Global Automotive Semiconductor Market Size, Trends & Growth Opportunity, By Component (Processor, Analog IC, Discrete Power Device, Sensor, Memory Device, Lighting Device), By Vehicle Type (Passenger Car, Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV)), By Fuel Type (Gasoline, Diesel, Electric/Hybrid Electric Vehicle (EV/HEV)), by Application (Powertrain, Safety, Body Electronics,

Report ID : QR1001256 | Industries : Semiconductors and Electronics | Published On :October 2021 | Page Count : 253Global Automotive Semiconductor Market

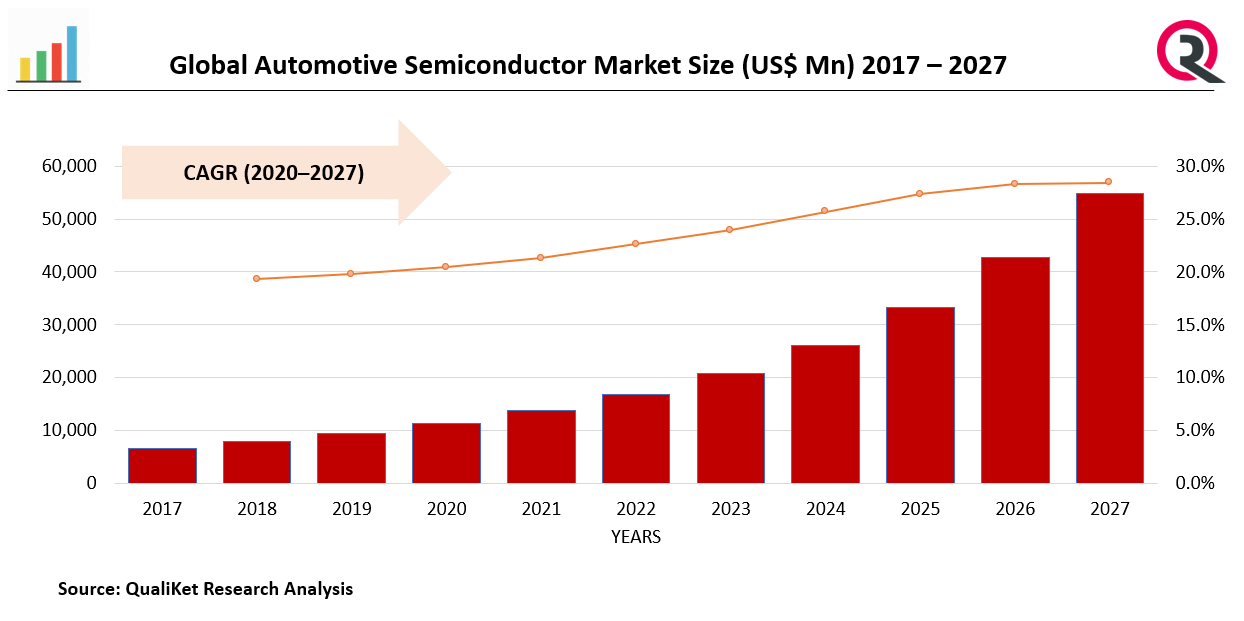

The global Automotive Semiconductor market was valued at USD 42090 million in 2020 which expected to reach USD 24.9 billion by 2027 at a CAGR 6.2% from 2020-2027.

Single metals or compounds are used to make semiconductors. Doping can modify the characteristics of these materials. Impurities are introduced through doping. They are compatible with the automotive industry's technical and quality standards. Autonomous driving is predicted to result in a rise in the number of semiconductor devices used in the car sector as technology improves. Autonomous vehicles rely on sophisticated algorithms, actuators, powerful processors, and machine learning systems to execute software.

Market Drivers

Consumers who really are accustomed to rich user experiences will be drawn to linked vehicles. As a result of these expectations, infotainment systems have evolved from bulky, purpose-built devices to streamlined, linked, upgradeable, and integrated platforms that demand the most up-to-date technology-featured chips. Every year, around 1.24 million people die as a result of road traffic accidents, according to the World Health Organization. If current trends continue, road traffic accidents will be the sixth largest cause of mortality by 2030.

Know more about this report: request for sample pages

Market Restraints

Advanced Featured Vehicles Have Higher Prices. From August 3, 2021, Tata Motors will increase the price of its passenger vehicles in India. Depending on the version and model, the price increase will be in the region of 0.8 percent on average. All automobiles sold on or before August 31, 21 will be protected from the price rise, according to the business. This will be the domestic automaker's third price increase this year. Tata boosted the prices of its automobiles by up to 1.8 percent in May. Prior to that, car costs were increased by up to Rs 26,000 in January.

Impact of COVID-19

The COVID-19 pandemic and the subsequent steps adopted to reduce the infection rate caused major commercial volatility, which had a detrimental impact on sectors all around the world. Various industries, including the automobile semiconductor industry, have suffered significant setbacks as a result of the epidemic. The volume of vehicles sold, as well as the extent of vehicle electrification and digitization, determine semiconductor sales for automotive applications.

Market Segmentation

The Global Automotive Semiconductor Market is segmented into Facility Type, Vehicle Type, Fuel Type and Application. By Component such as Processor, Analog IC, Discrete Power Device, Sensor, Memory Device, Lighting Device. Further, market is segmented into By Vehicle Type such as Passenger Car, Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV). By Fuel Type such as Gasoline, Diesel, Electric/Hybrid Electric Vehicle (EV/HEV). By Application such as Powertrain, Safety, Body Electronics, Chassis, Telematics and infotainment.

Regional Analysis

Global Automotive Semiconductor Market is segmented into five regions such as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific has the largest market share and is expected to dominate the market during the forecast period. Faster GDP growth and highly ambitious Asian consumers have been the two main development drivers for most rising nations, including China, India, Malaysia, and other developing markets in Southeast Asia. A burgeoning middle class in China, for example, is predicted to continue supporting the Chinese auto market's steady expansion, with the market for new vehicle purchases and replacements increasing.

Key Players

Various key players are listed in this report such as Infineon Technologies AG; NXP Semiconductors; Renesas Electronics Corporation; Texas Instrument Incorporated; STMicroelectronics, Ford Motor Co, General Motors, Honda Motor Co., Ltd, Delphi Automotive PLC, Denso Corp.

Market Taxonomy

By Component

- Processor

- Analog IC

- Discrete Power Device

- Sensor

- Memory Device

- Lighting Device

By Vehicle Type

- Passenger Car

- Light Commercial Vehicle (LCV)

- Heavy Commercial Vehicle (HCV)

By Fuel Type

- Gasoline

- Diesel

- Electric/Hybrid Electric Vehicle (EV/HEV)

By Application

- Powertrain

- Safety

- Body Electronics

- Chassis

- Telematics and infotainment

By Region

- North America

- Latin America

- Europe

- China

- Asia Pacific

- Middle East & Africa

Key Questions Addressed by the Report

- What are the Key Opportunities in Global Automotive Semiconductor Market?

- What will be the growth rate from 2020 to 2027?

- Which segment/region will have highest growth?

- What are the factors that will impact/drive the Market?

- What is the competitive Landscape in the Industry?

- What is the role of key players in the value chain?

Global Automotive Semiconductor Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global Automotive Semiconductor Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global Automotive Semiconductor Market, By Component

5.1 Y-o-Y Growth Comparison, By Component

5.2 Global Automotive Semiconductor Market Share Analysis, By Component

5.3 Global Automotive Semiconductor Market Size and Forecast, By Component

5.3.1 Processor

5.3.2 Analog IC

5.3.3 Discrete Power Device

5.3.4 Sensor

5.3.5 Memory Device

5.3.6 Lighting Device

6 Global Automotive Semiconductor Market, By Vehicle Type

6.1 Y-o-Y Growth Comparison, By Vehicle Type

6.2 Global Automotive Semiconductor Market Share Analysis, By Vehicle Type

6.3 Global Automotive Semiconductor Market Size and Forecast, By Vehicle Type

6.3.1 Passenger Car

6.3.2 Light Commercial Vehicle (LCV)

6.3.3 Heavy Commercial Vehicle (HCV)

7 Global Automotive Semiconductor Market, By Fuel Type

7.1 Y-o-Y Growth Comparison, By Fuel Type

7.2 Global Automotive Semiconductor Market Share Analysis, By Fuel Type

7.3 Global Automotive Semiconductor Market Size and Forecast, By Fuel Type

7.3.1 Powertrain

7.3.2. Safety

7.3.3 Body Electronics

7.3.4 Chassis

7.3.5 Telematics and infotainment

8 Global Automotive Semiconductor Market, By Application

8.1 Y-O-Y Growth Comparison, By Application

8.2 Global Automotive Semiconductor Market Share Analysis, By Application

8.3 Global Automotive Semiconductor Market Size and Forecast, By Application

8.3.1 Powertrain

8.3.2 Safety

8.3.3 Body Electronics

8.3.4 Chassis

8.3.5 Telematics and infotainment

9 Global Automotive Semiconductor Market, By Region

9.1 Global Automotive Semiconductor Market Share Analysis, By Region

9.2 Global Automotive Semiconductor Market Share Analysis, By Region

9.3 Global Automotive Semiconductor Market Size and Forecast, By Region

10 North America Automotive Semiconductor Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 North America Automotive Semiconductor Market Share Analysis, By Fuel Type

10.3 North America Automotive Semiconductor Market Size and Forecast, By Vehicle Type

10.4 North America Automotive Semiconductor Market Size and Forecast, By Fuel Type

10.5 North America Automotive Semiconductor Market Size and Forecast, By Application

10.6 North America Automotive Semiconductor Market Size and Forecast, By Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

11 Europe Automotive Semiconductor Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Europe Automotive Semiconductor Market Share Analysis, By Fuel Type

11.3 Europe Automotive Semiconductor Market Size and Forecast, By Vehicle Type

11.4 Europe Automotive Semiconductor Market Size and Forecast, By Fuel Type

11.5 Europe Automotive Semiconductor Market Size and Forecast, By Application

11.6 Europe Automotive Semiconductor Market Size and Forecast, By Country

11.6.1 Germany

11.6.2 France

11.6.3 UK

11.6.4. Rest of Europe

12 Asia Pacific Automotive Semiconductor Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Asia Pacific Automotive Semiconductor Market Share Analysis, By Fuel Type

12.3 Asia Pacific Automotive Semiconductor Market Size and Forecast, By Vehicle Type

12.4 Asia Pacific Automotive Semiconductor Market Size and Forecast, By Fuel Type

12.5 Asia Pacific Automotive Semiconductor Market Size and Forecast, By Application

12.6 Asia Pacific Automotive Semiconductor Market Size and Forecast, By Country

12.6.1 China

12.7.2 Japan

12.8.3 India

12.9.4. Rest of Asia Pacific

13 Latin America Automotive Semiconductor Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Latin America Automotive Semiconductor Market Share Analysis, By Fuel Type

13.3 Latin America Automotive Semiconductor Market Size and Forecast, By Vehicle Type

13.4 Latin America Automotive Semiconductor Market Size and Forecast, By Fuel Type

13.5 Latin America Automotive Semiconductor Market Size and Forecast, By Application

13.6 Latin America Automotive Semiconductor Market Size and Forecast, Country

13.7.1. Brazil

13.8.2. Rest of Latin America

14 Middle East Automotive Semiconductor Market Analysis and Forecast (2021-2027)

14.1 Introduction

14.2 Middle East Automotive Semiconductor Market Share Analysis, By Fuel Type

14.3 Middle East Automotive Semiconductor Market Size and Forecast, By Vehicle Type

14.4 Middle East Automotive Semiconductor Market Size and Forecast, By Fuel Type

14.5 Middle East Automotive Semiconductor Market Size and Forecast, By Application

14.6 Middle East Automotive Semiconductor Market Size and Forecast, By Country

14.7.1. Saudi Arabia

14.8.2. UAE

14.9.3. Egypt

14.10.4. Kuwait

14.11.5. South Africa

15Competitive Analysis

15.1 Competition Dashboard

15.2 Market share Analysis of Top Vendors

15.3 Key Development Strategies

16 Company Profiles

16.1 Infineon Technologies AG

16.1.1 Overview

16.1.2 Offerings

16.1.3 Key Financials

16.1.4 Business Segment & Geographic Overview

16.1.5 Key Market Developments

16.1.6 Key Strategies

17.2. NXP Semiconductors

17.2.1 Overview

17.2.2 Offerings

17.2.3 Key Financials

17.2.4 Business Segment & Geographic Overview

17.2.5 Key Market Developments

17.2.6 Key Strategies

17.3. Renesas Electronics Corporation

17.3.1 Overview

17.3.2 Offerings

17.3.3 Key Financials

17.3.4 Business Segment & Geographic Overview

17.3.5 Key Market Developments

17.3.6 Key Strategies

17.4 Texas Instrument Incorporated

17.4.1 Overview

17.4.2 Offerings

17.4.3 Key Financials

17.4.4 Business Segment & Geographic Overview

17.4.5 Key Market Developments

17.4.6 Key Strategies

17.5 STMicroelectronics

17.5.1 Overview

17.5.2 Offerings

17.5.3 Key Financials

17.5.4 Business Segment & Geographic Overview

17.5.5 Key Market Developments

17.5.6 Key Strategies

17.6 Ford Motor Co

17.6.1 Overview

17.6.2 Offerings

17.6.3 Key Financials

17.6.4 Business Segment & Geographic Overview

17.6.5 Key Market Developments

17.6.6 Key Strategies

17.7 General Motors

17.7.1 Overview

17.7.2 Offerings

17.7.3 Key Financials

17.7.4 Business Segment & Geographic Overview

17.7.5 Key Market Developments

17.7.6 Key Strategies

17.8 Honda Motor Co., Ltd

17.8.1 Overview

17.8.2 Offerings

17.8.3 Key Financials

17.8.4 Business Segment & Geographic Overview

17.8.5 Key Market Developments

17.8.6 Key Strategies

17.9 Delphi Automotive PLC

17.9.1 Overview

17.9.2 Offerings

17.9.3 Key Financials

17.9.4 Business Segment & Geographic Overview

17.9.5 Key Market Developments

17.9.6 Key Strategies

17.10 Denso Corp.

17.10.1 Overview

17.10.2 Offerings

17.10.3 Key Financials

17.10.4 Business Segment & Geographic Overview

17.10.5 Key Market Developments

17.10.6 Key Strategies