 China

10.5.2 Japan

10.5.3 India

10.5.4. Rest of Asia Pacific

11 Latin America Electronic Contract Manufacturing Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Latin America Electronic Contract Manufacturing Market Share Analysis, By Service Type

11.3 Latin America Electronic Contract Manufacturing Market Size and Forecast, By End-Use.

11.5 Latin America Electronic Contract Manufacturing Market Size and Forecast, Country

11.5.1. Brazil

11.5.2. Rest of Latin America

12 Middle East Electronic Contract Manufacturing Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Middle East Electronic Contract Manufacturing Market Share Analysis, By Service Type

12.3 Middle East Electronic Contract Manufacturing Market Size and Forecast, By End Use

12.5 Middle East Electronic Contract Manufacturing Market Size and Forecast, By Country

12.65.1. Saudi Arabia

12.5.2. UAE

12.5.3. Egypt

15.5.4. Kuwait

12.5.5. South Africa

13 Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14Company Profiles

14.1 Benchmark Electronics Inc.

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2. Celestica Inc.

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3. Compal Electronics Inc.

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 Creating Technologies LP

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 Flextronics International Ltd.

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies

14.6 Hon Hai Precision Industry Co. Ltd.

14.6.1 Overview

14.6.2 Offerings

14.6.3 Key Financials

14.6.4 Business Segment & Geographic Overview

14.6.5 Key Market Developments

14.6.6 Key Strategies

14.7 Jabil Circuit Inc.

14.7.1 Overview

14.7.2 Offerings

14.7.3 Key Financials

14.7.4 Business Segment & Geographic Overview

14.7.5 Key Market Developments

14.7.6 Key Strategies

14.8 Plexus Corporation

14.8.1 Overview

14.8.2 Offerings

14.8.3 Key Financials

14.8.4 Business Segment & Geographic Overview

14.8.5 Key Market Developments

14.8.6 Key Strategies

14.9 Fabrinet

14.9.1 Overview

14.9.2 Offerings

14.9.3 Key Financials

14.9.4 Business Segment & Geographic Overview

14.9.5 Key Market Developments

14.9.6 Key Strategies

14.10 Venture Corporation Limited.

14.10.1 Overview

14.10.2 Offerings

14.10.3 Key Financials

14.10.4 Business Segment & Geographic Overview

14.10.5 Key Market Developments

14.10.6 Key Strategies