Global Autonomous Underwater Vehicles Market Size, Trends & Growth Opportunity, By Technology (Collision Avoidance, Communication, Navigation, Propulsion, Imaging), By Shape (Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-hull Vehicle), By Payload Type (Cameras, Sensors, Synthetic Aperture Sonar, Echo Sounders, Acoustic Doppler Current Profilers, Others), by Application (Militar

Report ID : QR1001454 | Industries : Automotive and Transportation | Published On :March 2022 | Page Count : 227Autonomous Underwater Vehicles Market

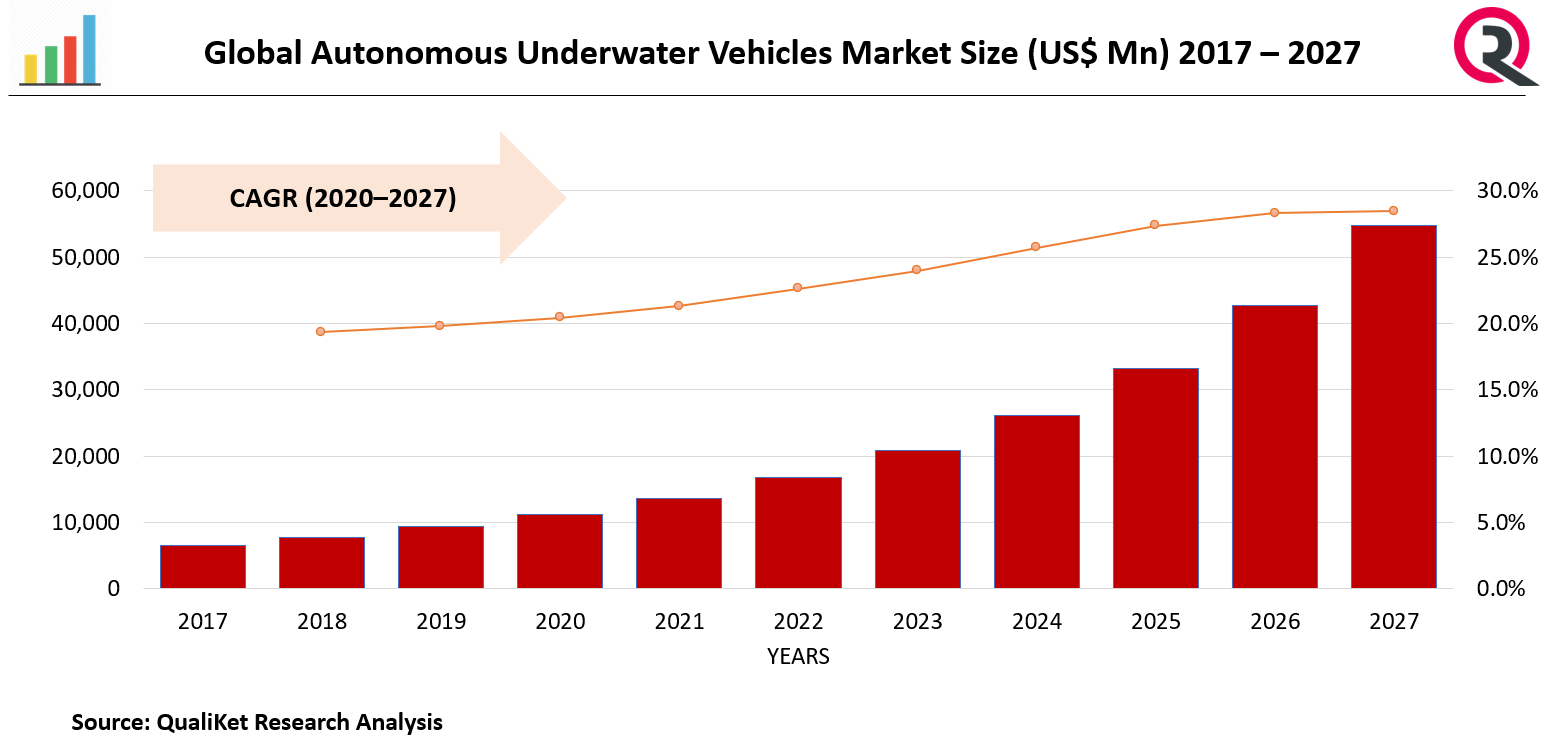

The Autonomous Underwater Vehicles market was valued at USD 1.5 billion in 2020 which expected to reach USD 4.3 billion by 2027 at a CAGR 10.9% from 2020-2027.

Autonomous underwater vehicles are useful for a variety of missions, including shipwrecks, mapping rock formations, and other hazards that may pose a hazard to recreational and commercial navigation vessels. Autonomous underwater vehicles are outfitted with cutting-edge sensor technologies, such as sonar systems and oceanographic sensors, that allow them to complete the entire mission without the need for operator intervention.

Market Drivers

Defense spending is increasing in a number of countries around the world.

Security concerns, as well as concerns about contested territories and threats, have resulted in a significant increase in global defence spending. AUVs are used by defence forces for mine countermeasures, rapid environmental assessment, intelligence, surveillance, and reconnaissance, harbor protection and port clearance operations, and anti-submarine warfare. As a result, AUVs are expected to be used more frequently in the coming years to combat underwater security threats, resulting in global market growth.

Know more about this report: request for sample pages

Market Restraints

AUVs have high operating costs.

AUVs are high-priced maritime systems. The A18 AUV (ECA GROUP), for example, has a depth rating of up to 3,000 m and a price range of USD 2–6 million. The deployment costs of AUVs used in exploration or surveying activities increase the overall cost of exploration and surveying missions. Furthermore, the high costs of maintenance, manufacturing, R&D, and system complexity associated with AUVs are slowing their adoption, despite the fact that they are increasingly being used in simple missions such as environmental monitoring.

Impact of COVID-19

COVID-19's impact on the AUV market and consumer demand is currently unknown. However, it is expected that there will be a short-term reduction in AUV production because the oil and gas industry, which is the largest consumer of AUVs, is experiencing a shortage of oil and gas. Travel restrictions imposed in a number of countries, including Albania, Armenia, Australia, Azerbaijan, Bosnia and Herzegovina, Brunei Darussalam, Canada, Japan, Jordan, New Zealand, Qatar, the Republic of Moldova, Saudi Arabia, Serbia, Singapore, South Korea, Ukraine, and China, are causing a shortage in demand for oil and gas.

Market Segmentation

The Autonomous Underwater Vehicles Market is segmented into Technology, Shape, Payload Type and Application. By Technology such as Collision Avoidance, Communication, Navigation, Propulsion, Imaging. Further, market is segmented into By Shape such as Torpedo, Laminar Flow Body, Streamlined Rectangular Style, Multi-hull Vehicle. By Payload Type such as Cameras, Sensors, Synthetic Aperture Sonar, Echo Sounders, Acoustic Doppler Current Profilers, Others. By Application such as Military & Defense, Oil & Gas, Environment Protection & Monitoring, Oceanography, Archeology & Exploration, Search & Salvage Operations.

Regional Analysis

Autonomous Underwater Vehicles Market is segmented into five regions such as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific has the largest market share. The market for autonomous underwater vehicles (AUVs) in APAC has been divided into three segments: China, Japan, and India, which are the fastest-growing markets for AUVs. Increased military spending, rising energy demand in emerging economies, and increased adoption of AUVs in a variety of applications are propelling the APAC AUV market forward. In recent years, there has been a significant increase in the demand for AUVs for mine exploration and oceanographic studies. Furthermore, the growing military capabilities of developing nations such as India and South Korea are expected to drive APAC demand for AUVs.

Key Players

Various key players are listed in this report such as Teledyne Technologies (US), Fugro (Netherlands), Bluefin Robotics (General Dynamics) (US), and Saab AB (Sweden) ECA GROUP (France), Lockheed Martin Corporation (US), ATLAS ELEKTRONIK GmbH (Germany), L3Harris Technologies (US), Boston Engineering Corporation(US)

Market Taxonomy

By Technology

- Collision Avoidance

- Communication

- Navigation

- Propulsion

- Imaging

By Shape

- Torpedo

- Laminar Flow Body

- Streamlined Rectangular Style

- Multi-hull Vehicle

By Payload Type

- Cameras

- Sensors

- Synthetic Aperture Sonar

- Echo Sounders

- Acoustic Doppler Current Profilers

- Others

By Application

- Military & Defense

- Oil & Gas

- Environment Protection & Monitoring

- Oceanography

- Archeology & Exploration

- Search & Salvage Operations

By Region

- North America

- Latin America

- Europe

- China

- Asia Pacific

- Middle East & Africa

Key Questions Addressed by the Report

- What are the Key Opportunities in Autonomous Underwater Vehicles Market?

- What will be the growth rate from 2020 to 2027?

- Which segment/region will have highest growth?

- What are the factors that will impact/drive the Market?

- What is the competitive Landscape in the Industry?

- What is the role of key players in the value chain?

Autonomous Underwater Vehicles Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Autonomous Underwater Vehicles Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Autonomous Underwater Vehicles Market, By Technology

5.1 Y-o-Y Growth Comparison, By Technology

5.2 Autonomous Underwater Vehicles Market Share Analysis, By Technology

5.3 Autonomous Underwater Vehicles Market Size and Forecast, By Technology

5.3.1 Collision Avoidance

5.3.2 Communication

5.3.3 Navigation

5.3.4 Propulsion

5.3.5 Imaging

6 Autonomous Underwater Vehicles Market, By Shape

6.1 Y-o-Y Growth Comparison, By Shape

6.2 Autonomous Underwater Vehicles Market Share Analysis, By Shape

6.3 Autonomous Underwater Vehicles Market Size and Forecast, By Shape

6.3.1 Torpedo

6.3.2 Laminar Flow Body

6.3.3 Streamlined Rectangular Style

6.3.4 Multi-hull Vehicle

7 Autonomous Underwater Vehicles Market, By Payload Type

7.1 Y-o-Y Growth Comparison, By Payload Type

7.2 Autonomous Underwater Vehicles Market Share Analysis, By Payload Type

7.3 Autonomous Underwater Vehicles Market Size and Forecast, By Payload Type

7.3.1 Cameras

7.3.2 Sensors

7.3.3 Synthetic Aperture Sonar

7.3.4 Echo Sounders

7.3.5 Acoustic Doppler Current Profilers

7.3.6 Others

8 Autonomous Underwater Vehicles Market, By Application

8.1 Y-O-Y Growth Comparison, By Application

8.2 Autonomous Underwater Vehicles Market Share Analysis, By Application

8.3 Autonomous Underwater Vehicles Market Size and Forecast, By Application

8.3.1 Military & Defense

8.3.2 Oil & Gas

8.3.3 Environment Protection & Monitoring

8.3.4 Oceanography

8.3.5 Archeology & Exploration

8.3.6 Search & Salvage Operations

9 Autonomous Underwater Vehicles Market, By Region

9.1 Autonomous Underwater Vehicles Market Share Analysis, By Region

9.2 Autonomous Underwater Vehicles Market Share Analysis, By Region

9.3 Autonomous Underwater Vehicles Market Size and Forecast, By Region

10 North America Indoor Farming Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 North America Indoor Farming Market Share Analysis, By Technology

10.3 North America Indoor Farming Market Size and Forecast, By Shape

10.4 North America Indoor Farming Market Size and Forecast, By Payload Type

10.5 North America Indoor Farming Market Size and Forecast, By Application

10.6 North America Indoor Farming Market Size and Forecast, By Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

11 Europe Indoor Farming Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Europe Indoor Farming Market Share Analysis, By Technology

11.3 Europe Indoor Farming Market Size and Forecast, By Shape

11.4 Europe Indoor Farming Market Size and Forecast, By Payload Type

11.5 Europe Indoor Farming Market Size and Forecast, By Application

11.6 Europe Indoor Farming Market Size and Forecast, By Country

11.6.1 Germany

11.6.2 France

11.6.3 UK

11.6.4. Rest of Europe

12 Asia Pacific Indoor Farming Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Asia Pacific Indoor Farming Market Share Analysis, By Technology

12.3 Asia Pacific Indoor Farming Market Size and Forecast, By Shape

12.4 Asia Pacific Indoor Farming Market Size and Forecast, By Payload Type

12.5 Asia Pacific Indoor Farming Market Size and Forecast, By Application

12.6 Asia Pacific Indoor Farming Market Size and Forecast, By Country

12.6.1 China

12.7.2 Japan

12.8.3 India

12.9.4. Rest of Asia Pacific

13 Latin America Indoor Farming Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Latin America Indoor Farming Market Share Analysis, By Technology

13.3 Latin America Indoor Farming Market Size and Forecast, By Shape

13.4 Latin America Indoor Farming Market Size and Forecast, By Payload Type

13.5 Latin America Indoor Farming Market Size and Forecast, By Application

13.6 Latin America Indoor Farming Market Size and Forecast, Country

13.7.1. Brazil

13.8.2. Rest of Latin America

14 Middle East Indoor Farming Market Analysis and Forecast (2021-2027)

14.1 Introduction

14.2 Middle East Indoor Farming Market Share Analysis, By Technology

14.3 Middle East Indoor Farming Market Size and Forecast, By Shape

14.4 Middle East Indoor Farming Market Size and Forecast, By Payload Type

14.5 Middle East Indoor Farming Market Size and Forecast, By Application

14.6 Middle East Indoor Farming Market Size and Forecast, By Country

14.7.1. Saudi Arabia

14.8.2. UAE

14.9.3. Egypt

14.10.4. Kuwait

14.11.5. South Africa

15Competitive Analysis

15.1 Competition Dashboard

15.2 Market share Analysis of Top Vendors

15.3 Key Development Strategies

16 Company Profiles

16.1 Teledyne Technologies

16.1.1 Overview

16.1.2 Offerings

16.1.3 Key Financials

16.1.4 Business Segment & Geographic Overview

16.1.5 Key Market Developments

16.1.6 Key Strategies

17.2. Fugro

17.2.1 Overview

17.2.2 Offerings

17.2.3 Key Financials

17.2.4 Business Segment & Geographic Overview

17.2.5 Key Market Developments

17.2.6 Key Strategies

17.3. Bluefin Robotics

17.3.1 Overview

17.3.2 Offerings

17.3.3 Key Financials

17.3.4 Business Segment & Geographic Overview

17.3.5 Key Market Developments

17.3.6 Key Strategies

17.4 Saab AB.

17.4.1 Overview

17.4.2 Offerings

17.4.3 Key Financials

17.4.4 Business Segment & Geographic Overview

17.4.5 Key Market Developments

17.4.6 Key Strategies

17.5 ECA GROUP

17.5.1 Overview

17.5.2 Offerings

17.5.3 Key Financials

17.5.4 Business Segment & Geographic Overview

17.5.5 Key Market Developments

17.5.6 Key Strategies

17.6 Lockheed Martin Corporation

17.6.1 Overview

17.6.2 Offerings

17.6.3 Key Financials

17.6.4 Business Segment & Geographic Overview

17.6.5 Key Market Developments

17.6.6 Key Strategies

17.7 ATLAS ELEKTRONIK GmbH

17.7.1 Overview

17.7.2 Offerings

17.7.3 Key Financials

17.7.4 Business Segment & Geographic Overview

17.7.5 Key Market Developments

17.7.6 Key Strategies

17.8 L3Harris Technologies

17.8.1 Overview

17.8.2 Offerings

17.8.3 Key Financials

17.8.4 Business Segment & Geographic Overview

17.8.5 Key Market Developments

17.8.6 Key Strategies

17.9 Boston Engineering Corporation

17.9.1 Overview

17.9.2 Offerings

17.9.3 Key Financials

17.9.4 Business Segment & Geographic Overview

17.9.5 Key Market Developments

17.9.6 Key Strategies