Global Asset Integrity Management Market Report Size, Trends & Growth Opportunity, By Service Type, By Industry, By Region and forecast till 2027

Report ID : QR1001437 | Industries : Semiconductors and Electronics | Published On :February 2022 | Page Count : 234Asset Integrity Management Market Report Size, Trends & Growth Opportunity, By Service Type, By Industry, By Region and forecast till 2027

Global Asset Integrity Management Market

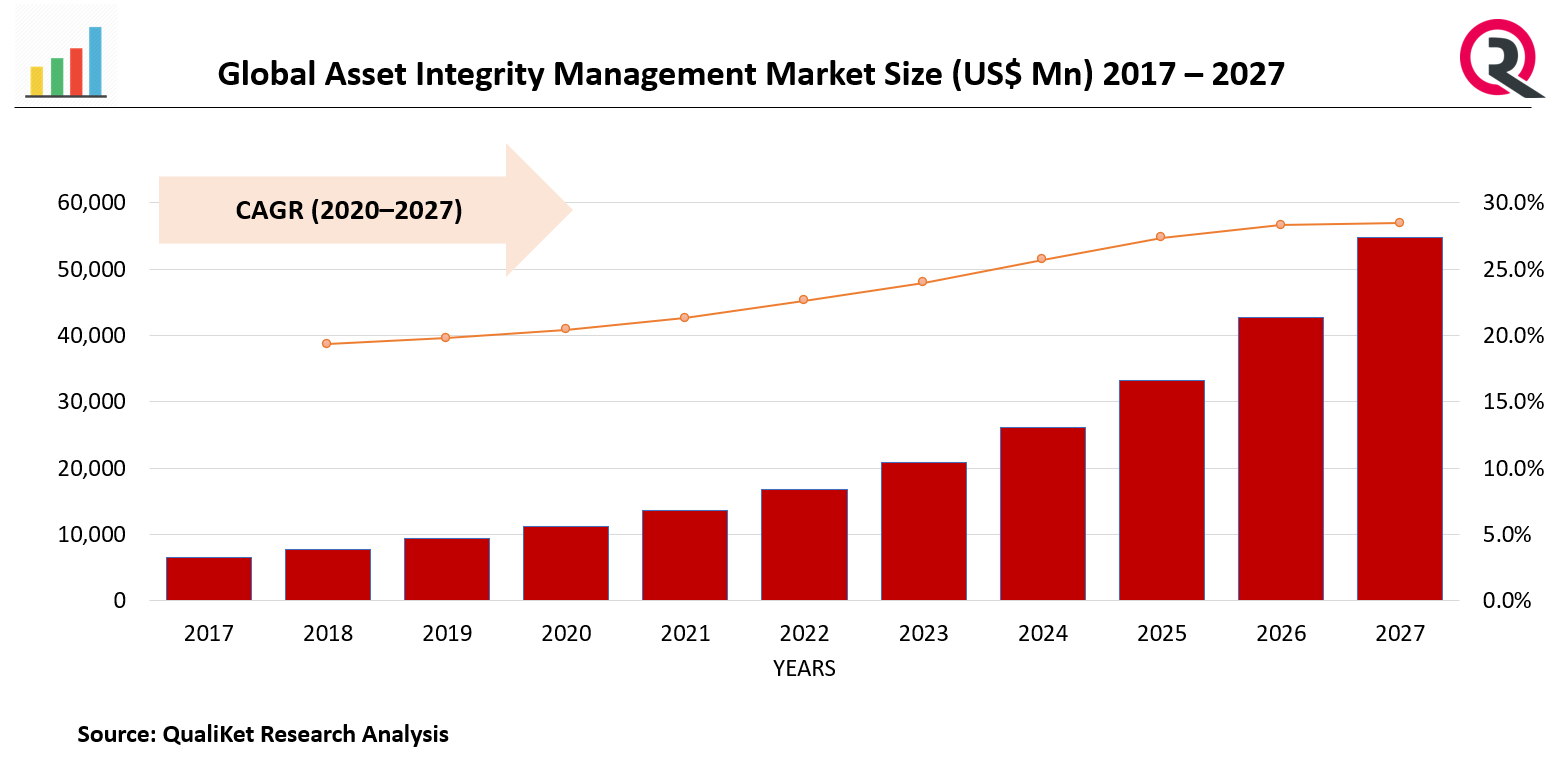

The global asset integrity management market was expected to grow from USD 20.3 billion in 2020 to USD 25.7 billion by 2027 at a CAGR of 4.9% from 2020 to 2027.

Asset Integrity Management includes numerous processes which are essentially used for the functioning of the systems and it maintains as well as manage corporate assets effectively, Also, make sure that they are safe, operationally competent as well as reliable.

Market Drivers

Growth of the Asset Integrity Management Market is driven by Climatic changes giving rise to operational disturbances in various industries. Also, increasing explorations for the oil and gas reserves in the developing countries, reduction in oil and gas prices, rising demand for maintaining the asset and plant, and strict government safety rules and quality control requirements are some of the driving factors of the global asset integrity management market.

Know more about this report: request for sample pages

Market Restraints

The factors like the harsh environmental conditions in the regions like Middle East and Arctic and high initial cost are also estimated to restrain the growth of the market. Another restraining factor to the growth of the market is the complex process of system installation.

Market Segmentation

Asset Integrity Management Marketsis segmented into major 4 categories. Based on Service Type, the market is segmented into Non-Destructive Testing (NDT), Risk-Based Inspection (RBI), Corrosion Management, Pipeline Integrity Management, Hazard Identification (HAZID) Study, Structural Integrity Management, Reliability, Availability, And Maintainability (RAM) study & others. Based on Industry, the market is segmented into Oil & gas, Power, Mining, Aerospace and Others. Based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, Middle East.

Regional Analysis

North America region leads the asset integrity management market because of the accessibility of large number of exploration plants and existing critical and complicated equipment in the North America region.

The asset integrity management market in Asia Pacific is likely to grow at the highest owing to the increasing demand for oil and gas and the rise in merger and acquisition activities, that have enlarged investments in the regional energy sector.

Market Key Players

Some of the key players operating in Global Asset Integrity Management Market are Aker Solutions, Bureau Veritas, Fluor Corporation., Intertek Group plc, SGS SA, SAINT LOUIS UNIVERSITY, DNV GL AS, John Wood Group PLC, Oceaneering International, Inc., ROSEN Group.

Industry development

In June 2021, Bureau Veritas signed a contract with Veolia, an energy services company, to provide technical verifications at all sites. Bureau Veritas will also provide inspection services of the equipment, diagnostics and regulatory check and consultation in a three-year agreement contract.

In November 2020, Aker Solutions received a contract from Equinor, an energy company, in Brazil. The contract is of 4 years in which Aker Solutions will provide maintenance and modifications service at Peregrino field to extend the life of Equinor’s assets

In August 2020, SGS partnered with Oilfield Production Enhancement Consulting Services Ltd. (OPECS) – a consultancy company based in Aberdeen, UK, to jointly deliver SGS ARPIN workflow consultancy services. They will also provide consultancy for hydraulic fracturing, well stimulation and geomechanics to support energy companies in optimizing their drilling and stimulation work.

Asset Integrity Management Market TOC

1 Introduction

1.1 Objective of the Study

1.2 Market definition

1.3 Market Scope

2 Research Methodology

2.1 Data Mining

2.2 Validation

2.3 Primary Interviews

2.4 List of Data Sources

3 Executive Summary

4 Asset Integrity Management Market Outlook

4.1 Overview

4.2 Market Dynamics

4.2.1 Drivers

4.2.2 Restraints

4.2.3 Opportunities

4.3 Porters Five Force Model

4.4 Value Chain Analysis

5 Asset Integrity Management Market, By Industry

5.1 Y-o-Y Growth Comparison, By Industry

5.2 Asset Integrity Management Market Share Analysis, By Industry

5.3 Asset Integrity Management Market Size and Forecast, By Industry

5.3.1 Oil & gas

5.3.2 Power

5.3.3 Mining

5.3.4 Aerospace

5.3.5 Others

6 Asset Integrity Management Market, By Service Type

6.1 Y-o-Y Growth Comparison, By Service Type

6.2 Asset Integrity Management Market Share Analysis, By Service Type

6.3 Asset Integrity Management Market Size and Forecast, By Service Type

6.3.1 Non-Destructive Testing (NDT)

6.3.2 Risk-Based Inspection (RBI)

6.3.3 Corrosion Management

6.3.4 Pipeline Integrity Management

6.3.5 Hazard Identification (HAZID) Study

6.3.6 Structural Integrity Management

6.3.7 Reliability, Availability, And Maintainability (RAM) study

6.3.8 Others

7 Asset Integrity Management Market, By Region

7.1 Asset Integrity Management Market Share Analysis, By Region

7.2 Asset Integrity Management Market Share Analysis, By Region

7.3 Asset Integrity Management Market Size and Forecast, By Region

8 North America Asset Integrity Management Market Analysis and Forecast (2021 – 2027)

8.1 Introduction

8.2 North America Asset Integrity Management Market Share Analysis, By Industry

8.3 North America Asset Integrity Management Market Size and Forecast, By Service Type

8.4 North America Asset Integrity Management Market Size and Forecast, By Country

8.4.1 U.S.

8.4.2 Canada

8.4.3 Mexico

9 Europe Asset Integrity Management Market Analysis and Forecast (2021 – 2027)

9.1 Introduction

9.2 Europe Asset Integrity Management Market Share Analysis, By Industry

9.3 Europe Asset Integrity Management Market Size and Forecast, By Service Type

9.4 Europe Asset Integrity Management Market Size and Forecast, By Country

9.4.1 Germany

9.4.2 France

9.4.3 UK

9.4.4. Rest of Europe

10 Asia Pacific Asset Integrity Management Market Analysis and Forecast (2021 – 2027)

10.1 Introduction

10.2 Asia Pacific Asset Integrity Management Market Share Analysis, By Industry

10.3 Asia Pacific Asset Integrity Management Market Size and Forecast, By Service Type

10.4 Asia Pacific Asset Integrity Management Market Size and Forecast, By Country

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4. Rest of Asia Pacific

11 Latin America Asset Integrity Management Market Analysis and Forecast (2021 – 2027)

11.1 Introduction

11.2 Latin America Asset Integrity Management Market Share Analysis, By Industry

11.3 Latin America Asset Integrity Management Market Size and Forecast, By Service Type

11.4 Latin America Asset Integrity Management Market Size and Forecast, By Country

11.4.1. Brazil

11.4.2. Rest of Latin America

12 Middle East Asset Integrity Management Market Analysis and Forecast (2021 – 2027)

12.1 Introduction

12.2 Middle East Asset Integrity Management Market Share Analysis, By Industry

12.3 Middle East Asset Integrity Management Market Size and Forecast, By Service Type

12.4 Middle East Asset Integrity Management Market Size and Forecast, By Country

12.4.1. Saudi Arabia

12.4.2. UAE

12.4.3. Egypt

12.4.4. Kuwait

12.4.5. South Africa

13 Competitive Analysis

13.1 Competition Dashboard

13.2 Market share Analysis of Top Vendors

13.3 Key Development Strategies

14 Company Profiles

14.1 Aker Solutions

14.1.1 Overview

14.1.2 Offerings

14.1.3 Key Financials

14.1.4 Business Segment & Geographic Overview

14.1.5 Key Market Developments

14.1.6 Key Strategies

14.2 Bureau Veritas

14.2.1 Overview

14.2.2 Offerings

14.2.3 Key Financials

14.2.4 Business Segment & Geographic Overview

14.2.5 Key Market Developments

14.2.6 Key Strategies

14.3 Fluor Corporation.

14.3.1 Overview

14.3.2 Offerings

14.3.3 Key Financials

14.3.4 Business Segment & Geographic Overview

14.3.5 Key Market Developments

14.3.6 Key Strategies

14.4 Intertek Group plc

14.4.1 Overview

14.4.2 Offerings

14.4.3 Key Financials

14.4.4 Business Segment & Geographic Overview

14.4.5 Key Market Developments

14.4.6 Key Strategies

14.5 SGS SA

14.5.1 Overview

14.5.2 Offerings

14.5.3 Key Financials

14.5.4 Business Segment & Geographic Overview

14.5.5 Key Market Developments

14.5.6 Key Strategies

14.6 SAINT LOUIS UNIVERSITY

14.6.1 Overview

14.6.2 Offerings

14.6.3 Key Financials

14.6.4 Business Segment & Geographic Overview

14.6.5 Key Market Developments

14.6.6 Key Strategies

14.7 DNV GL AS

14.7.1 Overview

14.7.2 Offerings

14.7.3 Key Financials

14.7.4 Business Segment & Geographic Overview

14.7.5 Key Market Developments

14.7.6 Key Strategies

14.8 John Wood Group PLC

14.8.1 Overview

14.8.2 Offerings

14.8.3 Key Financials

14.8.4 Business Segment & Geographic Overview

14.8.5 Key Market Developments

14.8.6 Key Strategies

14.9 Oceaneering International, Inc.

14.9.1 Overview

14.9.2 Offerings

14.9.3 Key Financials

14.9.4 Business Segment & Geographic Overview

14.9.5 Key Market Developments

14.9.6 Key Strategies

14.10 ROSEN Group

14.10.1 Overview

14.10.2 Offerings

14.10.3 Key Financials

14.10.4 Business Segment & Geographic Overview

14.10.5 Key Market Developments

14.10.6 Key Strategies