Global Diabetes Care Devices Market Size, Trends & Growth Opportunity, By Product (Blood Glucose Monitoring Devices, Insulin Delivery Devices) By Region and Forecast till 2027.

Report ID : QR1001429 | Industries : Others | Published On :January 2022 | Page Count : 236Global Diabetes Care Devices Market

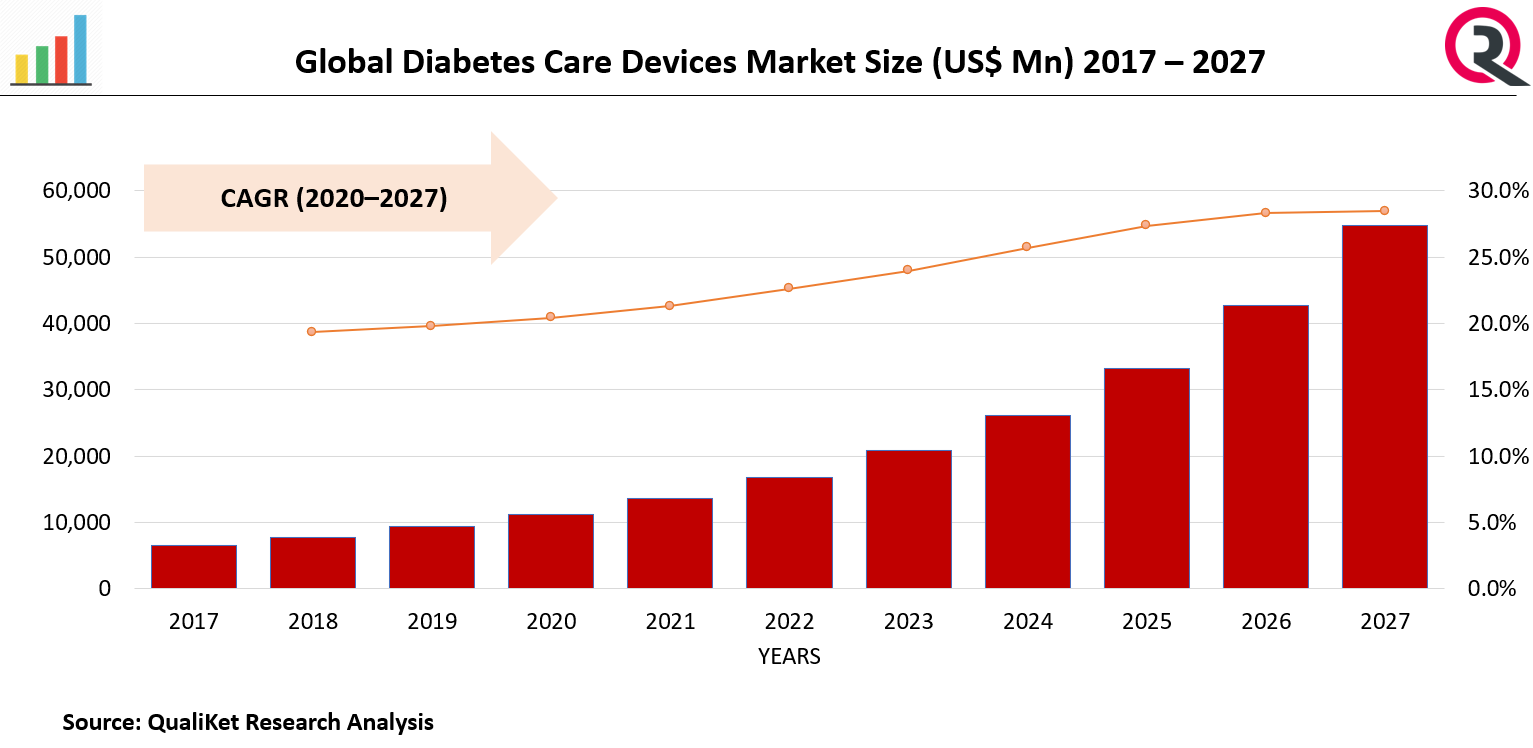

The global Diabetes Care Devices market was valued at USD 1.7 billion in 2020 which expected to reach USD 4.3 billion by 2027 at a CAGR 16.2% from 2020-2027.

Diabetes care devices are used to track the amount of glucose in a diabetic's bloodstream. These devices also aid in the delivery of insulin into the body of the patient. Diabetes care devices are primarily used to monitor blood sugar levels in the body as a result of insulin production. Diabetic patients are given diabetes care devices to help them monitor their blood glucose levels and improve their treatment for this chronic condition. In the forecast period, the market growth is expected to be accelerated by the increase in the number of diabetic patients and the population suffering from obesity, as well as rapid international research collaboration across the globe.

Market Drivers

Increasing Prevalence of Diabetes

Diabetes is a long-term condition in which the pancreas does not produce enough insulin or does not use it effectively to regulate blood sugar levels. In 2019, diabetes was the tenth leading cause of death, with an estimated 1.5 million deaths directly related to the disease. The body's poor insulin utilization causes type 2 diabetes (also known as non-insulin-dependent diabetes or adult-onset diabetes). More than 95 percent of diabetic patients have type 2 diabetes. Diabetes is caused by an excess of body weight and a lack of physical activity.

Know more about this report: request for sample pages

Market Restraints

Rising Obesity Rate and Unhealthy and Sedentary Lifestyle

The degree of actual work has decreased as urbanization and motorization have increased. According to the WHO, more than 60% of the world's population is not sufficiently dynamic. Active work, according to the World Wellbeing Organization, is one of the life-sustaining elements, and as a result, it protects against any ongoing medical conditions, such as many structures of cardiovascular illnesses or diabetes, at any stage of life. At all ages, the risk of type 2 diabetes increases with increasing body weight. Type 2 diabetes is three to four times more common in those affected by obesity than in those of normal weight, and it is more likely in those with a body mass index (BMI) greater than 35 kg/m 2.

COVID-19 Impact on the Diabetes Care Devices Market

The COVID-19 pandemic slowed the growth of the diabetic care device market significantly. The blood glucose levels of COVID-19 infected patients increased. The stress of infection, as well as the use of steroids for COVID-19 treatment, contributed to a rise in blood glucose levels, leading to an increase in the number of patients. This undoubtedly provided opportunities for the market's major players. Many players have launched new advanced diabetes care devices and signed collaborations and agreements for diabetes care devices as a result of the rising prevalence of diabetes. However, the market experienced a supply chain disruption due to lockdowns and travel restrictions, resulting in a scarcity of diabetes care devices, but this had only a temporary impact on the diabetic care devices market.

Market Segmentation

The Global Diabetes Care Devices Market is segmented into Product. By Product such as [Blood Glucose Monitoring Devices (Testing strips, Self-monitoring blood glucose meters, Lancets, Continuous glucose monitors), and Insulin Delivery Devices (Insulin syringes, Insulin pens, Insulin pumps, Insulin jet injectors)]

Regional Analysis

Global Diabetes Care Devices Market is segmented into five regions such as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. North America dominated the Diabetes Care Devices market. Due to stress, unhealthy diets, and obesity, the diabetes population in North America is growing. In 2020, North America generated more than USD 19 billion in revenue, which is expected to grow at a CAGR of more than 7% over the forecast period. This is primarily due to an increase in diabetes cases in North America, which is caused by stress, poor diets, and obesity. Diabetes affects more than 29 million people in North America, with that number expected to rise to 33 million by 2026. In 2020, the United States alone will have over 26 million diabetes patients. The diabetes care devices market in North America is dominated by the United States.

Key Players

Various key players are listed in this report such as Abbott Laboratories, Acon Laboratories, Inc., Ascensia Diabetes Care Holdings Ag, Becton, Dickinson And Company, Dexcom, Inc., F. Hoffmann-La Roche Ltd., Johnson & Johnson, Medtronic Plc, Novo Nordisk A/S, Terumo Corporation.

Market Taxonomy

By Product

- Blood Glucose Monitoring Devices

- Testing Strips

- Self-monitoring Blood Glucose Meters

- Lancets

- Continuous Glucose Monitors

- Insulin Delivery Devices

- Insulin Syringes

- Insulin Pens

- Insulin Pumps

- Insulin Jet Injectors

By Region

- North America

- Latin America

- Europe

- China

- Asia Pacific

- Middle East & Africa

Key Questions Addressed by the Report

- What are the Key Opportunities in Global Diabetes Care Devices Market?

- What will be the growth rate from 2020 to 2027?

- Which segment/region will have highest growth?

- What are the factors that will impact/drive the Market?

- What is the competitive Landscape in the Industry?

- What is the role of key players in the value chain?

Global Diabetes Care Devices Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global Diabetes Care Devices Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global Diabetes Care Devices Market, By Product

5.1 Y-o-Y Growth Comparison, By Product

5.2 Global Diabetes Care Devices Market Share Analysis, By Product

5.3 Global Diabetes Care Devices Market Size and Forecast, By Product

5.3.1 Blood Glucose Monitoring Devices

5.3.1.1 Testing Strips

5.3.1.2 Self-monitoring Blood Glucose Meters

5.3.1.3 Lancets

5.3.1.4 Continuous Glucose Monitors

5.3.2. Insulin Delivery Devices

5.3.2.1 Insulin Syringes

5.3.2.2 Insulin Pens

5.3.2.3 Insulin Pumps

5.3.2.4 Insulin Jet Injectors

6 Global Diabetes Care Devices Market, By Region

6.1 Global Diabetes Care Devices Market Share Analysis, By Region

6.2 Global Diabetes Care Devices Market Share Analysis, By Region

6.3 Global Diabetes Care Devices Market Size and Forecast, By Region

7 North America Diabetes Care Devices Market Analysis and Forecast (2021-2027)

7.1 Introduction

7.2 North America Diabetes Care Devices Market Share Analysis, By Product

7.3 North America Diabetes Care Devices Market Size and Forecast, By Country

7.5.1 U.S.

7.6.2 Canada

7.7.3 Mexico

8 Europe Diabetes Care Devices Market Analysis and Forecast (2021-2027)

8.1 Introduction

8.2 Europe Diabetes Care Devices Market Share Analysis, By Product

8.3 Europe Diabetes Care Devices Market Size and Forecast, By Country

8.5.1 Germany

8.6.2 France

8.7.3 UK

8.8.4. Rest of Europe

9 Asia Pacific Diabetes Care Devices Market Analysis and Forecast (2021-2027)

9.1 Introduction

9.2 Asia Pacific Diabetes Care Devices Market Share Analysis, By Product

9.3 Asia Pacific Diabetes Care Devices Market Size and Forecast, By Country

9.5.1 China

9.6.2 Japan

9.7.3 India

9.8.4. Rest of Asia Pacific

10 Latin America Diabetes Care Devices Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 Latin America Diabetes Care Devices Market Share Analysis, By Product

10.3 Latin America Diabetes Care Devices Market Size and Forecast, Country

10.5.1. Brazil

10.6.2. Rest of Latin America

11 Middle East Diabetes Care Devices Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Middle East Diabetes Care Devices Market Share Analysis, By Product

11.3 Middle East Diabetes Care Devices Market Size and Forecast, By Country

11.5.1. Saudi Arabia

11.6.2. UAE

11.7.3. Egypt

11.8.4. Kuwait

11.9.5. South Africa

12 Competitive Analysis

12.1 Competition Dashboard

12.2 Market share Analysis of Top Vendors

12.3 Key Development Strategies

13Company Profiles

13.1 Abbott Laboratories

13.1.1 Overview

13.1.2 Offerings

13.1.3 Key Financials

13.1.4 Business Segment & Geographic Overview

13.1.5 Key Market Developments

13.1.6 Key Strategies

13.2. Acon Laboratories, Inc

13.2.1 Overview

13.2.2 Offerings

13.2.3 Key Financials

13.2.4 Business Segment & Geographic Overview

13.2.5 Key Market Developments

13.2.6 Key Strategies

13.3. Ascensia Diabetes Care Holdings Ag

13.3.1 Overview

13.3.2 Offerings

13.3.3 Key Financials

13.3.4 Business Segment & Geographic Overview

13.3.5 Key Market Developments

13.3.6 Key Strategies

13.4 Becton

13.4.1 Overview

13.4.2 Offerings

13.4.3 Key Financials

13.4.4 Business Segment & Geographic Overview

13.4.5 Key Market Developments

13.4.6 Key Strategies

13.5 Dickinson And Company

13.5.1 Overview

13.5.2 Offerings

13.5.3 Key Financials

13.5.4 Business Segment & Geographic Overview

13.5.5 Key Market Developments

13.5.6 Key Strategies

13.6 Dexcom, Inc

13.6.1 Overview

13.6.2 Offerings

13.6.3 Key Financials

13.6.4 Business Segment & Geographic Overview

13.6.5 Key Market Developments

13.6.6 Key Strategies

13.7 F. Hoffmann-La Roche Ltd

13.7.1 Overview

13.7.2 Offerings

13.7.3 Key Financials

13.7.4 Business Segment & Geographic Overview

13.7.5 Key Market Developments

13.7.6 Key Strategies

13.8 Johnson & Johnson

13.8.1 Overview

13.8.2 Offerings

13.8.3 Key Financials

13.8.4 Business Segment & Geographic Overview

13.8.5 Key Market Developments

13.8.6 Key Strategies

13.9 Medtronic Plc

13.9.1 Overview

13.9.2 Offerings

13.9.3 Key Financials

13.9.4 Business Segment & Geographic Overview

13.9.5 Key Market Developments

13.9.6 Key Strategies

13.10 Novo Nordisk A/S

13.10.1 Overview

13.10.2 Offerings

13.10.3 Key Financials

13.10.4 Business Segment & Geographic Overview

13.10.5 Key Market Developments

13.10.6 Key Strategies