Global Automatic Fare Collection (AFC) Systems Market Research Report by Application (Rail and transport, Parking applications, Theme park applications, others), by Service Type (Consulting, System implementation, Training, support, and maintenance, Managed service) by Vertical (Transportation and logistics, Government, Media and entertainment, Retail, Others), by Technology Type (Near field commu

Report ID : QR1001363 | Industries : Semiconductors and Electronics | Published On :January 2022 | Page Count : 234Global Automatic Fare Collection (AFC) Systems Market

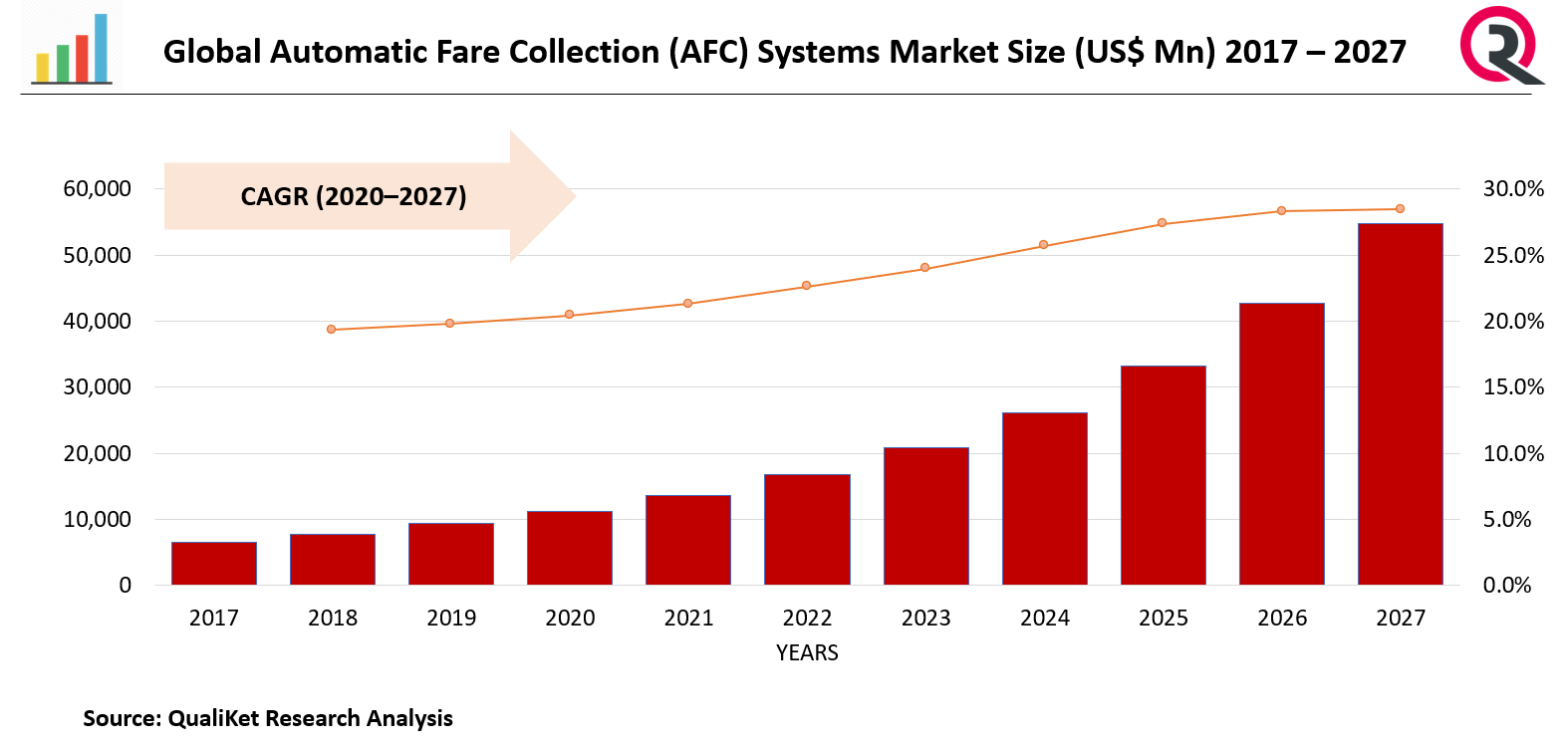

The global Automatic Fare Collection (AFC) Systems market was valued at USD 6,639.10 million in 2020 which expected to reach USD 12,753.75 million by 2027 at a CAGR 11.6 % from 2020-2027.

An automated fare collection (AFC) system is a collection of components that automate a public transportation network's ticketing system - an automated version of manual fare collection. Typically, an AFC system serves as the foundation for integrated ticketing.

Market Drivers

The advantages of a cashless travel facility

The AFC system provides the option of cashless travel by directly debiting the driver/bank owner's account for the services used by the owner. This gives them the freedom and convenience to travel whenever and wherever they want without having to carry cash with them.

Know more about this report: request for sample pages

Market Restraint

Expensive installation

The high installation cost is one of the major factors limiting the growth of the AFC system market. The installation of an AFC system is more expensive than that of other toll collection systems, such as manual tolling. The system also necessitates extensive maintenance, which adds to the costs. Expenses are compensated in the traditional method by either a tax payment on fuel or rubber or a budget allocation from national income.

Impact of COVID-19

In the current COVID-19 health crisis, unprecedented times necessitate innovative solutions, and the payments technology industry provides numerous opportunities for people to support one another as well as communities in a safe and effective manner with little to no physical contact. The major impact of COVID-19 impact analysis is felt by public mobility, as people are advised to stay at home and work from home whenever possible.

Market Segmentation

The Global Automatic Fare Collection (AFC) Systems Market is segmented into Application, Service Type Vertical, and Technology Type. Based on the Vertical, the market is segmented into Rail and transport, Parking applications, Theme park applications, others. Further, market is segmented into The Technology Type, the market is segmented into near field communication, Magnetic stripes, others. By Service Type, the market is segmented into Consulting, System implementation, Training, support, and maintenance, Managed service)

Regional Analysis

Global Automatic Fare Collection (AFC) Systems Market is segmented into five regions such as North America, Latin America, Europe, Asia Pacific, and Middle East & Africa. Asia Pacific has the largest market share and the increasing government support for the development of transit systems to improve public transportation in the region is attributed to the growth of the Asia Pacific AFC system market. For example, the Kuala Lumpur government introduced Bus Rapid Transit (BRT) service in Sunway in June 2015 to alleviate traffic congestion in the area. The market is gaining traction as these systems become more widely used in public transportation, particularly the metro. For example, in June 2015, the metro authorities in Delhi (India) installed 210 new AFC gates in key stations such as Huda City Center Station and Nehru Place Station to ensure a smooth flow of passengers.

Key Players

Various key players are listed in this report such as Thales Group, Omron Corporation, Advance Card Systems, Samsung, GMV, Scheidt & Bachmann, Sony Corporation, Vix Technology, LG Corporation, and Fare Logistics.

Market Taxonomy

By Application

- Rail and transport

- Parking applications

- Theme park applications

- Others

By Service Type

- Consulting

- System implementation

- Training, support, and maintenance

- Managed service

By Vertical

- Transportation and logistics

- Government

- Media and entertainment

- Retail

- Others

By Technology Type

- Near field communication

- Magnetic stripes

- Others

By Region

- North America

- Latin America

- Europe

- China

- Asia Pacific

- Middle East & Africa

Key Questions Addressed by the Report

- What are the Key Opportunities in Global Automatic Fare Collection (AFC) Systems Market?

- What will be the growth rate from 2020 to 2027?

- Which segment/region will have highest growth?

- What are the factors that will impact/drive the Market?

- What is the competitive Landscape in the Industry?

- What is the role of key players in the value chain?

Global Automatic Fare Collection (AFC) Systems Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Global Automatic Fare Collection (AFC) Systems Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Global Automatic Fare Collection (AFC) Systems Market, By Application

5.1 Y-o-Y Growth Comparison, By Application

5.2 Global Automatic Fare Collection (AFC) Systems Market Share Analysis, By Application

5.3 Global Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Application

5.3.1 Rail and transport

5.3.2 Parking applications

5.3.3 Theme park applications

5.3.4 Others

6 Global Automatic Fare Collection (AFC) Systems Market, By Service Type

6.1 Y-o-Y Growth Comparison, By Service Type

6.2 Global Automatic Fare Collection (AFC) Systems Market Share Analysis, By Service Type

6.3 Global Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Service Type

6.3.1 Consulting

6.3.2 System implementation

6.3.3 Training, support, and maintenance

6.3.4 Managed service

7 Global Automatic Fare Collection (AFC) Systems Market, By Vertical

7.1 Y-o-Y Growth Comparison, By Vertical

7.2 Global Automatic Fare Collection (AFC) Systems Market Share Analysis, By Vertical

7.3 Global Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Vertical

7.3.1 Transportation and logistics

7.3.2 Government

7.3.3 Media and entertainment

7.3.4 Retail

7.3.5Others

8 Global Automatic Fare Collection (AFC) Systems Market, By Technology Type

8.1 Y-O-Y Growth Comparison, By Technology Type

8.2 Global Automatic Fare Collection (AFC) Systems Market Share Analysis, By Technology Type

8.3 Global Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Technology Type

8.3.1 near field communication

8.3.2 Magnetic stripes

8.3.3 Others

9 Global Automatic Fare Collection (AFC) Systems Market, By Region

9.1 Global Automatic Fare Collection (AFC) Systems Market Share Analysis, By Region

9.2 Global Automatic Fare Collection (AFC) Systems Market Share Analysis, By Region

9.3 Global Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Region

10 North America Automatic Fare Collection (AFC) Systems Market Analysis and Forecast (2021-2027)

10.1 Introduction

10.2 North America Automatic Fare Collection (AFC) Systems Market Share Analysis, By Application

10.3 North America Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Service Type

10.4 North America Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Vertical

10.5 North America Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Technology Type

10.6 North America Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Country

10.7.1 U.S.

10.7.2 Canada

10.7.3 Mexico

11 Europe Automatic Fare Collection (AFC) Systems Market Analysis and Forecast (2021-2027)

11.1 Introduction

11.2 Europe Automatic Fare Collection (AFC) Systems Market Share Analysis, By Application

11.3 Europe Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Service Type

11.4 Europe Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Vertical

11.5 Europe Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Technology Type

11.6 Europe Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Country

11.6.1 Germany

11.6.2 France

11.6.3 UK

11.6.4. Rest of Europe

12 Asia Pacific Automatic Fare Collection (AFC) Systems Market Analysis and Forecast (2021-2027)

12.1 Introduction

12.2 Asia Pacific Automatic Fare Collection (AFC) Systems Market Share Analysis, By Application

12.3 Asia Pacific Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Service Type

12.4 Asia Pacific Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Vertical

12.5 Asia Pacific Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Technology Type

12.6 Asia Pacific Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Country

12.6.1 China

12.7.2 Japan

12.8.3 India

12.9.4. Rest of Asia Pacific

13 Latin America Automatic Fare Collection (AFC) Systems Market Analysis and Forecast (2021-2027)

13.1 Introduction

13.2 Latin America Automatic Fare Collection (AFC) Systems Market Share Analysis, By Application

13.3 Latin America Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Service Type

13.4 Latin America Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Vertical

13.5 Latin America Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Technology Type

13.6 Latin America Automatic Fare Collection (AFC) Systems Market Size and Forecast, Country

13.7.1. Brazil

13.8.2. Rest of Latin America

14 Middle East Automatic Fare Collection (AFC) Systems Market Analysis and Forecast (2021-2027)

14.1 Introduction

14.2 Middle East Automatic Fare Collection (AFC) Systems Market Share Analysis, By Application

14.3 Middle East Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Service Type

14.4 Middle East Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Vertical

14.5 Middle East Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Technology Type

14.6 Middle East Automatic Fare Collection (AFC) Systems Market Size and Forecast, By Country

14.7.1. Saudi Arabia

14.8.2. UAE

14.9.3. Egypt

14.10.4. Kuwait

14.11.5. South Africa

15Competitive Analysis

15.1 Competition Dashboard

15.2 Market share Analysis of Top Vendors

15.3 Key Development Strategies

16 Company Profiles

16.1 Thales Group

16.1.1 Overview

16.1.2 Offerings

16.1.3 Key Financials

16.1.4 Business Segment & Geographic Overview

16.1.5 Key Market Developments

16.1.6 Key Strategies

16.2. Omron Corporation

16.2.1 Overview

16.2.2 Offerings

16.2.3 Key Financials

16.2.4 Business Segment & Geographic Overview

16.2.5 Key Market Developments

16.2.6 Key Strategies

16.3. Advance Card Systems

16.3.1 Overview

16.3.2 Offerings

16.3.3 Key Financials

16.3.4 Business Segment & Geographic Overview

16.3.5 Key Market Developments

16.3.6 Key Strategies

16.4 Samsung

16.4.1 Overview

16.4.2 Offerings

16.4.3 Key Financials

16.4.4 Business Segment & Geographic Overview

16.4.5 Key Market Developments

16.4.6 Key Strategies

16.5 GMV

16.5.1 Overview

16.5.2 Offerings

16.5.3 Key Financials

16.5.4 Business Segment & Geographic Overview

16.5.5 Key Market Developments

16.5.6 Key Strategies

16.6 Scheidt & Bachmann

16.6.1 Overview

16.6.2 Offerings

16.6.3 Key Financials

16.6.4 Business Segment & Geographic Overview

16.6.5 Key Market Developments

16.6.6 Key Strategies

16.7 Sony Corporation

16.7.1 Overview

16.7.2 Offerings

16.7.3 Key Financials

16.7.4 Business Segment & Geographic Overview

16.7.5 Key Market Developments

16.7.6 Key Strategies

16.8 Vix Technology

16.8.1 Overview

16.8.2 Offerings

16.8.3 Key Financials

16.8.4 Business Segment & Geographic Overview

16.8.5 Key Market Developments

16.8.6 Key Strategies

16.9 LG Corporation

16.9.1 Overview

16.9.2 Offerings

16.9.3 Key Financials

16.9.4 Business Segment & Geographic Overview

16.9.5 Key Market Developments

16.9.6 Key Strategies

16.10 Fare Logistics

16.10.1 Overview

16.10.2 Offerings

16.10.3 Key Financials

16.10.4 Business Segment & Geographic Overview

16.10.5 Key Market Developments

16.10.6 Key Strategies